Zinger Key Points

- Chesapeake Energy shares surge after Citigroup and Mizuho upgrade ratings.

- Analysts predict strong competitive positioning and long-term outperformance.

- Every week, our Whisper Index uncovers five overlooked stocks with big breakout potential. Get the latest picks today before they gain traction.

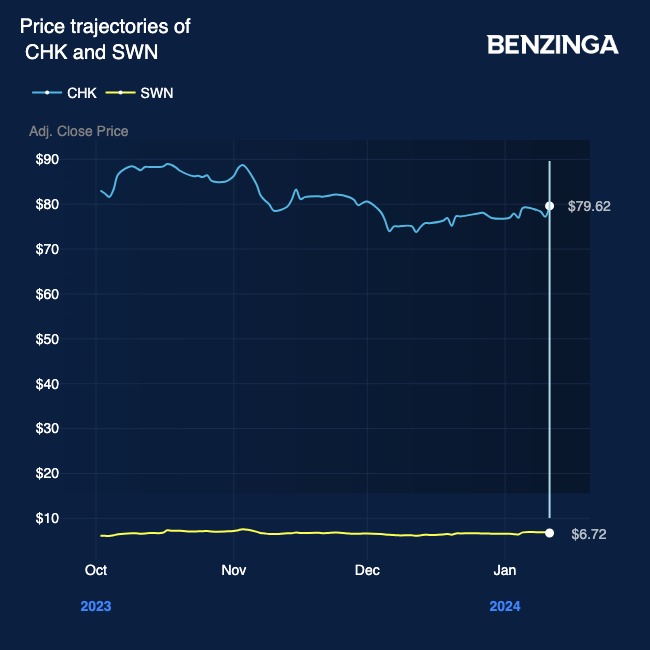

Chesapeake Energy Corp CHK shares are trading higher after Citigroup and Mizuho upgraded the stock following its merger deal with Southwestern Energy Co SWN.

Yesterday, CHK and SWN announced a merger deal in an all-stock transaction valued at $7.4 billion, based on Chesapeake’s closing price on January 10, 2024.

The companies expect annual operational and overhead synergies of approximately $400 million from the merger, which is projected to be immediately accretive to all key per share financial metrics.

Mizuho: Analyst Nitin Kumar upgraded CHK to Buy (from Neutral) at an increased price target of $104 (from $96).

The analyst expects the much-anticipated merger between CHK and SWN to create a U.S. shale gas powerhouse (~7.9 bcfe/ d production) and generate demonstrable cost synergies of at least $400 million annually by 2025.

Kumar estimates pro forma FCF for the combined company of $506 million in FY24, $2.279 billion in FY25, and $1.333 billion in FY26 and expects it to maintain production at ~7.7-7.9 bcfe/d.

Also, the analyst expects the deal to be ~13%/23% accretive to FY24/FY25 FCF per share, respectively, and ~1.0% to FY25 FCF/EV.

Citigroup: Analyst Paul Diamond upped CHK to Buy (from Neutral) at an increased price target of $95 (from $82).

The analyst said he favors the CHK/SWN merger deal given the value increasingly ascribed to both scale & operational efficiency across the producers and the expected strong competitive positioning of the pro-forma company.

The analyst sees EPS estimates of $4.57 (vs. $4.78 earlier) for current year and $3.99 for next year.

Apart from this, B of A Securities analyst Doug Leggate reaffirmed the Buy rating and the price target of $120 on CHK.

The analyst sees the initial synergies suggested by management as conservative. The analyst says that with the multiple secondary potential benefits, CHK is poised for an extended period of outperformance through a lower discount rate and enhanced competitive scale.

Also, Leggate writes that the dynamics of U.S. natural gas markets are on the cusp of significant change as LNG demand raises the incremental clearing price for U.S. gas.

The analyst estimates CHK’s EPS to be $1.60 in FY24 and $7.57 in FY25.

Price Action: CHK shares are up 3.25% at $82.21 on the last check Friday.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.