Zinger Key Points

- Tesla could see its stock trade higher on a sum of the parts analysis after its robotaxi day, an analyst said.

- Tesla will host its robotaxi day on August 8, 2024.

- Get real-time earnings alerts before the market moves and access expert analysis that uncovers hidden opportunities in the post-earnings chaos.

The Tesla Inc TSLA story is shifting to autonomous vehicles, artificial intelligence and FSD after beating second-quarter deliveries.

Here's what one analyst is saying ahead of the company's highly anticipated robotaxi day.

The Tesla Analyst: Wedbush analyst Dan Ives has an Outperform rating and recently raised the price target to $300.

The Analyst Takeaways: Tesla price cuts could be in the rearview mirror after seeing demand stabilization for electric vehicles, Ives said.

"We believe Tesla's march towards 2 million units annual trajectory should be reached over the coming quarters with clear momentum and easier comps for 2025," Ives said.

The analyst sees Tesla's August 7 robotaxi day as a key catalyst for the company.

"The key for Tesla's stock looking ahead is the Street recognizing that Tesla is the most undervalued AI play in the market in our view with a historical Robotaxi Day ahead for Musk and Tesla."

Ives said the robotaxi day could "lay the yellow brick road to FSD and an autonomous future."

"We believe the August 8th Robotaxi Day will be a key historical moment for the Tesla story that we see as a near-term catalyst."

The analyst said the robotaxi day comes with Tesla's latest FSD v.12.4 rolled out and China FSD testing underway.

"Musk has said in the past that Tesla will make a car without controls for human use, saying in the past that FSD will reach a point of full autonomous use for taxi and driverless scenarios."

Ives stated that Tesla's FSD segment could be worth $1 trillion in the future. He mentioned that the robotaxi day could highlight Tesla’s autonomous capabilities, with a sum-of-the-parts valuation for the stock that includes energy storage, FSD, software, and automotive divisions.

"We continue to believe that Tesla is more of an AI and robotics play than a traditional car company… now the rubber meets the road as the Street anticipates August 8th as a key linchpin day for the Tesla story."

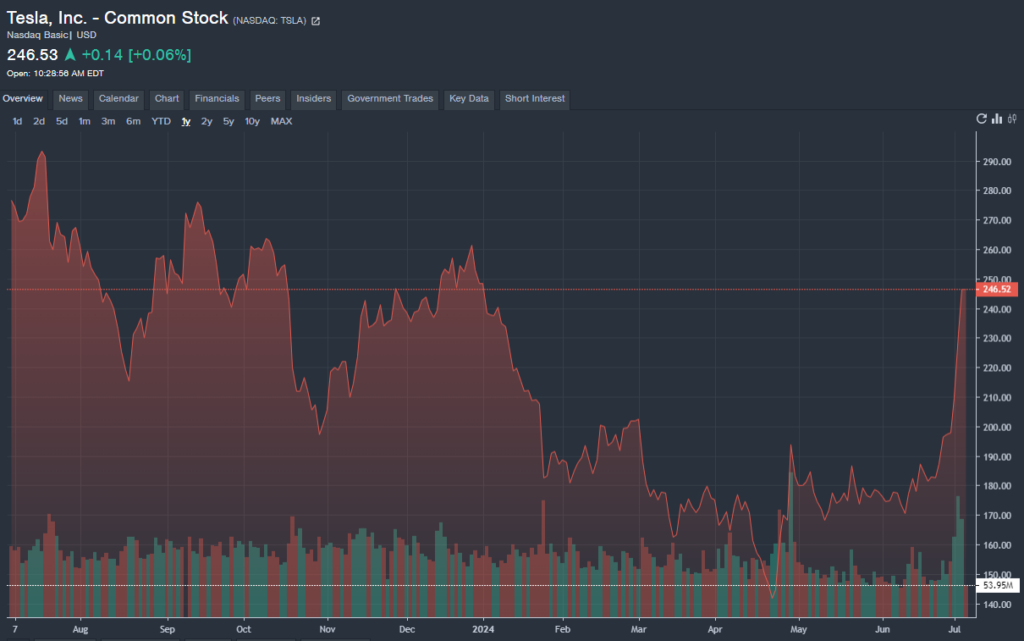

TSLA Price Action: According to Benzinga Pro, Tesla shares are up 2% to $250.75 on Friday, versus a 52-week trading range of $138.80 to $299.29. Tesla stock is up 36% over the last month, nearly turning the stock positive in 2024 with shares currently down 0.8% year-to-date.

Tesla’s one-year chart from Benzinga Pro

Read Next:

Elon Musk Now Follows Uber Founder On X: Foreshadowing For Robotaxi Day Or Coincidence?

Image created using artificial intelligence via Midjourney.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.