Zinger Key Points

- Amazon offers higher growth potential with a 10.17% projected upside, outperforming Apple's modest 0.86%.

- Amazon's recent momentum and market dominance make it a compelling buy over Apple for growth seekers.

- China’s new tariffs just reignited the same market patterns that led to triple- and quadruple-digit wins for Matt Maley. Get the next trade alert free.

As the stock market sizzles in mid-2024, investors are eyeing two tech titans: Amazon.com, Inc. AMZN and Apple Inc. AAPL. Both stocks have hit all-time highs – with Amazon hitting the $200.43 mark and Apple stock hitting the $220.38 mark during day trading on Tuesday.

With both stocks being extremely popular and watched by Wall Street investors, the common all-time-high event raises the burning question: which is the better buy?

Amazon Stock

Amazon’s stock has soared, up 53.59% in the past year and 31.63% year-to-date. It recently touched a 52-week high of $200.43. With a market cap of $2.08 trillion and a P/E ratio of 56.02, Amazon is a heavyweight in tech.

Source: Benzinga Report

Analysts are bullish, with 43 ratings predicting a 12-month price target range of $200 to $245, averaging $222.50. This suggests a potential upside of 10.17%. The latest ratings from Needham, Wells Fargo, and B of A Securities, released between June 26 and July 1, imply a 10.66% upside with an average price target of $221.33.

Apple Stock

Apple’s stock has also performed well, up 14.45% over the past year and 14.41% year-to-date, closing at $220.27 on July 2. With a market cap of $3.36 trillion and a P/E ratio of 34.26, Apple remains a market leader.

Source: Benzinga Report

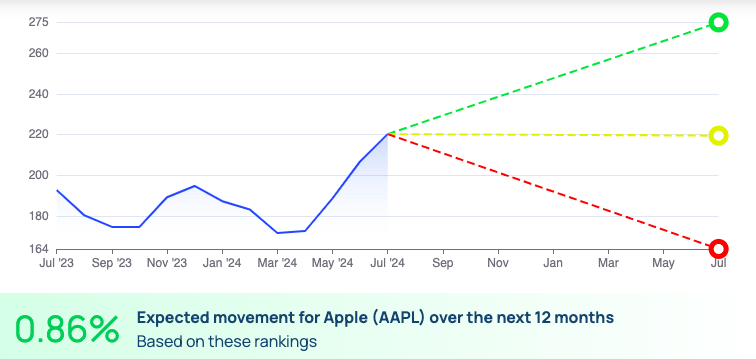

However, analysts forecast a modest upside. With 33 ratings suggesting a 12-month price target range of $164 to $275, the average is $219.50, indicating just a 0.86% potential rise. Recent ratings from UBS, Needham, and Oppenheimer, dated June 28 and July 1, offer an average target of $220, a minimal 0.27% upside.

Amazon Vs. Apple

Growth Potential: Amazon shows more promise with a 10.17% projected upside versus Apple’s 0.86%.

Valuation: Amazon’s P/E of 56.02 suggests higher growth expectations compared to Apple’s 34.26, but also higher risk.

Market Position: Amazon dominates e-commerce and cloud computing, while Apple leads in consumer electronics. Apple’s larger market cap and lower P/E might appeal to conservative investors, whereas Amazon’s growth potential attracts those seeking higher returns.

Recent Momentum: Amazon’s stronger recent performance hints at continued upward momentum.

Both Amazon and Apple are stellar investments.

However, Amazon appears to offer better growth prospects with a higher potential upside. Investors looking for robust growth may find Amazon more appealing, while those valuing stability might prefer Apple. As always, investment decisions should align with individual goals and risk tolerance.

Read Next:

Photo: Shutterstock

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.