Zinger Key Points

- China's stock market is rebounding, offering new opportunities for investors, with insights from KraneShares' CIO on key catalysts.

- KraneShares' CIO highlights 5 factors driving China's market resurgence, from government intervention to improving economic indicators.

- China’s new tariffs just reignited the same market patterns that led to triple- and quadruple-digit wins for Matt Maley. Get the next trade alert free.

China's stock market has been a hot topic in 2024, and for good reason. After a rough start, marked by a sharp decline in January due to derivative-related issues, Chinese stocks have staged an impressive comeback.

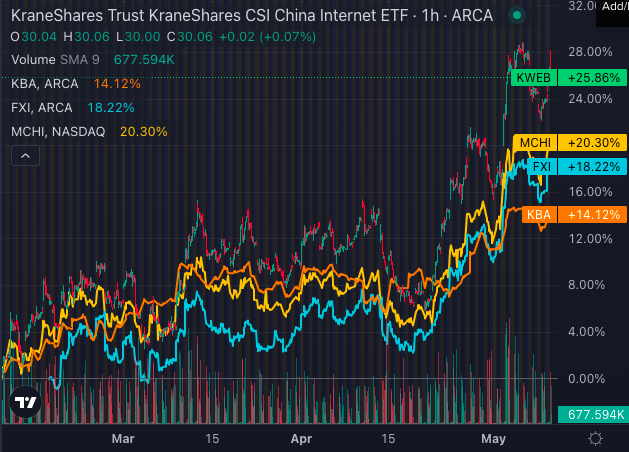

China ETFs Outperform U.S.

Key ETFs such as KraneShares CSI China Internet ETF KWEB, KraneShares Bosera MSCI China A 50 Connect Index ETF KBA, iShares MSCI China ETF MCHI, and iShares China Large-Cap ETF FXI have outperformed major U.S.-equity ETFs, such as the S&P 500 index-tracking SPDR S&P 500 ETF Trust SPY, since February, signaling a potential shift in the market landscape.

Also Read: China’s Strong Q1 Economic Rebound Sparks Optimism for Apple, Tesla And These Companies

KraneShares’ CIO Gives 5 Reasons To Invest

In a recent post, Brendan Ahern, chief investment officer at KraneShares, highlighted five key catalysts driving the current China market rebound.

- Government Support as a Catalyst: One of the fundamental differences in this rally is the proactive stance of the Chinese government in stabilizing the market.

State-linked entities like Central Huijin Investments have openly announced purchases of mainland-listed ETFs and increased holdings in mainland bank stocks. This level of transparency and support can instill confidence in investors and provide a strong foundation for the market to grow. - Global Investors' Changing Sentiments: Global investors are starting to reallocate their investments back into Chinese equities. Earlier in the year, many investors were cautious due to trade tensions and regulatory uncertainties.

However, with signs of easing tensions and supportive policies, there is a growing interest in Chinese stocks. This shift in sentiment could lead to increased capital inflows into Chinese markets, driving up stock prices. - Policy Reforms and Market Improvements: The Chinese government has issued “9 Key Points” to improve the country’s capital markets, focusing on controlling IPO supply, encouraging dividends, and enhancing corporate governance. These reforms are aimed at creating a more transparent and investor-friendly market environment, which could attract more investors, both domestic and international.

- Economic Recovery and Consumer Confidence: China’s economy is showing signs of recovery, with GDP exceeding expectations in the first quarter of 2024. Consumer confidence is also on the rise, with increased spending on services like dining and travel.

This uptick in economic activity could translate into higher corporate earnings and stock prices, making it an opportune time for investors to enter the market. - Attractive Valuations and Buyback Opportunities: Despite the recent rally, valuations in certain sectors of the Chinese market remain attractive. Many companies are taking advantage of this by buying back their stock, particularly in the internet sector.

This not only demonstrates confidence in their own businesses but also reduces the supply of shares in the market, potentially driving up prices.

These, according to Ahern, are compelling reasons why this resurgence in Chinese equities could offer lucrative opportunities for investors.

The recent resurgence in China's stock market presents an exciting opportunity for investors. With government support, changing investor sentiments, policy reforms, economic recovery and attractive valuations, Chinese equities could be poised for further growth.

Investors looking to capitalize on this trend should consider adding exposure to Chinese stocks in their portfolios, particularly through ETFs KWEB, FXI, MCHI and KBA, which offer diversified exposure to the Chinese market.

Photo: Chonrawit Boonprakob via Shutterstock

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.