Editor’s note: This story has been corrected to clarify that Canoo and Fisker have issued “going concern” warnings, while only EV startup Arrival has filed for bankruptcy.

Electric vehicle startups Rivian Automotive, Inc. RIVN and Lucid Group, Inc. LCID are facing a harsh market reality, mirroring the struggles of even industry leader Tesla, Inc. TSLA. Their stocks have plummeted, and Tesla CEO Elon Musk couldn’t help but chime in on the situation.

Rivian’s Fall From Grace: A Tesla investor (@alojoh) recently reshared a post by Gary Black, managing partner of the Future Fund FFND, from November 2021. Back then, Black expressed optimism about Rivian, even at a $70 billion market cap, expecting them to produce 150,000 EVs annually by 2024 with $10 billion in revenue.

Source: Y Charts

See Also: Best Electric Vehicle Stocks

However, reality painted a different picture. “Guess this didn't age well. Rivian stock dropped below $9.0 billion, a stock which Gary had bought even for $70B market capitalisation,” the influencer said. Musk simply replied with a surprised “Wow.”

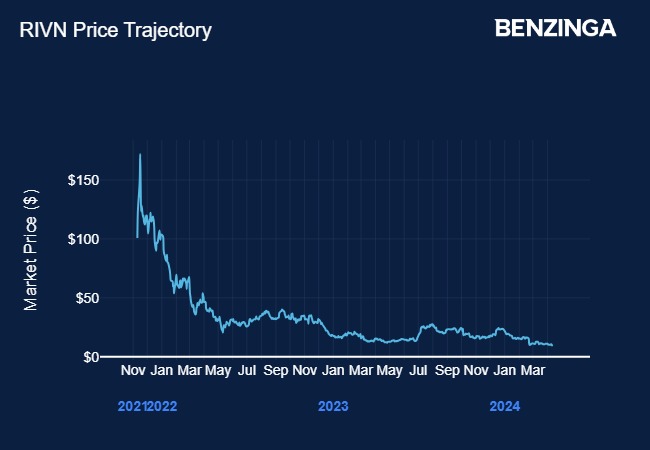

Rivian went public in November 2021, and its stock has seen a downward trend since its initial peak of around $179 shortly after the IPO. On Friday, it hit an all-time closing low of $9.13 after hitting a record intraday low of $9.08, according to Benzinga Pro data, amid a broader market pullback spurred by underwhelming earnings from Big Banks.

Source: Benzinga

Production Woes And Tough Market: Several factors contribute to Rivian’s struggles, with production ramp-up difficulties being the most significant. Musk, known for his bluntness, has repeatedly warned about the challenges startups face in scaling production, saying, “Prototypes are easy, production is hard.”

Initially, Rivian posed a credible threat to Tesla, becoming the first automaker to launch an electric pickup truck, the R1T, ahead of established players like Ford, GM, and even Tesla. Additionally, the company benefited from backing from e-commerce giant Amazon as both an investor and a customer.

However, the macroeconomic situation worsened in 2022 with rising interest rates slowing EV adoption, while supply chain issues hampered production.

Additionally, Rivian experiences significant losses per vehicle produced. Cash flow could be a concern for Rivian, considering the capital-intensive nature of the industry. The recent bankruptcy of fellow EV startup Arrival, and “going concern” warnings from Canoo and Fisker highlight this challenge.

At the end of 2023, Rivian’s cash reserves were $9.4 billion, including short-term investments and credit facilities.

Black’s Bullishness On Tesla’s Long-Term Prospects: Interestingly, Black’s Future Fund recently reduced its Tesla stake due to concerns about near-term prospects. Tesla now has less than 3% weighting in the ETF from the 1,842 shares it holds. In comparison, the ETF owns 15,796 Rivian shares, accounting for 1.30% of the portfolio weighting.

However, Black remains bullish long-term, anticipating the launch of a sub-$30,000 Tesla and significant advancements in self-driving technology. Black has advised Tesla to focus on education and dispel consumer concerns about EVs, rather than relying on price cuts.

Incidentally, Tesla reported its first year-over-year quarterly sales decline in four years for the March quarter. Recent reports suggest potential workforce reductions of up to 20% as the company navigates these challenges.

Read Next: Tesla On The Cusp Of Massive 20% Job Cuts Amid Fundamental Woes, Stock Slump: Report

Image made via photos on Shutterstock

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.