Zinger Key Points

- Fed's rate cut delay possible amid inflation and strong labor market data.

- Supply chain, wage growth risks, and geopolitical tensions could impact inflation.

- The ‘Trade of the Day’ is now live. Get a high-probability setup with clear entry and exit points right here.

Markets have been so obsessed for the past six months on when the Federal Reserve will make its first cut in interest rates, no-one has even considered thinking the unthinkable: what if it doesn’t cut at all in 2024?

Until around a month ago, you could still take odds at around 3/1 that the first cut would come in March. Now almost certainly off the table, May or June come into focus for the first downward move.

But a sticky consumer price inflation number for January and stronger-than-expected labor market data, followed by hawkish Fed comments at the last Open Market Committee meeting, have led some to push expectations back to the July meeting.

And what if between now and then, the inflation data begin to show further stickiness. There are plenty of outliers that haven’t yet been seen in the official data.

Supply Chain And Wage Growth Risks

Outliers such as the impact of longer lead times and higher shipping costs on goods and raw materials because of longer shipping routes as freight avoids the Red Sea.

“Red Sea tensions have started to impact freight costs, which could lead to more general supply-chain pressures that were a major cause of the inflation surge in 2022,” said Jeremy De Pessemier, strategist at the World Gold Council.

Wage inflation could also present an outlier risk as the labor market remains tight, with strong levels of job creation and low levels of layoffs continuing into what was supposed to be the latter part of the current business cycle.

“If labor demand remains strong on the back of strong nominal spending, there can be a non-linear increase in nominal wages that can feed into service inflation,” said Claudio Irigoyen, analyst at Bank of America.

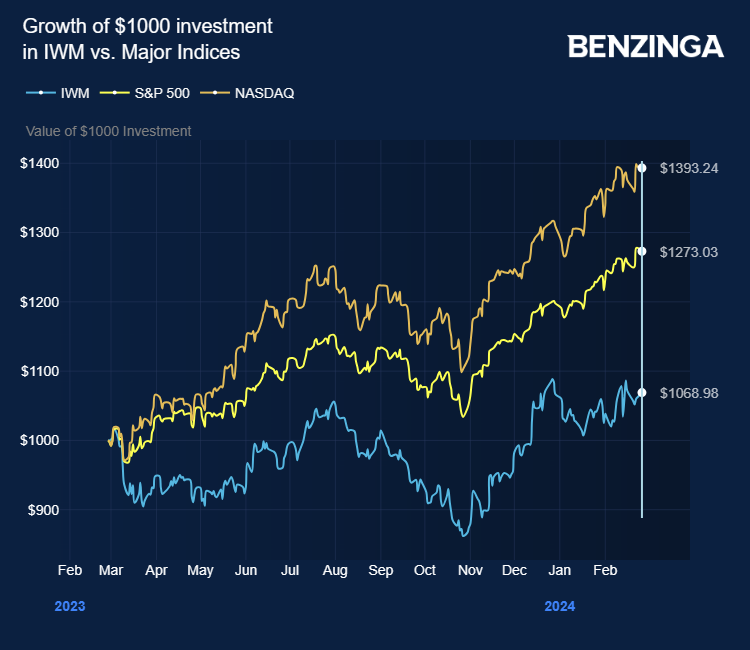

The above chart shows the iShares Russell 2000 ETF against both the S&P 500 and Nasdaq indices

Also Read: Fed Minutes Stress Inflation Vigilance, Push Back Earlier Rate Cut Moves

Despite these uncertainties — including fiscal policy challenges as the government repeatedly delays the federal budget plan, and the looming presidential election — the economy has proven to be much more resilient than many anticipated six months ago.

“The path back to target inflation, as much as a path to a soft landing, was always likely to be bumpy and narrow,” said De Pessemier.

While the market is still priced for several rate cuts in 2024 and more to come in 2025, the risk of a further upward surprise in inflation cannot be ruled out given the potential outlying threats.

“The market might be wrong, as much as it was wrong in completely underestimating inflation and overestimating the slowdown of the economy. And to be fair, the Fed, by delaying the tightening cycle by one year, was in the same camp,” said Irigoyen.

Meanwhile, a recent National Federation of Independent Businesses survey of small companies asked 10,000 firms if they plan to increase selling prices over the next three months.

"The recent acceleration in the share of firms saying yes suggests that CPI inflation could increase over the coming months," said Torsten Slok, chief economist at Apollo Global Management.

How Would Markets React?

So what would this mean for markets? If the Fed were to further delay cuts beyond May and June, the equity market rally could potentially fade and go into reverse.

This would likely be led by losses for small- and mid-cap companies — those that require loans for growth opportunities, that become more difficult to service, the longer rates remain higher.

The iShares Russell 2000 ETF IWM, an exchange traded fund that tracks the small-cap index, has stalled in 2024 after a strong two months during November and December, when hopes were still high of a March rate cut.

Highly indebted tech stocks and non-dividend payers might also share the brunt of an equity sell off. Stocks in the Magnificent Seven, such as Nvidia Corporation NVDA and Meta Platforms Inc META, which have been at the forefront of the rally, could find profits taking hits.

The dollar, which has gained in 2024 on fading hopes of a March cut, would find further support the longer rate cut expectations are pushed back. The Invesco Dollar Index Bullish Fund UUP has gained 3.3% so far in 2024.

A higher dollar is broadly a bad thing for gold. The higher the rate of the U.S. currency, the more expensive dollar-denominated gold is to buy in other currencies. After a surge to record highs in December, the price of gold has broadly traded sideways, between the $2,000 and $2,100 levels. The SPDR Gold Shares ETF GLD has tracked this performance.

Oil markets tend to respond to wider economic developments and geopolitics. Thus, if higher inflation were to prompt tougher consumer conditions and a fall in demand, prices would be hit. Such considerations are currently being balanced by the potential for geopolitical developments in the Middle East and Russia/Ukraine.

The United States Oil Fund ETF USO is up nearly 10% so far in 2024.

Read Now: Biden Calls In Budget Big Guns: But What Happens If Government Shutdown Can’t Be Avoided?

Photo: Shutterstock

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.