Zinger Key Points

- TMTG's fortunes are closely tied to Trump's political fortunes and for now, the road ahead may not be very bumpy for the stock.

- Reddit has evince more confidence among analysts, who laud it for its key user metrics and growth opportunity.

- Get 5 stock picks identified before their biggest breakouts, identified by the same system that spotted Insmed, Sprouts, and Uber before their 20%+ gains.

Social media stocks Reddit, Inc. RDDT and Trump Media & Technology Group Corp. DJT were among high-profile public listings in March and their fortunes have diverged. Here’s a rundown on how the shares have fared since their listings vis-a-vis fundamentals and what lies ahead.

TMTG’s Roller-Coaster Ride: TMTG, the parent of the Truth Social platform, is owned by Republican presidential candidate Donald Trump, and the company completed a long-delayed merger with the SPAC Digital World Acquisition Corp on March 25. The shares of the company began trading on the Nasdaq on March 26.

Ahead of the listing, the shares of the SPAC jumped about 35% on March 25 amid the confirmation of the combination. On its debut session as a public company, the stock moved in a range of $57.25-$79.38 before settling up 16% at $57.99. From the post-listing high, the stock declined steadily and hit an intraday low of $22.55 on April 16. The stock lock-stepped with the news flow concerning Trump, who faced multiple lawsuits and is navigating through a tight presidential race with President Joe Biden.

Also weighing down on the stock are concerns about its overvalued nature vis-a-vis fundamentals. Truth Social was struggling to grow its user base against established rivals. Data from Similarweb showed that U.S. daily visits to Truth Social fell 21% month-over-month in May, CNBC reported. The average number of monthly visits over the past year plunged 39% to 4 million for the period from May 2023 to April 2024 versus the prior 12-month period.

The company’s maiden quarterly report as a public entity released in late May showed a net loss of $327.9 million for the March quarter.

Although the stock staged a recovery from the mid-April lows and went past the $53 level by the end of May, it began to head lower subsequently. It picked up some momentum this week after the odds of a Trump victory improved after a failed assassination attempt aimed at Trump.

Source: Benzinga

See Also: Best Social Media Stocks

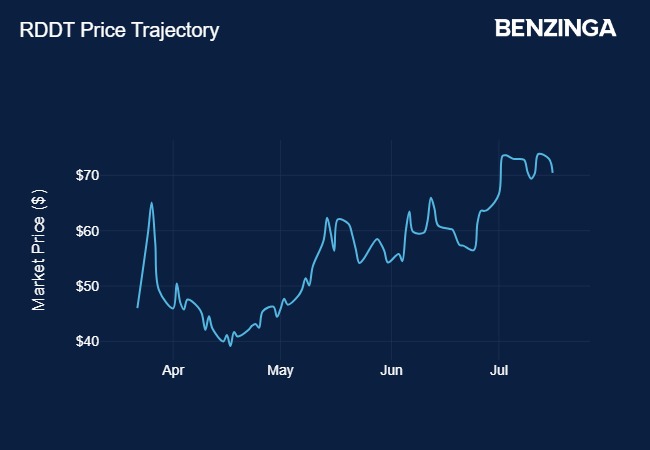

Reddit Rides AI Wave: Compared to TMTG, Reddit has had fairly smooth sailing following its March 21 listing. The San Francisco, California-based social-media company had to price its offering at $34 per share, giving it an IPO valuation of $6.5 billion, marking a discount from the $10 billion at which it was valued at a 2021 private fundraising round.

The stock opened the debut session at $47, rose to an intra-day high of $57.80 and closed at $50.44. The stock reached a post-IPO high of $74.90 in three sessions, before beginning to lose steam. After bottoming at $37.35 on April 18, the stock has embarked on an uptrend, hitting a high of $76.73 last Friday.

The most recent run in the stock is due to its exposure to the hot-and-happening artificial intelligence technology. The Alexis Ohanian co-founded company announced a partnership with OpenAI that will allow the social network’s content to be made available for the latter to train its ChatGPT products. The agreement also provided for Reddit to add AI features to its communities.

Source: Benzigna

What’s Next: TMTG’s fortunes are closely tied to Trump’s political fortunes. The tide turned in his favor after the first presidential debate and the weekend rally shooting and the stock skyrocketed on Monday. Since then, he has suffered a setback as he announced Sen. J.D. Vance (R-Ohio) as his running mate.

Trump has a majority 64.9% stake in TMTG thanks to the 114.7 million shares he owns in the company. The lock-up period for shares held by insiders expires in September. Around that time, if insiders choose to flood the market, the stock could see some downside. All said and done, investors should brace for considerable volatility in the run-up to the Nov. 5 election. A Trump victory could provide a boost to the shares and give it an extended run but if he fails to win a second term, the way ahead could be bleak.

On the other hand, Reddit is positioned relatively better than TMTG in terms of fundamentals. Needham analyst Laura Martin raised the price target for the stock in mid-June, lifting it from $63 to $75. She also kept the company in the firm’s “Conviction List” stock pick.

“RDDT’s core advertising fundamentals and user adds are exceeding our prior estimates, and its operating costs are growing more slowly than our prior estimates,” Martin said. Data licensing revenues, with 85% margins, have nearly doubled since Needham’s initiation report, the analyst said. This will likely add to Reddit’s revenues and free cash flow, beginning in the third quarter, she added.

Martin expects additional data-licensing deals to be announced in the second half of the year and 2025.

The average analysts’ price target for Reddit, based on data compiled by TipRanks, is $63, suggesting a downside potential of over 10%. More details could be forthcoming when Reddit announces its second-quarter results on Aug. 6.

TMTG shares ended Tuesday’s session down 9.09% at $36.89, according to Benzinga Pro data, while Reddit fell 3.48% to $70.44.

Read Next:

Image Via Shutterstock

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.