Zinger Key Points

- Nvidia and Broadcom top AI picks by BofA; NVDA $1,100, AVGO $1,680 targets. "Junior samurAIs" like MRVL, MU, AMD eye growth amid volatility.

- Arya sees AI accelerator market doubling to $200B by 2027; NVDA to hold 75%+ share. MU's HBM growth to drive record sales,.

- Pelosi’s latest AI pick skyrocketed 169% in just one month. Click here to discover the next stock our government trade tracker is spotlighting—before it takes off.

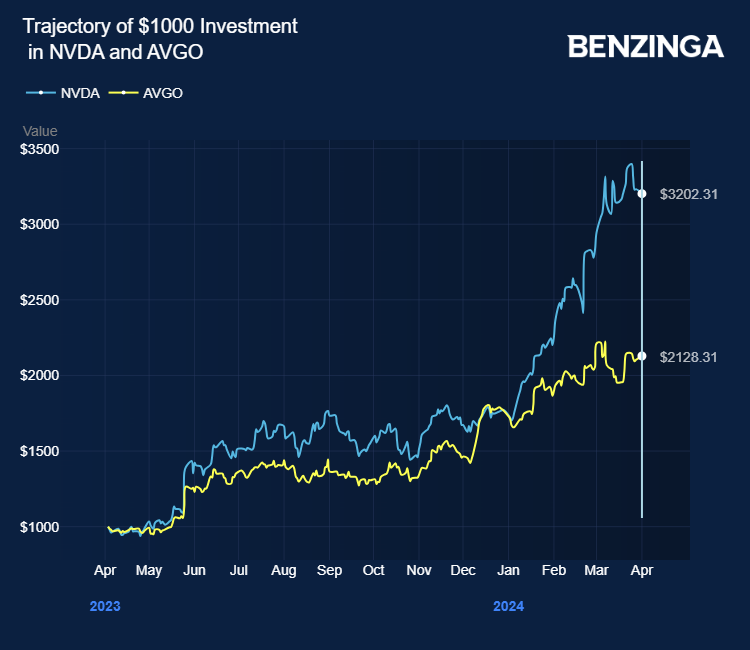

BofA Securities analyst Vivek Arya’s top picks were Nvidia Corp NVDA (Buy, price target of $1,100) and Broadcom Inc AVGO (Buy, price target of $1,680) in artificial intelligence, considering the adoption of accelerated/AI servers a generational shiſt with NVDA and AVGO, the leaders.

However, he noted the rising tide – accelerator market ~2xing to $200 billion over next three years – could create volatile but fruitful opportunities among the #2 vendors, including Marvell Technology, Inc MRVL (#2 to AVGO in AI networking, up and comer in custom chips) (Buy, price target $95), Micron Technology, Inc MU (potential to rapidly expand high-bandwidth memory or HBM market share behind Korean peers), and Advanced Micro Devices, Inc AMD (#2 GPU and #3 AI accelerator vendor) (Buy, price target $195).

Each “junior samurAI” trades interestingly at a valuation premium to its respective leader, so greater stock volatility is to be expected, as per the analyst. However, as the leader expands the market TAM, the junior can likely continue to carve a profitable niche.

Arya expects demand for HBM to grow at a 48% CAGR from the calendar year 2023-2027 to cross $20 billion and for Micron to expand its share to the mid-20s% vs. <5% currently, helping drive record overall company sales in the calendar year 2025- 2026.

According to the analyst, the memory industry also benefits as AI expands to the edge via higher-spec smartphones, PCs, and other smart/connected devices. He raised MU’s price target to $144 from $120 on a higher 2.8x the calendar year 2025 P/B vs. 2.2x prior, though in line with the 0.8x-3x historical range.

While AMD is behind in the maturity of its soſtware and developer base, Arya expects it to leverage its chiplet architecture to move faster to the 3nm node for calendar year 2026 AI products.

Arya forecasts the AI accelerator market to double from about $90 billion in the calendar year 2024 to $180 billion or even $200 billion by calendar year 2027. He expects NVDA to maintain or expend its 75%+ share, with custom chips (ASICs) contributing 10-15% share, and other merchant accelerator options (AMD, Intel Corp INTC, other private companies) the remaining 10-15%.

Price Actions: NVDA shares traded lower by 0.64% at $897.78 on the last check Monday. AMD shares traded higher by 1.66% at $183.48. AVGO shares traded higher by 1.17% at $1,340.83. MU shares traded higher by 5.6% at $124.51.

Photo by Gerd Altmann from Pixabay

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.