Zinger Key Points

- MongoDB Inc.'s stock faces a strongly bearish trend post its Q4 earnings, with key indicators signaling caution.

- Investors eyeing MongoDB should be wary as technical signals, including oversold RSI and conflicting MACD, amid post-earnings uncertainties.

- Don't face extreme market conditions unprepared. Get the professional edge with Benzinga Pro's exclusive alerts, news advantage, and volatility tools at 60% off today.

MongoDB Inc MDB, reported its fourth-quarter earnings on March 7. The stock is down 7% since then, despite the company reporting a 82.98% surprise on EPS and a 5.60% surprise on revenue. Nonetheless, the report failed to lift the stock as guidance fell short of estimates.

Related: MongoDB’s Concerns About Outlook Despite Strong Q4 Results: Analysts Revise Forecasts

Having delivered 82%+ price returns over the past year, MongoDB’s stock is down over 10% so far this year.

Let’s looks at some technical indicators to see whether the stock is offering a buy-the-dip opportunity here.

MongoDb Stock Technical Setup Post Q4 Earnings

Charts indicate that the the prevailing trend for MongoDB stock is strongly bearish.

The share price is currently trading below its 5, 20, and 50-day exponential moving averages (EMAs). This indicates considerable selling pressure, posing a risk of further bearish movement.

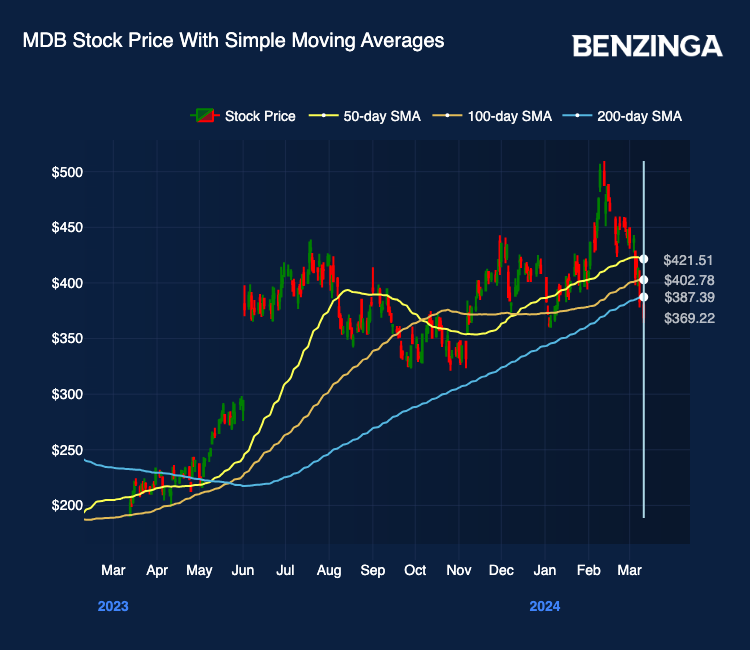

Moreover, the 20-day SMA is $446.89, and the 50-day SMA is $421.51, both indicating bearish signals. The stock’s price of $369.22 is below the 200-day simple moving average of $387.39, reinforcing the negative outlook.

Also Read: Market Whales and Their Recent Bets on MDB Options

The Moving Average Convergence Divergence (MACD) indicator is 21.57, which is viewed as a bullish sign, while the Relative Strength Index (RSI) at 24.84 implies that MongoDB is oversold.

However, caution is advised as the Bollinger Bands (25) indicate a bearish signal with a range of $420.69 – $474.27, and the Bollinger Bands (100) reinforce this sentiment with a range of $364.94 – $440.6.

MongoDB Analysts Consensus Ratings

Ratings & Consensus Estimates: The consensus analyst rating on MongoDB stock stands at a Buy, currently with a price target of $439.18.

Price Action: MongoDB stock closed 4.2% lower at $366.99 on Monday.

Read Next: These Analysts Revise Their Forecasts On MongoDB After Q4 Results

Photo: Michael Vi/Shutterstock

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.