Zinger Key Points

- This retailer's stock forms a Golden Cross, signaling optimistic market sentiment, backed by robust fundamentals and analyst conviction.

- A robust dividend track record, strategic initiatives and shareholder-friendly practices suggest potential for long-term growth.

- Get two weeks of free access to pro-level trading tools, including news alerts, scanners, and real-time market insights.

A dividend king stock just made a Golden Cross, indicating bullish sentiments among traders. What company is this? A few hints: a discount retailer that has a long history of paying and growing dividends for more than 50 years, has a 5-year average annualized dividend growth rate of 11.44% and a YoY TTM dividend growth rate of 5.80%.

Yes! You guessed right: Target Corp TGT. This Minnesota-based company is the seventh-largest retailer in the U.S. and a component of the S&P 500 Index.

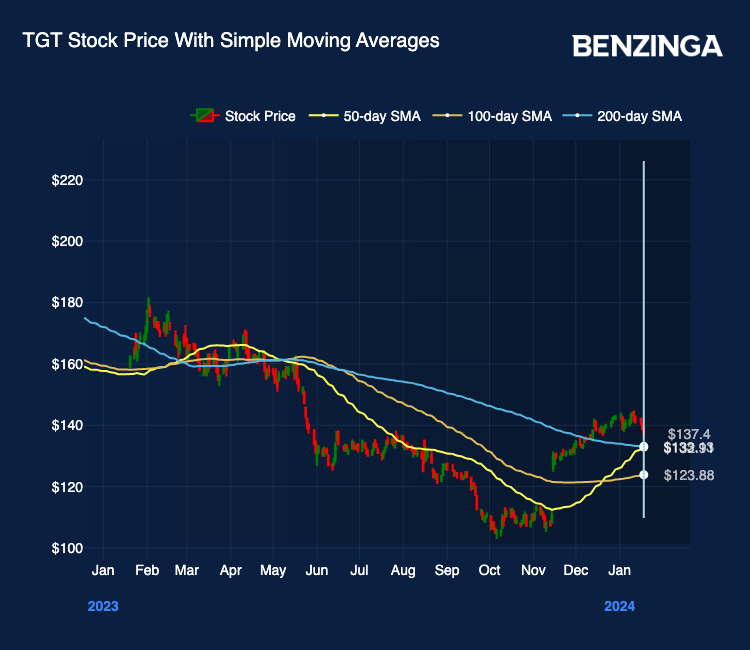

On Jan. 18, Target’s stock price’s simple moving averages just made a Golden Cross, indicating bullish sentiments around the stock.

The 50-day SMA for Target stock just crossed over the 200-day SMA, indicating bulls taking over market sentiments towards the stock.

Target, a resilient retail giant, distinguishes itself through diverse, affordable products, and robust digital strategies. Despite industry challenges, the company boasts a large customer base, a strong private labels portfolio and an omnichannel approach across 1,900-plus stores.

Financial concerns, including tight dividend coverage and cash flow pressures, exist. However, its more than 50 years of dividends, a reasonable forward P/E of 16.9x, and consistent share buybacks showcase Target’s potential for long-term growth. These catalysts are also backed by strategic initiatives and shareholder-friendly practices existing at Target.

Recent analyst reports have also set a bullish tone for the stock:

- On Jan. 16, Target was upgraded by Morgan Stanley analyst Simeon Gutman from Equal-Weight to Overweight with a raised price target of $165 a share.

- This came in after Wells Fargo’s George Kelly, on Jan. 4, maintained his Overweight rating on the stock while raising his price target to $155 a share.

The technical setup, the fundamental strength and the analyst conviction together put Target stock in a good spot right now.

TGT Price Action: Target stock was trading at $138.21 at the time of publication Friday.

Now Read: Retail Trends Unwrapped: Analyst Unveils Surprising Shifts In Consumer Spending As 2023 Looms

Photo: Shutterstock

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.