Zinger Key Points

- "Data as the new oil" is taking center stage, underlining the integral role semiconductors play in powering the digital realm.

- While the current semiconductor revenues are trailing below the GDP trend line, there's a clear signal for a compelling resurgence in 2024.

- Find out which stock just plummeted to the bottom of the new Benzinga Rankings. Updated daily—spot the biggest red flags before it’s too late.

A Cantor Fitzgerald report on its 2024 Outlook for the semiconductors and semiconductor equipment industry highlighted recent trends in semiconductor revenues.

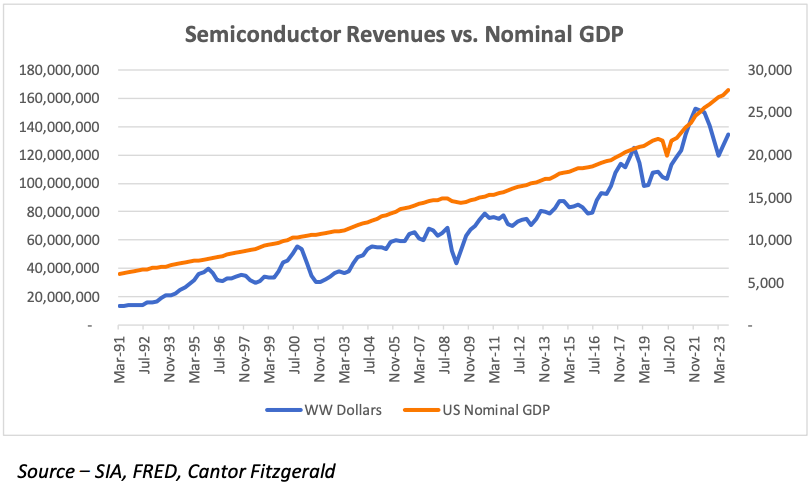

Per analyst C.J. Muse’s analysis, current semiconductor revenue figures are trailing below the GDP trend line. This dip serves as a clear signal of ongoing inventory digestion within the industry, setting the stage for a compelling resurgence in 2024.

Notable semiconductor companies reviewed under the report include NVIDIA Corp NVDA, Western Digital Corp WDC, ASML Holding NV ASML, NXP Semiconductors NV NXPI, GlobalFoundries Inc GFS, Micron Technology Inc MU, Advanced Micro Devices Inc AMD, Marvell Technology Inc MRVL, Qualcomm Inc QCOM, Teradyne Inc TER and Intel Corp INTC.

Examining the recent trajectory, Muse noted semiconductor revenues faced headwinds during the “semiconstrained” period from 2020 to 2022. Notably, higher Average Selling Prices (ASPs) provided a crucial boost during this challenging timeframe. However, the semiconductor data also bore the brunt of a significant downturn in memory, acting as a partial offset to the industry’s overall performance.

Looking ahead, Muse saw the semiconductor sector poised for a noteworthy recovery. He even saw a strong likelihood of it, catching up to and surpassing the GDP trend line.

Beyond short-term dynamics, a longer-term perspective revealed the rising silicon intensity could outpace the growth of global GDP. The importance of semiconductors in the creation, transmission, analysis and storage of data positions the industry as a key driver of the digital age.

Amidst this landscape, the concept of “Data as the new oil” takes center stage, underlining the integral role semiconductors play in powering the digital realm. With the added momentum from the evolving landscape of Generative AI, the semiconductor sector remains exceptionally bullish.

The SOX index hit a low on Oct. 13, 2022, and has since risen by ~95%. Although semiconductor fundamentals bottomed in the second quarter of 2023, marking only three quarters into an upturn compared to the typical nine in previous cycles, the market suggested another strong year for semiconductor stocks in 2024.

Despite ongoing debates on soft- vs. hard-landing and potential Fed actions, the semiconductor revenue outlook is positive.

Muse’s projections estimate an 18% growth in CY24, with potential risks pushing it beyond 20%.

The most promising end markets are identified as AI (Compute & Networking) and Memory (DRAM and NAND), with a selective focus on System-on-Chip (SPE) companies serving as key players in these trends.

Now Read: Nvidia Will Lead 2024 Double-Digit Semiconductor Stock Rally, Analysts Say

Photo: Shutterstock

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.