Zinger Key Points

- M&A is the best way to enter the gaming market at scale

- Artificial intelligence could provide new opportunities for game developers

- Today's manic market swings are creating the perfect setup for Matt’s next volatility trade. Get his next trade alert for free, right here.

Despite their size and scale, Amazon.com Inc AMZN and Alphabet GOOGL haven’t been among the big winners in the gaming industry.

But given their huge investments in artificial intelligence (AI), could this be about to change?

“It’s a gamers world — more than four in 10 people globally are gamers,” said Brian Pitz, internet and interactive entertainment analyst at BMO Capital Markets.

Audience growth, the analyst said, has continued uninterrupted since the early 2000s and is forecast to reach 3.8 billion gamers by 2026. Today, there are more than 3.3 billion gamers worldwide, up from around 200 million in the pre-smartphone era of 2006.

And the video game market — bigger than the movie, music and pro-sports industries combined — is expected to have generated $190 billion of spending in 2023.

Mobile Gamers Take To Smartphones

Mobile is the biggest segment of the gaming market, with global revenue of $92 billion in 2022. With so many successful platforms on mobile, it’s expected that the tech giants will emerge as providers of online gaming.

Amazon, which is rated outperform by BMO with a target price of $200, launched Amazon Game Studios in 2014. The subsidiary developed three intellectual property (IP) video games but, after little success, all have fallen by the wayside.

Alphabet, which is rated outperform by BMO with a target price of $170, set up Google Stadia. The cloud-based gaming platform was shut down after a lack of exclusive games last January — just four years after launch.

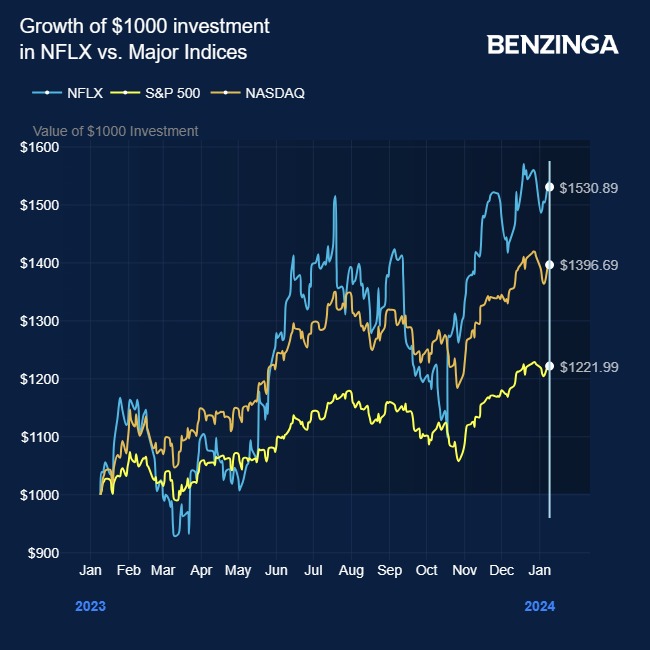

Netflix NFLX, which is rated outperform with a target price of $566, has met with some moderate success.

Netflix Games has launched some internally-based titles and, notably, it controls IP, distribution and has access to a large global audience.

“Because of this, Netflix has been able to generate a library of decent games that are driving modest engagement. But Neflix does not have expertise in gaming,” said Pitz.

Takeover To Success

“M&A (mergers and acquisitions) is the only realistic way to enter the video game sector at scale,” Pitz says. “Building development studios, creating new IP, and launching new platforms have proven to be challenging for outsiders.”

If they want to grab market share in the gaming sector, they’ll need to control more hit games. And buoyed by the approval of Microsoft's MSFT $69 billion acquisition of Activision, Pitz reckons almost all gaming names now appear to be potential takeout candidates.

The analyst also noted how, with their huge investments in generative AI, Alphabet and Amazon should be well-placed to capitalize in the coming years.

“The promise of AI is undeniable: one day, creating games from the ground up may be possible using generative AI. But when and how this will translate into meaningful profit opportunities is unknown,” Pitz says.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.