Zinger Key Points

- Broadcom will be reporting Q1 earnings on Mar. 7 and anticipates strong results in AI revenues for FY24.

- Technicals reveal a bullish stock trend and AI revenues for FY24 to be driven by custom ASIC programs with Google and Meta.

- China’s new tariffs just reignited the same market patterns that led to triple- and quadruple-digit wins for Matt Maley. Get the next trade alert free.

Broadcom Inc AVGO, will be reporting its first-quarter earnings on March 7. Wall Street expects $10.26 in EPS and $11.71 billion in revenues as the company reports after market hours.

The company is part of the AI5 group of stocks – which the markets expect to grow on the back of artificial intelligence. The stock is up over 112% in the past year; climbing over 20% YTD.

Here's how the stock is technically setup ahead of earnings, and how the stock currently maps against Wall Street estimates.

Broadcom Stock Technical Setup Ahead Of Earnings

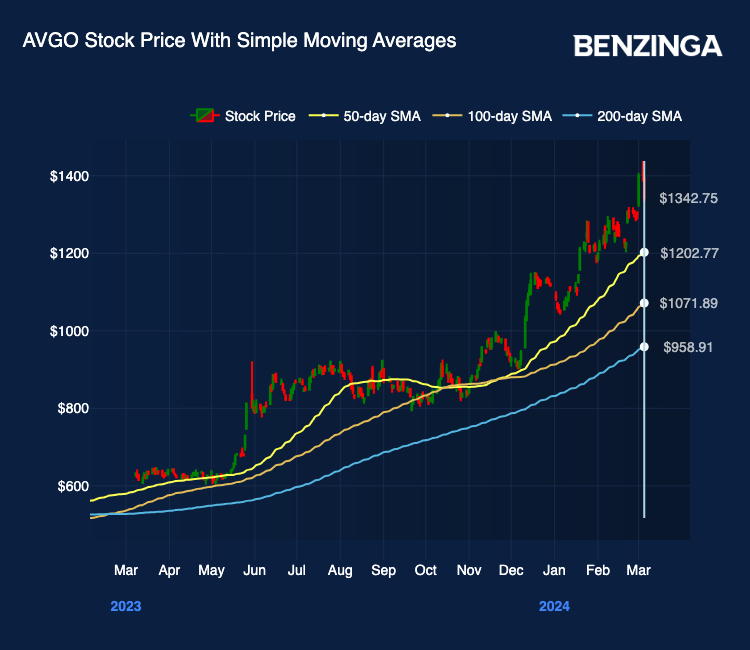

As the company prepares to report Q1 earnings, the technical setup for Broadcom stock reveals a strongly bullish trend. The share price consistently remains above its 5, 20, and 50-day exponential moving averages. However, the presence of selling pressure suggests a potential risk of future bearish movements.

At its current price of $1,342.75, AVGO exhibits favorable signals based on its moving averages. The 8-day simple moving average suggests an advantageous position at $1,329.50, while the 20-day SMA at $1,286.08 and the 50-day SMA at $1,202.77 also portray promising trends. The 200-day simple moving average, standing at $958.91, reinforces the favorable outlook at the current stock price.

The Moving Average Convergence Divergence (MACD) indicator stands at 41.1, reinforcing a bullish outlook, while the Relative Strength Index (RSI) of 61.45 suggests that Broadcom may be overbought. The Bollinger Bands (25) signal favorable conditions within a range of $1,217.39 to $1,324.65, while the Bollinger Bands (100) similarly support this outlook within a range of $914.96 to $1,228.74.

Overall, the technical analysis suggests a favorable outlook for Broadcom’s stock, with multiple indicators supporting a bullish position.

Also Read: Comparing Broadcom With Industry Competitors In Semiconductors & Semiconductor Equipment Industry

Broadcom Analysts Consensus Ratings

Ratings & Consensus Estimates: The consensus analyst rating on Broadcom stock stands at a Buy, with a price target of $959.67.

JPMorgan analyst Harlan Sur, who reviewed the stock recently, sees Broadcom “tracking to $8-9B+ in AI revenues for FY24”. Sur attributes its expansion to proprietary AI ASIC programs, notably including the Google TPU AI ASIC program. The company also plans to increase its collaboration with Meta by launching a 3nm AI ASIC program this year.

Price Action: Broadcom stock was trading at $1,342.75 at the close of trading day on March 5.

Read Next: Best Long-Term Semiconductor Stocks According To Redditors: Favorites Beyond Nvidia

Photo: Shutterstock

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.