Zinger Key Points

- Despite a sharp decline in iPhone shipments in China, JPMorgan analyst suggests suggesting the downturn may be due to inventory adjustments.

- While immediate concerns about Apple's market share may be eased, uncertainty looms regarding the sustainability of any market recovery.

- Feel unsure about the market’s next move? Copy trade alerts from Matt Maley—a Wall Street veteran who consistently finds profits in volatile markets. Claim your 7-day free trial now.

Amidst the bustling landscape of China’s smartphone market, Apple Inc AAPL finds itself facing a daunting challenge as iPhone shipments witness a sharp decline.

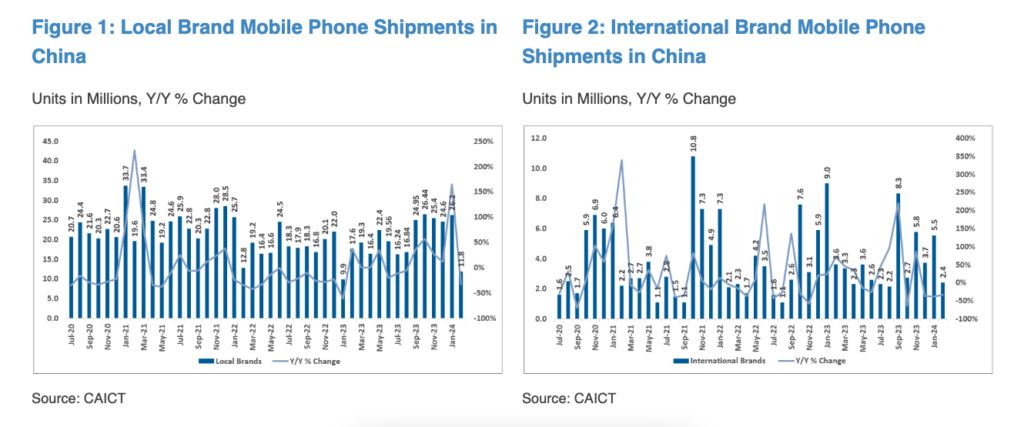

The latest data for February paints a concerning picture, with shipments plummeting by -33% year-on-year (y/y) and a staggering -56% month-on-month (m/m).

This decline, far exceeding typical seasonal patterns of -20% m/m, reflects a challenging landscape for the tech giant.

Related: Apple’s iPhone Sales Faces Sharp Decline in China Amid Rising Competition

As investors scrutinize the implications of this downturn, questions arise regarding Apple’s foothold in one of its key markets. Analysts too, are busy, reviewing the situation and offering their perspectives.

The Apple Analyst: JPMorgan analyst Samik Chatterjee gave his view of the situation. Chatterjee has an Overweight rating on the stock.

The Apple Thesis: Despite the alarming statistics, a closer examination revealed nuances that temper immediate alarm. While iPhone shipments did suffer, mirroring a broader -33% y/y and -55% m/m downturn in domestic mobile phone shipments, the root cause appeared to lie in inventory adjustments rather than a fundamental shift in market dynamics.

Chatterjee’s analysis offered a tempered perspective on the situation. He suggested that while the decline was notable, it might reflect a phase of market digestion rather than a definitive loss of market share.

Image Source: JPMorgan Analyst Note

Comparing the downturn in iPhone shipments with the broader decline in domestic mobile phone shipments (chart above), Chatterjee noted inventory adjustments within the market may be influencing these figures more than shifts in consumer preference.

Chatterjee cautioned against complacency, emphasizing the need for continued monitoring of market trends. He indicated that while immediate fears regarding market share may be alleviated, the sustainability of any market recovery remains uncertain.

Despite these challenges, Chatterjee maintained confidence in Apple’s resilience. He underscored the company’s history of innovation and adaptability, suggesting that it weathered similar storms in the past. Such resilience, he argued, positioned Apple well to navigate the current market turbulence.

Apple’s market share, particularly concerning local rivals such as Huawei, appeared more resilient upon closer scrutiny. The data suggested that the decline in iPhone shipments may be more a reflection of channel inventory levels rather than a loss of competitive ground to domestic players.

Nevertheless, this data warrants caution. While immediate fears regarding market share might be assuaged, the sustainability of any sequential recovery in the market remained uncertain.

AAPL Price Action: Apple stock was trading up 1.53% at $172.31 at publication Wednesday.

Read Next: Semiconductor Stocks Turn Volatile As China Changes Guidelines: Here Are The Key Players

Photo: Shutterstock

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.