Zinger Key Points

- Over 85% of Americans worry about the national debt's impact on their future, highlighting a broad concern for economic stability.

- 'At some point the national debt bomb will explode unless we raise our voices to our representatives,' Main Street Economics CEO says.

- China’s new tariffs just reignited the same market patterns that led to triple- and quadruple-digit wins for Matt Maley. Get the next trade alert free.

Over 85% of Americans are deeply concerned about the grave impact the burgeoning national debt may have on their future, according to a new study.

What Happened: A survey from John Zogby Strategies for the non-profit organization Main Street Economics gauged the awareness and apprehensions of some 1,000 voters. The findings come at a time when the U.S. government faces a potential shutdown if lawmakers can’t agree on a spending package.

The findings underscore a widespread anxiety that transcends current economic conditions, projecting a troubled outlook for the years ahead.

About 59% of the respondents feel that Washington’s policymakers are making insufficient efforts to tackle the debt crisis. Many of these respondents are significantly more inclined to call for action, driven by their awareness that:

- A prolonged default on the national debt could trigger a harsh recession, eliminate eight million jobs, contract the economy by more than six percent, or lead to even graver consequences (45%).

- The government is projected to incur an additional $20 trillion in debt over the next decade, with the possibility of reaching $100 trillion in the next 30 years (41%).

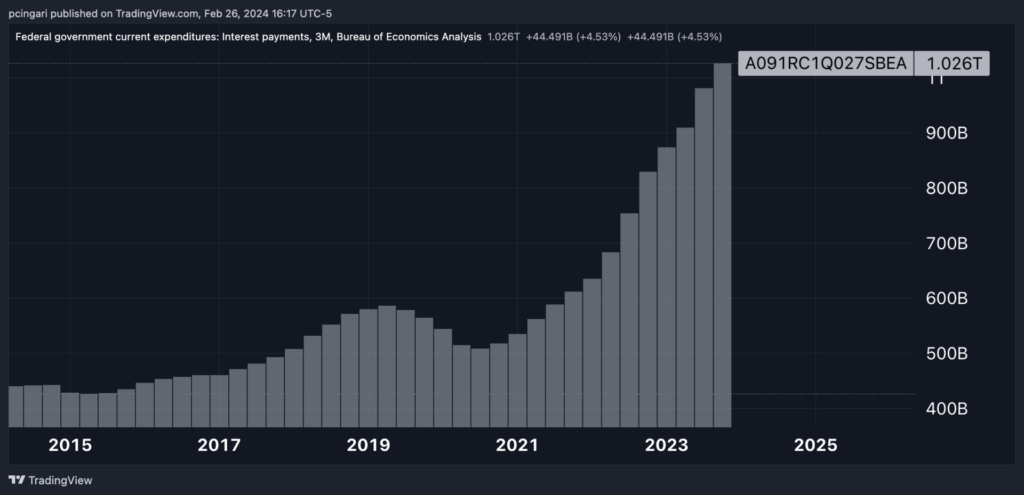

- Interest payments in 2023 alone surpassed $1 trillion due to escalating interest rates and growing debt (40%).

Chart: Government Interest Payments Top $1 Trillion As Rates Weigh On Debt

The Call for Action

Les Rubin, the founder and CEO of Main Street Economics, warns that if politicians continue prioritizing their re-election over addressing the debt issue, it will lead to reduced funding for essential public services.

“The country will continue to dig the financial hole deeper,” he said.

"While this data is startling, it's not surprising. At some point the national debt bomb will explode unless we, united, raise our voices to our representatives and demand they make meaningful decisions to ensure future generations will not pay the unfortunate price for our country's current financial debacle," Rubin added.

Other economists are also nervous. Olivier Blanchard, the former chief economist of the International Monetary Fund, recently expressed grave worries over the likelihood of a fiscal emergency in the U.S.

He pinpointed the danger to the nation’s debt, which has ballooned to more than 120% of its GDP, coupled with a political atmosphere that seems unwilling to address these issues.

And yet, Jonathan Gruber — chair of MIT's economic department — told Boston Public Radio in December that the debt conversation needs context.

To lower the deficit, Gruber says a good first step is getting inflation under control.

"I understand prices are high, but inflation, which is how rapidly prices are rising, is back to where it was,” Gruber said. “Prices are not rising rapidly anymore.”

Image: Shutterstock

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.