Zinger Key Points

- JPMorgan analyst highlights Boeing's impact, driving increased short interest in key supplier Kaiser Aluminum.

- Kaiser Aluminum's short interest surged 23% due to Boeing's challenges and overstretched stock momentum.

- The new Benzinga Rankings show you exactly how stocks stack up—scoring them across five key factors that matter most to investors. Every day, one stock rises to the top. Which one is leading today?

In the world of aerospace, when a giant like Boeing Co BA hits turbulence — the shockwaves are felt far and wide. One such ripple effect has landed squarely on Kaiser Aluminum Corp KALU.

Kaiser has a long-term contract with Boeing. Kaiser supplies sheet and light gauge aluminum plate for use in Boeing commercial aircraft products.

Read Also: How Boeing’s Guilty Plea Could Impact US Defense Contracts

Boeing’s plight in recent months has led investors to cast a doubt on its suppliers’ prospects. A prime example of this is seen in Kaiser Aluminium’s stock. Kaiser’s short interest has surged to a 12-month high, according to JPMorgan analyst Bill Peterson’s latest Short Interest Tracker.

High-Flying Concerns

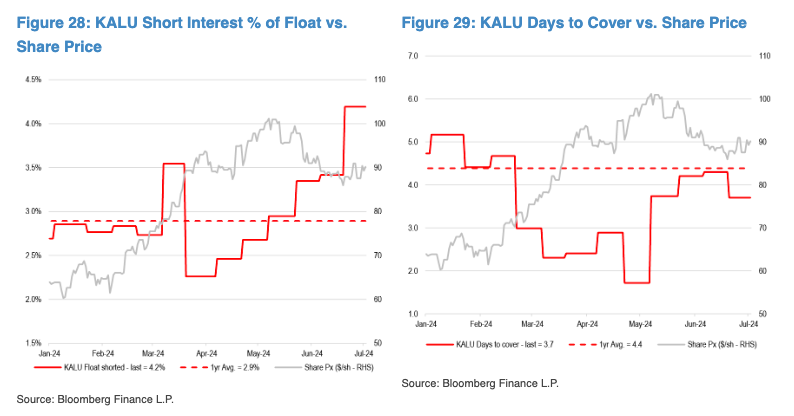

As of the June 28 settlement, Kaiser Aluminum’s short interest had rocketed 23% to 4.2% — a significant leap from its one-year average of 2.9%. The reasons? Mounting concerns over Boeing’s de-stocking and an overstretched stock momentum have investors on edge.

Numbers That Speak

- KALU's short interest: 4.2%, up 23% in two weeks, 25% over four weeks

- Stock price (as of July 10): $90.19

- Analyst rating: Neutral (N)

- Price target: $85.00, indicating a 6% downside

- Price movements: +2.2% over one week, -2.1% over one month

The Boeing Effect

Peterson points out that the catalyst for this spike in short interest is the increased risk surrounding Boeing.

As Boeing grapples with its own set of challenges, the ripple effect has not only impacted its stock but also put suppliers like Kaiser Aluminum. Boeing’s de-stocking fears have made investors wary, prompting them to bet against Kaiser Aluminum stock in anticipation of further declines.

Short Sellers In The Cockpit

With the average days-to-cover falling to 3.3 days from 5.1 days, short sellers are clearly in the cockpit. They are clearly navigating this volatile landscape with heightened activity. The jump in short interest is a stark reminder of the cautious sentiment pervading the market as investors brace for potential fallout from Boeing’s woes.

In the ever-turbulent skies of aerospace investments, Kaiser Aluminum finds itself in a precarious position. As Boeing battles its own demons, the reverberations continue to unsettle its suppliers, making Kaiser Aluminum a focal point for short sellers betting on further instability.

Whether this turbulence will lead to a smoother landing or more rough skies ahead remains to be seen.

Read Next:

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.