Zinger Key Points

- Tim Cook’s first-time mention of AI this year has still not excited investors, with Apple’s stock down over 5% this year so far.

- Analyst Gene Munster thinks this Apple stock action in 2024 has reminded him of another company from 2022.

- Feel unsure about the market’s next move? Copy trade alerts from Matt Maley—a Wall Street veteran who consistently finds profits in volatile markets. Claim your 7-day free trial now.

Deepwater Asset Management managing partner Gene Munster thinks that while Tim Cook's first-time mention of AI during Apple Inc.'s AAPL shareholder meeting in January failed to excite investors, he thinks Apple stock action in 2024 reminds him of Mark Zuckerberg's Meta Platforms Inc. META.

He also believes Apple's AI play can move the earnings needle for Cupertino in double-digit percentages.

What Happened: Munster expressed optimism about Apple's AI play, stating that the company's first AI model is expected to be announced sometime in June.

However, investors in 2024 so far have not been very optimistic about Apple's prospects like analysts have.

See Also: Gene Munster Suggests Apple Acquire Rivian Following Surprising Cancellation Of Apple Car Project

However, Apple stock itself has not performed as well as it should have if AI is indeed a potential revenue maker for the company.

In fact, the Nasdaq Composite has beaten the Apple stock as far as performance in 2024 so far is concerned.

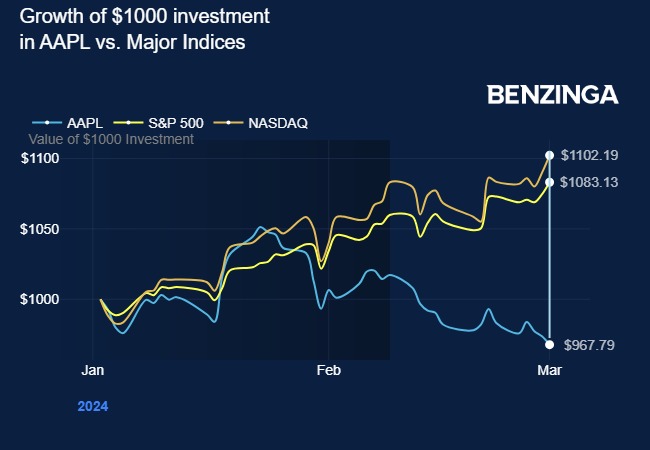

A $1000 investment in Apple at the beginning of 2024 would be worth $967.79 today.

A similar investment in an index fund replicating the Nasdaq and S&P 500 would be worth $1,102.19 and $1,083.13, respectively.

Essentially, Apple is down 5.68% this year so far, while Nasdaq is up 9.76%, and S&P 500 is up 8.18%.

So what are investors not seeing that analysts like Munster are?

"AAPL stock action this year reminds me a little of when in the fall of 2022 investor concern that Meta would lose share to TikTok pressured the stock to $100."

A $33B Opportunity: Munster thinks Apple's AI model will join the ranks of Microsoft Corp.-backed MSFT OpenAI's GPT, Alphabet Inc.'s GOOG GOOGL Google Gemini, Elon Musk's xAI, and Anthropic.

While this would help Apple compete better with other Big Tech companies currently working on AI, what exactly would it mean for investors? Munster thinks it could give Apple a revenue boost.

"Apple has 2.2B active devices, which I estimate are owned by 1.4B active users. If 20% of Apple’s active base subscribe to an AI product (personalized AI) at $10 a month, that's $33B a year in 80% margin revenue."

He thinks Apple can leverage its user base to blaze past rivals working on AI, boosting its operating revenue by 16%.

"In the end, these products (Meta, Google Search, Microsoft Office and Apple Services) are sticky in the long-term."

Price Action: Apple closed at $172.47, down 1.5% on Monday, according to Benzinga Pro.

Check out more of Benzinga’s Consumer Tech coverage by following this link.

Read Next: Apple Hit With $1.95B EU Fine In Spotify Antitrust Case

Photo courtesy: Shutterstock

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.