Zinger Key Points

- Google is Laura Martin's top large-cap pick for 2024, driven by AI and political ad spending.

- Analyst Martin highlights YouTube's rapid growth and GenAI's potential as key drivers for Google's long-term success.

- Get two weeks of free access to pro-level trading tools, including news alerts, scanners, and real-time market insights.

Needham analyst Laura Martin reiterated Alphabet Inc GOOGL Google with a Buy and a $210 price target.

GOOGL is Martin’s top large-cap stock pick for 2024, backed by a more robust macro backdrop, record political ad spending, data advantages, and Generative artificial intelligence integrations.

The analyst highlighted Google’s compelling long-term position, backed by the company’s global ad revenue and digital market moat. Martin also highlighted YouTube as a rapid subscription revenue growth driver.

The analyst expects Google’s proprietary large language models (LLMs), with thousands of small and medium-sized businesses developing apps on these platforms, to be its primary upside value driver over the next 3-5 years.

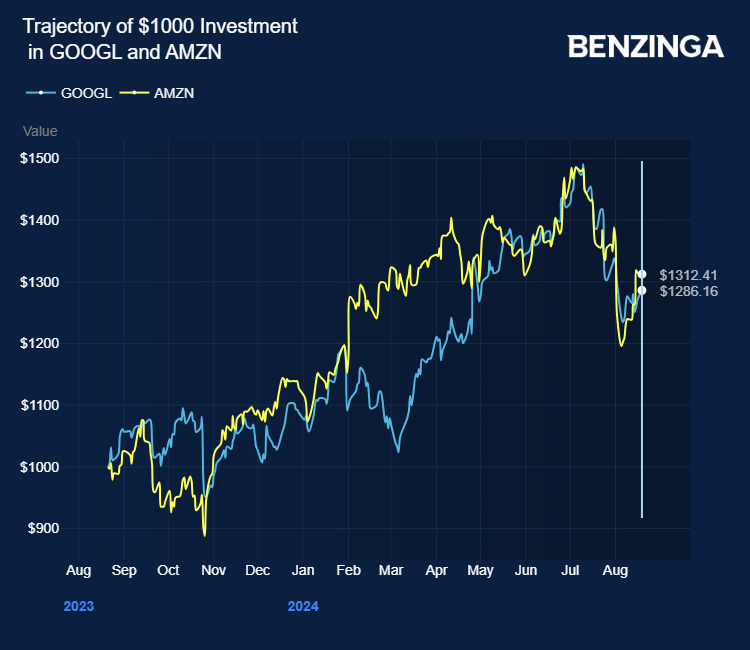

Martin listed critical takeaways from her conversation with the CEO of a GenAI infrastructure company that flagged Google and Amazon.Com Inc AMZN as the most likely winners of the current arms race to build out GenAI tools, features, and capabilities. Companies have invested $1.3 trillion over the past 12 years to build the public cloud.

Amazon and Microsoft Corp MSFT took six years to achieve profitability from their cloud business. GenAI is much bigger; the analyst highlighted the CEO’s view.

The CEO projects $5 trillion—$6 trillion in total capital expenditure required for new data center infrastructure to support GenAI. He expects hyperscalers to spend $250 billion in 2024 on GenAI infrastructure projects, five times higher than the $50 billion annually they spent six years ago to build their cloud infrastructures.

Martin noted the CEO’s view that GenAI has already generated over $100 billion in revenue after 18 months. He expects GenAI business demands in 2024 to exceed GenAI capacity by 2x.

Martin projected fiscal 2024 revenue and EPS of $346.40 billion and $7.62.

Price Action: GOOGL shares traded higher by 1.37% at $165.19 at last check Monday.

Photo via Shutterstock

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.