Zinger Key Points

- Lawrence Summers criticizes the Federal Reserve's readiness to cut interest rates amidst a strong economy and above-target inflation.

- Amid looser financial conditions and elevated inflation expectations, Summers critiques the Fed's approach.

- Feel unsure about the market’s next move? Copy trade alerts from Matt Maley—a Wall Street veteran who consistently finds profits in volatile markets. Claim your 7-day free trial now.

Former U.S. Treasury Secretary Lawrence Summers has openly criticized the Federal Reserve’s indications of potential interest rate cuts in the near future, questioning the urgency of such decisions in light of a robust economy and persistent inflation concerns.

During an appearance on Bloomberg Television’s Wall Street Week, Summers expressed perplexity over the Fed’s current stance, especially considering the healthy state of the economy and financial markets.

“My sense is still that the Fed has itchy fingers to start cutting rates, and I don't fully get it,” Summers said.

Fed Flags Rate Cuts, Summers See Higher Neutral Rates

This critique comes in the wake of the Federal Reserve updating its interest rate forecasts, showing an anticipated three rate reductions this year.

Fed Chair Jerome Powell emphasized the importance of not dismissing recent inflation readings, though he suggested that these do not alter the broader expectation of diminishing price pressures.

Nonetheless, Summers argues that the Fed’s understanding of the neutral policy rate—considered neither stimulative nor restrictive—is flawed, potentially leading to misjudgments about the actual restrictiveness of its monetary policy.

Summers has previously highlighted the possibility of rate increases, pointing out the necessity for the Fed to navigate cautiously. He stresses a fundamental oversight by the Fed in recognizing that the actual neutral interest rate far exceeds the preferred 2.5%. Despite a slight adjustment in the Fed’s long-term rate forecast from 2.5% to 2.6%, Summers insists on a longer-run neutral rate closer to 4%.

The former Treasury Secretary underscores the economy’s consistent performance above expectations, despite the long period since the Fed initiated rate hikes.

Loose Financial Conditions Contrast With Above 2% Inflation Expectations

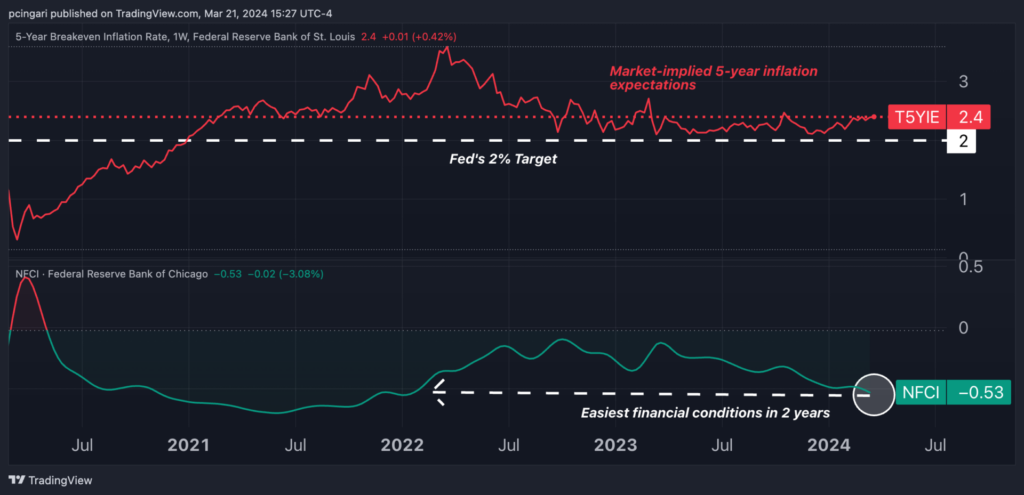

Recent data reveals a telling dichotomy in the U.S. financial landscape: while financial conditions have notably loosened, inflation expectations remain persistently above the Federal Reserve’s target, painting a complex picture of the economic environment the Fed is navigating.

The Chicago Fed National Financial Conditions Index, which offers a comprehensive weekly glimpse into U.S. financial conditions across money markets, debt, and equity markets, fell to –0.53 in the week ending March 15.

This descent into negative territory, marking the lowest level since January 2022, historically signifies looser-than-average financial conditions. Such easing financial conditions, characterized by more accessible credit and increased liquidity, typically aim to stimulate economic activity.

Concurrently, the 5-year breakeven rate, a gauge of market-based expectations for inflation over the next five years, remains at 2.4%.

This figure has consistently stayed above the Federal Reserve’s 2% inflation target for the past three years, signaling enduring market sentiments of higher inflation. This sustained expectation of inflation, despite the Fed’s efforts to anchor it at a lower level, reflects the challenges facing monetary policymakers as they strive to balance growth with price stability.

Treasury-inflation protected bonds are tracked by the iShares TIPS Bond ETF TIP.

This backdrop of loosening financial conditions alongside stubbornly high inflation expectations may explain Summers’s critique of the Federal Reserve’s direction.

Read now: Fed’s Dovish Stance Ignites Market Rally: ‘Everybody Is Bullish,’ Veteran Wall Street Investor Says

Photo by Brookings Institution on Flickr

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.