Zinger Key Points

- Johnson & Johnson reports second quarter financial results Wednesday July 17.

- JNJ stock has underperformed the market and is one of the worst performing Dow Jones Industrial Average stocks in 2024.

- Our government trade tracker caught Pelosi’s 169% AI winner. Discover how to track all 535 Congress member stock trades today.

Johnson & Johnson JNJ was one of the worst-performing Dow Jones Industrial Average stocks in the first half of 2024. Investors and analysts will be looking for the company to show progress from a mixed first quarter when second-quarter financial results are reported Wednesday, July 17.

Earnings Estimates: Analysts expect Johnson & Johnson to report second-quarter revenue of $22.31 billion, according to data from Benzinga Pro.

The company reported revenue of $25.53 billion in last year's second quarter, meaning analysts see a revenue decline on a year-over-year basis. Johnson & Johnson has beaten revenue estimates in six of the past 10 quarters and four of the last five quarters.

Analysts expect Johnson & Johnson to report second-quarter earnings per share of $2.70, which would be a decline from $2.80 reported in last year's second quarter. The company has beaten analysts’ estimates for earnings per share in the last 10 straight quarters.

Guidance from the company calls for full year sales of $88.7 billion to $89.1 billion, which was ahead of previous consensus estimates. The company estimates that full fiscal year earnings per share will be in a range of $10.57 to $10.72.

What Analysts Are Saying: Johnson & Johnson is making noise in the intraocular lens segment, Stifel analyst Thomas Stephan said in a new investor note.

The analyst surveyed 93 U.S. ophthalmologists to find out which IOLs were being favored over others.

"JNJ's Odyssey is already showing impressive early survey results," Stphen said.

The bad news for Johnson & Johnson could be that Odyssey could "cannibalize other JNJ lenses" like Synergy, the analyst said.

The analyst has a Buy rating on Alcon ALC and RxSight RXST in the sector and sees the potential of Johnson & Johnson losing more market share.

"RXST's LAL expectedly is poised to gain overall IOL share in 2025; ALC share loss appears moderate, and potentially less than JNJ."

Guidance from analysts and the company are reasonable for Johnson & Johnson, Goldman Sachs recently said.

The firm reiterated a Neutral rating on Johnson & Johnson and has a $160 price target.

Goldman Sachs estimated Johnson & Johnson will have second-quarter revenue of $22.5 billion and earnings per share of $2.72.

The analyst cautioned that growth could slow for the company citing the biosimilar entry of Stelara, the company's largest product.

Read Also: 5 Biggest Winners, 5 Biggest Losers From Dow Jones Industrial Average In First Half 2024

Key Items to Watch: Psoriasis drug Stelara had sales of $2.45 billion in the first quarter, which was below estimates. Analysts and investors will likely be looking for this number to improve ahead of competition in 2025.

Several cancer drugs saw growth in the first quarter and will be closely monitored in the second quarter report.

Medical devices were a strong segment in the first quarter with sales of $7.82 billion, up 4.5% year-over-year. The segment could provide some relief from any weakness in other segments.

Since reporting first-quarter financial results, Johnson & Johnson has shared updated clinical trial results for several promising drugs.

The company's cell therapy Carvykti showed strong survival rates in a Phase 3 study. The study could expand the use cases for Carvykti going forward.

In June, Johnson & Johnson shared data from its Phase 3 study of Tremfya, an induction therapy to treat Crohn's Disease. The study met co-primary endpoints.

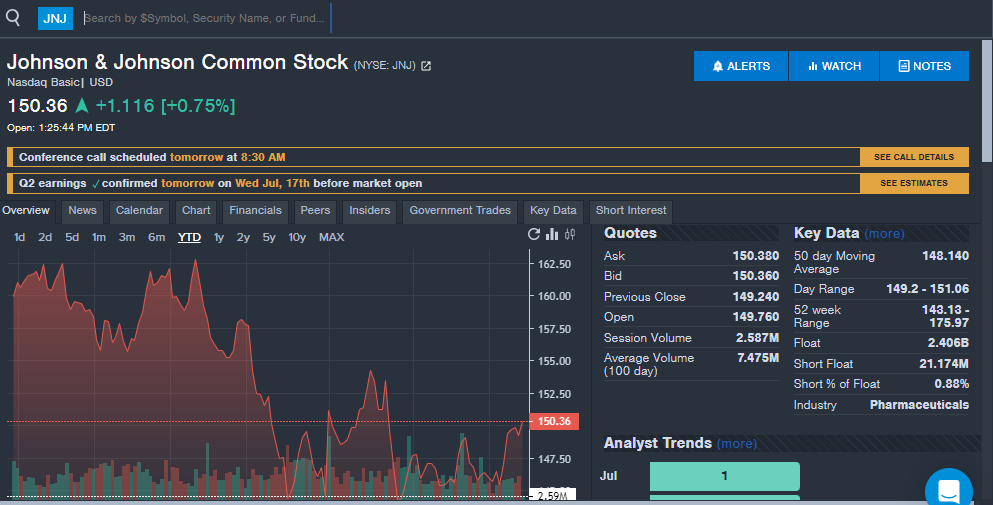

With shares of Johnson & Johnson shares down 4.1% year-to-date in 2024, as seen on the chart from Benzinga Pro below, the company could use the earnings report and earnings call as a chance to highlight the drug pipeline and future growth.

JNJ Price Action: Johnson & Johnson shares trade at $150.51 at last check Tuesday, versus a 52-week trading range of $143.13 to $175.97. Johnson & Johnson stock is down 5.5% over the last year, trailing the broader market.

Read Next:

Photo: Michael Vi via Shutterstock

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.