Zinger Key Points

- Warren Buffett's Berkshire Hathaway first invested in American Express stock in the first quarter of 2001.

- Amex stock should benefit from macro tailwinds and investors would be watching as it reports Q4 earnings on Jan. 25.

- Every week, our Whisper Index uncovers five overlooked stocks with big breakout potential. Get the latest picks today before they gain traction.

Billionaire investment manager, aka the Oracle of Omaha, and Berkshire Hathaway Chairman and CEO Warren Buffett has been bullish on American Express Company AXP stock since the first quarter of 2001.

American Express stock is up about 350% since mid-February 2001 and the company continues to deliver on Wall Street estimates.

Also Read: American Express Q4 Earnings Preview: Financial Insights, Investment Factors, Analyst Consensus

Berkshire Hathaway first invested in American Express stock in the first quarter of 2001. The stock traded at a price of around $40 back then. Amex stock is currently trading at around $187. That's more than 3.5X the investment.

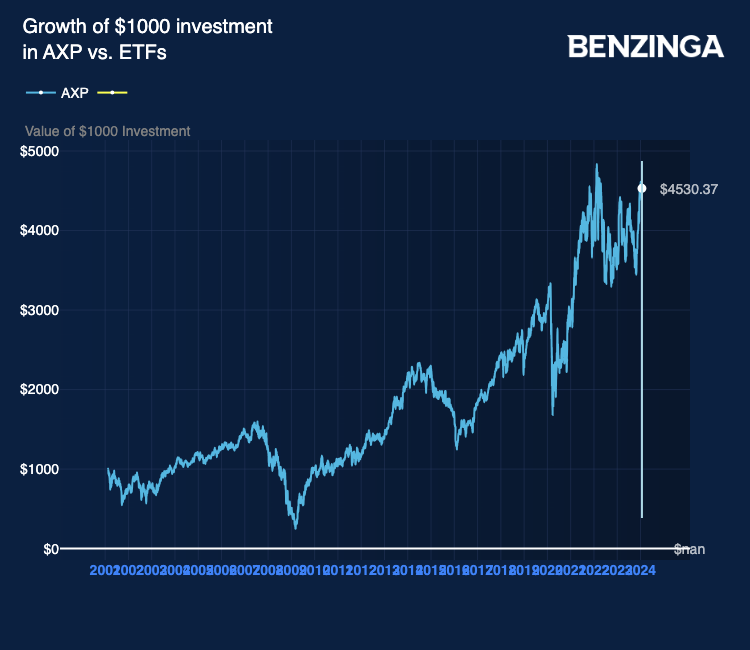

The chart above depicts the stock’s trajectory from the first quarter of 2001 to now. If you invested $1,000 into the stock right about the time Buffett became bullish on it, your investment would have grown to about $4,530 today. That’s a whopping 353% return. In annualized terms, that’s a 9.2% CAGR.

As of the latest 13F filing, American Express is Berkshire Hathaway’s third-largest holding, commanding 7.12% of the portfolio. With that, Buffett’s Berkshire Hathaway effectively owns more than 20% of the company.

Over the past year, the stock was up 20.5%. Having gained so much so fast, investors could wonder whether there’s any upside left. Despite having gained so much, American Express is well-positioned with the Fed’s pivot to lower rates this year. Inflation has settled and should boost credit card spend, also benefitting Amex’s business. Its bank holding company status brings in diversified revenue streams, lower borrowing costs and access to Federal Reserve funding.

Per consensus estimates, Amex was currently a Neutral-rated stock for financial sector investors.

Analysts who recently reviewed the company raised their price targets from consensus estimate levels on Amex stock.

- Deutsche Bank initiated coverage on Jan. 10 with a Buy rating and a price target of $235 on the stock.

- JP Morgan’s coverage from Jan. 4 raised their price target from $167 to $205.

Photo: Shutterstock

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.