Zinger Key Points

- Historically, large annual gains for the Philly Semi index have been followed by a further rally

- Growth in AI and grants from U.S. CHIPS Act will provide tailwinds in 2024

- Don't face extreme market conditions unprepared. Get the professional edge with Benzinga Pro's exclusive alerts, news advantage, and volatility tools at 60% off today.

Semiconductor stocks have fallen in the first two trading sessions of 2024. Is this a sign of a strained market with valuations running too hot and prompting investors to take profits?

Bank of America said it remained bullish on the Philadelphia Semiconductor Index (SOX) for 2024, despite its 65% gain in 2023.

The iShares Semiconductor ETF SOXX, an exchange traded fund that tracks the Philly Semiconductor Index, fell 5.4% over the past two sessions but, like the index it tracks, was up 65% in 2023.

“The key question for investors,” said BofA analyst Vivek Arya, “is whether 2024 will bring more of the same, or rotation into last year’s laggards.”

Also Read: A Glitch In The Rally? Cruise Operators And Chip Stocks Targeted In Profit Taking

Risks And Reasons To Be Bullish

The main risks for the semiconductor sector, according to BofA, are:

- Premium valuations: The Philly Semi is currently trading at a price earnings ratio of 25x, compared with the S&P 500’s 20X

- Market rotation: Away from high beta technology stocks

- Market volatility: Influenced by geopolitics, trade conflicts and upcoming elections

Arya added reasons to be bullish on the sector, included:

- New upcycle: With expectations of around 15% industry sales growth in 2024. Upcycles last 2-2.5 years, he added.

- Generative Artificial Intelligence — or GenAI: This is in its early stages and it’s too soon to predict a peak

- U.S. CHIPS Act: Could provide new sources of funding for semiconductor manufacturing

BofA’s Top Themes For 2024

- As GenAI starts to become monetized BofA sees stocks such as Nvidia Corp NVDA, Broadcom AVGO, Advanced Micro Devices Inc AMD and Marvell Technology Inc MRVL as best placed to benefit

- U.S. CHIPS Act grants will benefit the stocks most exposed to increasing output from China. The U.S. government has pledged around $280 billion to boost domestic research and manufacturing. BofA believed the stocks that would benefit most include Intel Corporation INTC, Texas Instruments Inc TXN and Micron Technology Inc MU

- Industrial chip inventory correction could last through the first quarter.

SOX Continues To Outperform After Strong Year

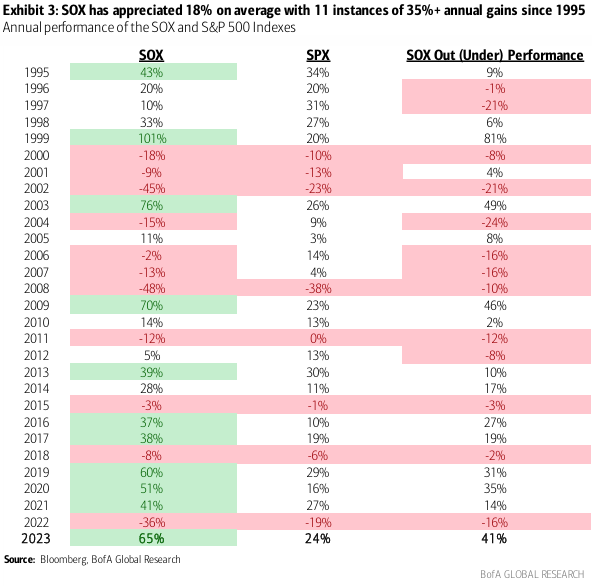

BofA noted that even though the Philly Semi index had a powerful rally in 2023, historically it continued to outperform following such gains.

The chart below shows that since 1995, the index exceeded 35% annual gains 10 times and delivered double-digit gains following six of those.

Arya concluded secular tailwinds persisted: “Continued adoption and investment in AI infrastructure, growing chip design complexity, automotive semiconductor content proliferation and government focus on silicon independence will continue to drive the sector in 2024.”

Now Read: Oil Investing In 2024: 4 ETFs To Consider For Backing Or Hedging Prices

Photo: Unsplash

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.