Zinger Key Points

- Sales of previously owned homes rose to an annual rate of four million in January.

- Mortgage rates continue to creep higher on fading hopes of early Fed cuts.

- Don't face extreme market conditions unprepared. Get the professional edge with Benzinga Pro's exclusive alerts, news advantage, and volatility tools at 60% off today.

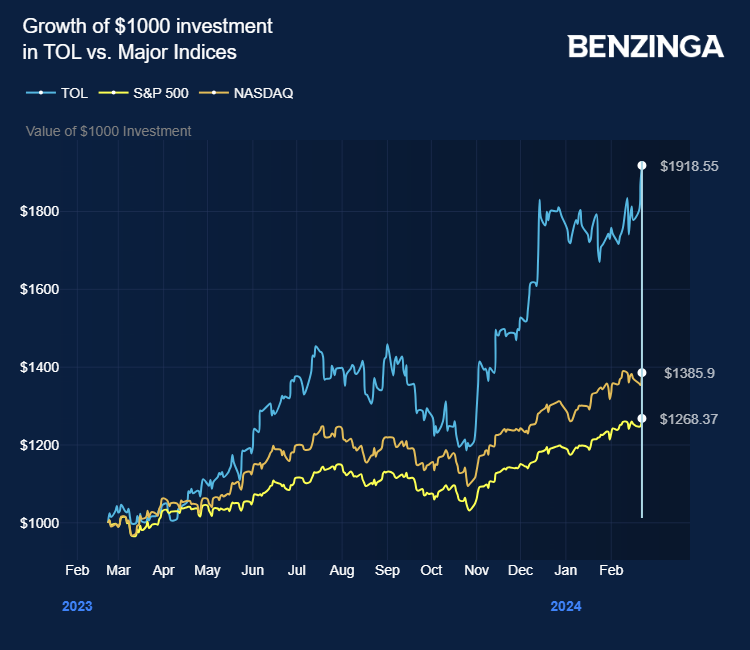

On the heals of strong results by Toll Brothers Inc TOL this week, rising sales of existing homes suggested additional good news for the U.S. housing market.

Having been stuck in a slump in 2023 due to high mortgage rates, which peaked at 7.79% in October, the final quarter saw some improvement in home sales, according the building companies that have already reported sales and earning figures for the October-December period.

On Thursday, data from the National Association of Realtors (NAR) showed that previously-owned homes were sold at an annual rate of four million in January, up from an upwardly-revised 3.88 million in the previous month and beating market expectations of 3.97 million.

Better Supply And Demand

Lawrence Yun, NAR chief economist, said: “While home sales remain sizably lower than a couple of years ago, January’s monthly gain is the start of more supply and demand. Listings were modestly higher, and home buyers are taking advantage of lower mortgage rates compared to late last year.”

Oliver Allen, senior U.S. economist at Pantheon Macroeconomics, agreed that it appeared the housing market slump was past its worst.

He said: “The jump in existing home sales, along with the upward revision to December's number, means that the low of 3.85 million in October was probably the cyclical trough.”

Also Read: Toll Brothers Paves The Way: 2024 Profit Projections Rise, Cementing Homebuilder Hopes

Mortgage Applications Fall

Mortgage applications, however, fell sharply in the week ending Feb. 16, down 10.6% from the previous week, according to data from the Mortgage Bankers Association (MBA), published on Wednesday.

Buyers were likely put off as mortgage rates began to creep higher again as hopes of early rate cuts from the Federal Reserve faded.

Data from mortgage broker Freddie Mac, published on Thursday, showed that in the week to Feb. 22, the average rate on a 30-year mortgage rose to 6.9%, the fourth-consecutive week of gains.

Mike Fratantoni, MBA chief economist, said: “Mortgage applications dropped as a result. Potential homebuyers are quite sensitive to these rate changes, as affordability is strained with both higher rates and higher home values in this supply-constrained market.”

Allen at Pantheon, however, said the MBA numbers were misleading, as “residual seasonality” in the data often leads to a sharp fall in February.

Market Reaction

Homebuilder Toll Brothers reported on Wednesday strong sales and margins in its October-December quarter and its outlook was optimistic for 2024. The shares climbed 4% on Wednesday and were up a further 2.1% on Thursday.

Elsewhere in the sector, shares in D.R. Horton Inc DHI, the biggest homebuilder in the U.S., were up 1%, while Lennar Corporation LEN gained 1.2%.

The iShares U.S. Home Construction ETF ITB, an exchange trade fund that tracks the sector, gained 1.2%.

Now Read: Slump In Housing Starts: ‘Extremely Noisy’ Numbers Indicate Demand For New Homes Dipping

Photo:

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.