Zinger Key Points

- Investors should also be aware that Eli Lilly and Novo Nordisk's current advantages might be challenged by new drugs in the pipeline.

- There is also a case for considering ETFs to capture the weight-loss drug market's potential.

- Feel unsure about the market’s next move? Copy trade alerts from Matt Maley—a Wall Street veteran who consistently finds profits in volatile markets. Claim your 7-day free trial now.

With more than 10% of the global population now suffering from obesity, the share prices of companies providing the latest weight-loss drugs have surged.

However, according to industry observers, investors considering exposure through the newly launched weight-loss exchange-traded funds (ETFs) need to evaluate their potential.

The Roundhill GLP-1 Weight Loss ETF OZEM and the Amplify Weight Loss Drug and Treatment ETF THNR debuted on May 21 with an expense ratio of 0.59%.

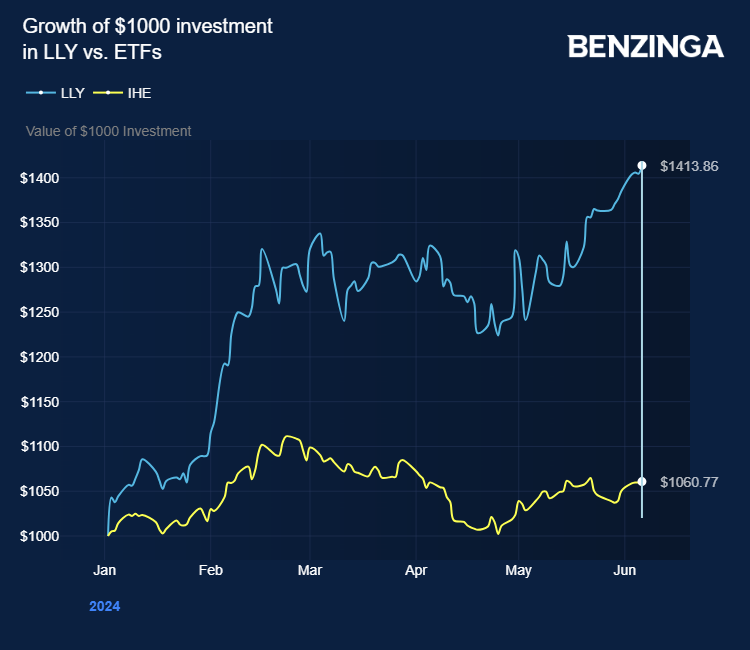

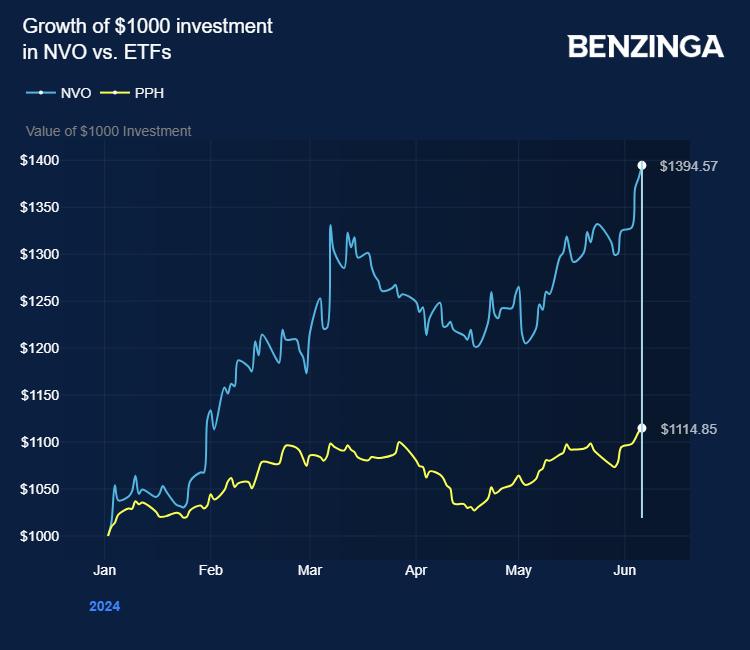

Both ETFs have significant weightings in industry giants Eli Lilly And Co LLY and Novo Nordisk A/S NVO, with OZEM and THNR allocating about 40% and 30%, respectively, to these companies.

Eli Lilly and Novo Nordisk are the only companies licensed to supply GLP-1 agonist drugs for weight loss.

Recent trials have shown that they can also reduce the risk of heart attacks and strokes, and there are anecdotal reports of their effectiveness in curbing cravings for substances like alcohol.

The Financial Times noted that industry observers are cautious about the long-term prospects of these drugs.

Kenneth Lamont, senior research analyst with Morningstar, said “solving obesity” has been a long-sought goal with many setbacks.

A VettaFi research paper highlighted the historical pattern of promising weight-loss drugs eventually facing serious issues, such as the 1933 drug 2,4-Dinitrophenol and various amphetamines over the decades.

The Financial Times added that investors should also be aware Eli Lilly and Novo Nordisk’s current advantages might be challenged by new drugs in the pipeline which could offer benefits like less frequent administration, oral options instead of injections and fewer side effects.

There is also a case for considering ETFs to capture the weight-loss drug market’s potential.

THNR, for instance, includes companies expected to bring new drugs to market soon and Fujifilm Holdings, which manufactures injection devices that are currently in shortage.

Christian Magoon, CEO of Amplify, believed this shortage indicated potential growth in the injectable GLP-1 drug market, especially given that many insurance companies do not cover these drugs as part of regular medical expenses.

Dave Mazza, CEO of Roundhill, emphasized the importance of active management in his fund, given the industry’s fast-paced developments.

However, Lamont questioned whether ETFs such as OZEM and THNR are the best approach, noting their concentrated bets and questioning the need to pay an annual fee of 0.59% when investors could achieve similar exposure by buying a few key stocks directly.

NVO, LLY Price Action: Novo Nordisk shares are up 0.25% at $142.76, and Eli Lilly shares are down 0.27% at $835.02 at last check Friday.

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo: I Yunmai via Unsplash

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.