Zinger Key Points

- Ferrari stock hits $411.90, outperforming S&P 500 by double, driven by Warren Buffett's endorsement and robust financials.

- Ferrari stock has been propelled by strong 2023 profits, raised 2024 forecast, and UBS 'Buy' rating with a $448 target.

- Feel unsure about the market’s next move? Copy trade alerts from Matt Maley—a Wall Street veteran who consistently finds profits in volatile markets. Claim your 7-day free trial now.

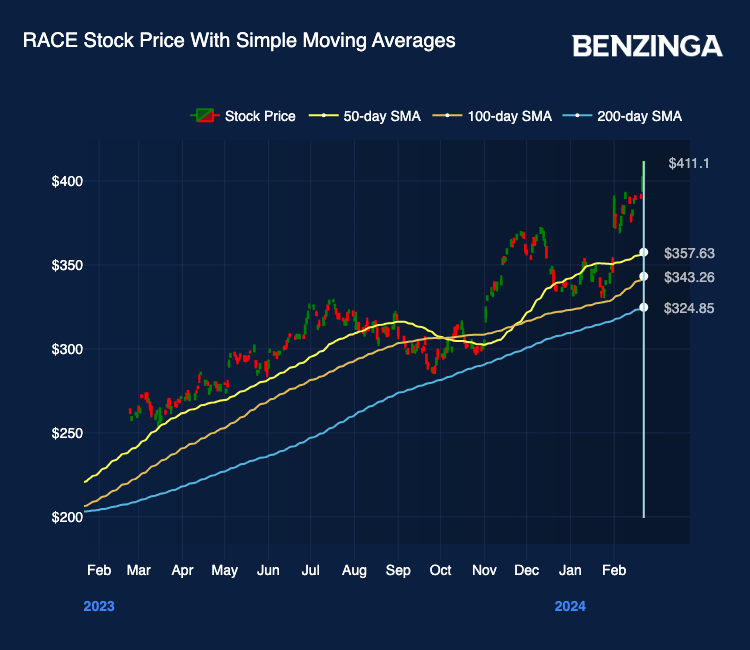

Ferrari RACE stock just made a new 52-week high, breaking its earlier annual record. During the trading day of Feb. 22, Ferrari stock raced to a new record 52-week high of $411.90.

Ferrari Stock Has Outperformed S&P 500 Index By 2X

Over the past year, Ferrari stock has raced ahead of the S&P 500 Index by double measure. While Ferrari stock has gained 54.36%, the S&P 500 has gained 24.63% over one year.

So far in 2024, the stock is far ahead of the S&P 500 gaining 21.15% relative to the benchmark which is up 4.44%.

Key Catalysts Behind The Race To New Highs

Catalysts that may have spurred the stock are:

- Warren Buffett‘s endorsement at Berkshire Hathaway‘s shareholder meeting boosts investor confidence in Ferrari.

- Ferrari’s 34% surge in net profit for 2023 highlights strong financial performance.

- The company’s raised 2024 forecast signals a positive outlook for future growth.

- Full order books until 2025 indicate robust demand for Ferrari’s luxury sports cars.

- Record-high share prices reflect positive market sentiment and increased investor interest.

- Ferrari’s approaching $100 billion market cap showcases its growing valuation and attractiveness.

Recently (Feb. 2), UBS reviewed the stock and rated it a Buy. Price target was raised from $413 to $448, implying a 9.8% upside.

Options Activity, Buyback Program, Competitive Differentiation

Options activity in Ferrari stock also indicates that the general mood among heavyweight investors is 62% leaning bullish and 37% bearish.

Also Read: Market Whales and Their Recent Bets on RACE Options

Ferrari also has an ongoing multi-year share buyback program in place of approximately Euro 2 billion (approximately $2.16 billion) expected to be executed by 2026. Buybacks are a great tool for shareholder returns, and tend to be positive for the stock.

Ferrari’s success stands out in an industry known for fierce competition and lack of permanence. The company’s ability to differentiate itself and maintain a strong market position could be seen as a key catalyst, attracting investors seeking stability and excellence in the auto sector.

Read Next: What’s Ferrari Doing With A Tesla Model S Plaid At Its Italian Factory?

Image: Shutterstock

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.