Zinger Key Points

- Chewy reports Q2 financial results Wednesday after market close.

- An analysts sees growth ahead thanks to a shift to online sales and several product launches.

- Feel unsure about the market’s next move? Copy trade alerts from Matt Maley—a Wall Street veteran who consistently finds profits in volatile markets. Claim your 7-day free trial now.

All signs point to analysts and investors looking to see if Chewy Inc CHWY can keep up recent momentum and financials ahead of estimates when second-quarter results are reported Wednesday, Aug. 28 after market close.

Earnings Estimates: Analysts expect Chewy to report second-quarter revenue of $2.86 billion compared to $2.78 billion in last year's second quarter, according to data from Benzinga Pro.

The company has beaten revenue estimates from analysts in two straight quarters and seven of the past 10 quarters overall.

Analysts see Chewy reporting second-quarter earnings of 2 cents per share, compared to 15 cents per share in last year's second quarter. The company has beaten analysts’ estimates in nine straight quarters.

Guidance from the company calls for revenue to come in a range of $2.84 billion to $2.86 billion.

Read Also: Ryan Cohen The GOAT? Fresh Data Shows Chewy Mastermind Anticipated Massive Trends In Pet Supplies

What Analysts Are Saying: Improving industry trends for the pet market could be shown in the second quarter, JPMorgan analyst Doug Anmuth said.

The analyst reiterated an Overweight rating and $28 price target ahead of earnings.

Anmuth sees strong execution by the company and the potential for customer growth in the second half of the fiscal year.

"We believe pet is a growing and a highly attractive category that is early in the shift online, and, in our view, Chewy is well-positioned as the leader in online pet with a ~33% market share," Anmuth said.

Anmuth said secular growth, the shift to online sales, and growth of pharmacy, services and international expansion could all be catalysts for Chewy.

"We continue to like CHWY's category positioning, improving profitability, and efforts to diversify revenue into healthcare, international & sponsored Ads."

The analyst said pharmacy and private label are among the fastest growth areas for the companies and also come with high margins.

Chewy's Autoship subscriptions plan also serves as a competitive advantage, Anmuth said.

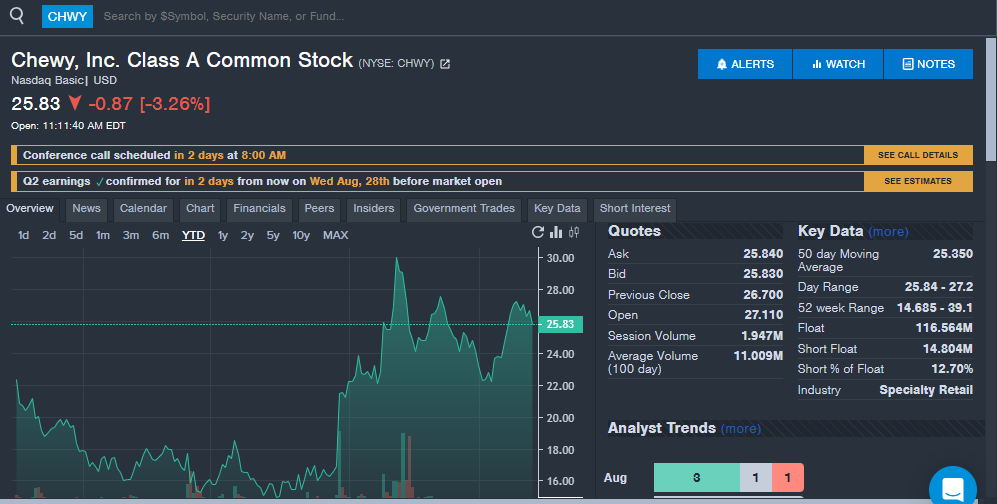

While Chewy shares are up only 8.6% year-to-date in 2024, Anmuth highlights that the stock is up 660% since first-quarter financial results, as illustrated in the Benzinga Pro chart below.

Here are other recent analyst ratings on Chewy and their price targets:

Morgan Stanley: Maintained Overweight rating, raised price target from $28 to $30

Raymond James: Downgraded from Outperform to Market Perform, no price target

Baird: Maintained Outperform rating, raised price target from $26 to $32

Bank of America: Maintained Underperform rating, raised price target from $18.50 to $20

Wedbush: Reiterated Outperform rating, $35 price target

Key Items to Watch: There are many items to watch when Chewy reported with new business verticals like health care among the top items investors and analysts may be watching.

The cross-promotion of pet food and pet care products has resulted in higher net spending per customer in recent quarters.

Chewy also opened several veterinarian clinics with plans to open more in 2024. Investors and analysts could get an update on how this newer segment is performing and what plans are.

Chewy Plus, a paid membership program in beta, could also be a key item shared in the company's results and outlook.

"Chewy's value proposition continues to resonate with our customers, and I am proud of the teams at Chewy who are executing flawlessly on our strategic roadmap and the controllable elements of our business," Chewy CEO Sumit Singh said after first-quarter results.

A $500 share buyback announced in the first quarter could also be a key highlight in the second-quarter results and future guidance.

CHWY Price Action: Chewy shares are down 3.90% to $25.66 on Monday versus a 52-week trading range of $14.69 to $39.10. Chewy stock is down 1.7% over the past year and up 8.6% year-to-date in 2024.

Read Next:

Photo: Shutterstock

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.