Zinger Key Points

- U.S. oil and gas stocks plunge alongside a sharp drop in commodity prices, signaling widespread market retreat.

- Analyst Jeff Currie counters the slump with a bullish forecast for commodities in 2024, citing low inventories and high demand.

- Our government trade tracker caught Pelosi’s 169% AI winner. Discover how to track all 535 Congress member stock trades today.

The U.S. oil and gas sector witnessed a significant downturn on Monday, with industry stocks falling sharply alongside a decline in oil and natural gas prices.

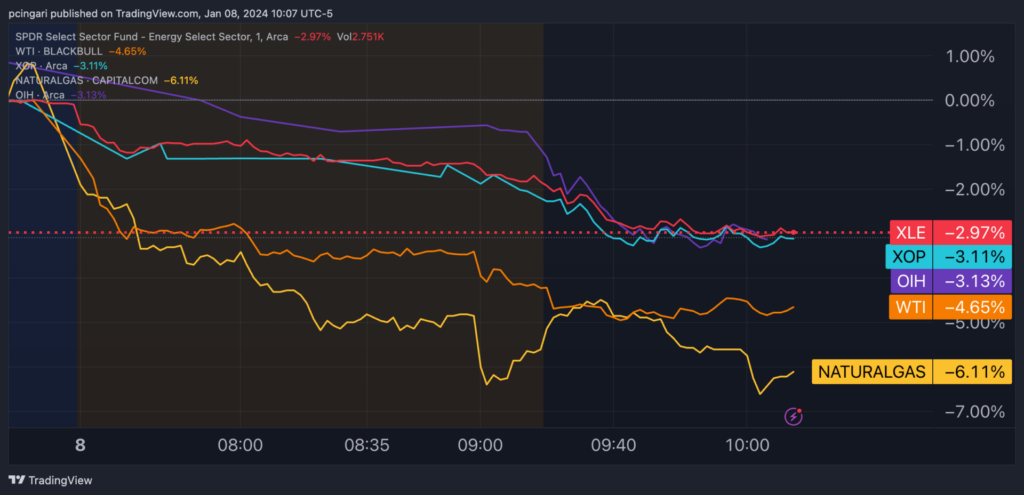

The Energy Select Sector SPDR Fund XLE, a gauge for energy equities, dropped nearly 3%, signaling a broad-based retreat from last week’s 1% gain. Industry-specific ETFs, including the SPDR Oil & Gas Exploration and Production ETF XOP and the VanEck Oil Services ETF OIH, also recorded steep declines.

WTI crude prices plummeted by nearly 5% to $70 per barrel on Monday. The catalyst for the fall can be traced back to Saudi Arabia’s decision to slash crude prices across all regions for February, reflecting concerns over waning demand.

Concurrently, increasing oil production from both OPEC and non-OPEC countries has heightened the prospect of a market surplus. According to a Reuters survey, OPEC’s output in December saw an uptick of 70,000 barrels per day, culminating in a production rate of 27.88 million bpd.

In the natural gas arena, U.S. prices at the Henry Hub dipped as much as 6% to $2.77/MMBtu, retreating from a six-week peak of $2.90. This decline was attributed to forecasts indicating warmer weather and the adequacy of natural gas reserves that are 13% above the seasonal norm due to unprecedented domestic production.

Chart: Monday’s Sell-Off In Energy Assets

Monday’s Laggards In The Energy Sector

| Security Name | Price | % Return |

|---|---|---|

| Schlumberger Limited SLB | $49.66 | -4.24% |

| Targa Resources Corp. TRGP | $82.17 | -4.22 |

| Halliburton Company HAL | $34.47 | -4.18 |

| Baker Hughes Company BKR | $32.17 | -3.74 |

| Marathon Oil Corporation MRO | $23.56 | -3.40 |

| Exxon Mobil Corporation XOM | $99.18 | -3.36 |

‘Own Commodities In 2024’, Former Goldman Commodities Chief Says

Despite the current downturn, Jeff Currie, former commodity research chief at Goldman Sachs, provided a bullish outlook for the commodity sector during an interview on Bloomberg TV.

The fundamental setup for commodity markets is more favorable compared to the previous year, Currie said. He highlighted that if central banks shift toward interest rate cuts, it could pave the way for a robust performance in 2024, dubbing it a “classic ‘own commodities'” scenario.

Currie emphasized that demand for raw materials is soaring, inventories remain low, and production capacity is virtually maxed out. He earmarked copper, in particular, as having substantial potential for price increases after a stagnant 2023.

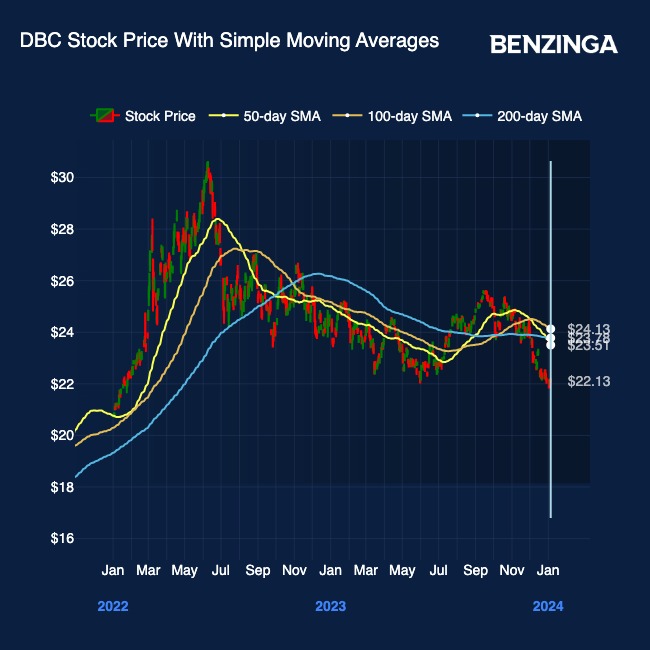

The Invesco DB Commodity Index Tracking Fund DBC tumbled 2.3% on Monday, touching its lowest point in nearly two years, with prices hovering well below key long-term moving averages, which could be indicative of broader commodity market pressures.

Photo via Shutterstock.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.