Zinger Key Points

- Fitch reaffirms the U.S. credit rating at 'AA+' but warns of rising debt and political polarization risks.

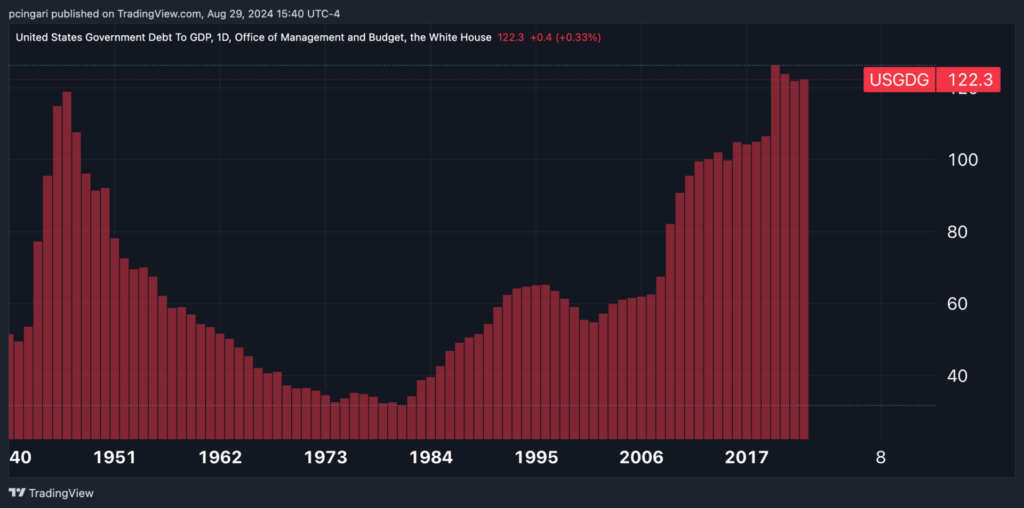

- Fitch predicts U.S. economic growth will slow to 2.1% in 2024 and 1.6% in 2025-2026. Debt-to-GDP ratio is expected to hit 124.4% by 2026.

- Feel unsure about the market’s next move? Copy trade alerts from Matt Maley—a Wall Street veteran who consistently finds profits in volatile markets. Claim your 7-day free trial now.

Fitch Ratings reaffirmed the U.S. sovereign credit rating at ‘AA+’ with a stable outlook Thursday, citing strengths like high per capita income and the financial flexibility afforded by the U.S. dollar.

The rating agency also flagged growing concerns over escalating debt and increasing political polarization. According to Fitch, this heightens the nation’s vulnerability to economic and confidence shocks.

The “government has failed to meaningfully tackle large fiscal deficits, the growing debt burden and looming increases in spending associated with an aging population,” the Fitch report said.

For this reason, the U.S. standards of governance fall short of the average levels seen in similarly rated country peers.

It’s worth noting that, as of August 2024, Fitch Ratings assigned an AA+ rating to Austria, Canada, and Taiwan as well.

Governance Shortcomings, Fiscal Woes Persist, Fitch Says

Last August, Fitch downgraded the U.S. sovereign credit rating from AAA citing “a steady deterioration in standards of governance,” leading to a high and growing general government debt burden.

Yet, in that occasion, the agency had also predicted that tighter credit conditions, declining business investment, and a slowdown in consumption would have led to a mild recession in the U.S. economy during the fourth quarter of 2023 and the first quarter of 2024 — a forecast that turned out to be entirely off the mark.

Fitch expects the current precarious fiscal position to remain largely unsolved, despite the contrasting economic goals, tax policies, and spending priorities of presidential candidates Vice President Kamala Harris and former President Donald Trump.

“We expect most of the 2017 tax cuts will be extended under either Trump or Harris,”

These cuts represent about 1.2% of GDP and are expected to exacerbate the fiscal position.

While revenue-enhancing measures such as Trump’s proposed trade tariffs or Harris’ plan to raise corporate taxes are on the table, Fitch believes their impact will be neutralized by other policy measures, including the extension of the Tax Cuts and Jobs Act or the implementation of child tax credits.

Economic Deceleration Looms, Debt Projections Worsen

U.S. economic growth is projected to decelerate, with Fitch estimating an average growth rate of 2.1% in 2024, down from 2.5% in 2023. The slowdown is partly attributed to reduced government spending. For 2025-2026, growth is anticipated to average 1.6% as economic imbalances gradually correct.

For 2024, Fitch forecasts a slight narrowing of the deficit to 8.1% of GDP, driven by modest revenue gains and a reduction in discretionary spending. However, the interest burden is expected to rise due to higher debt levels and increasing interest rates.

“Given our expectation that fiscal policy will not change much under the new administration, we expect 7.7% of GDP deficits in both 2025-2026.”

The debt ceiling suspension is anticipated to last until the end of 2024, after which the debt threshold will be reinstated. As in previous years, the government may rely on extraordinary measures and cash reserves to delay reaching the critical x-date.

“We expect Congress to pass continuing resolutions to extend the FY2025 appropriations bills due Sept. 30, 2024 until after the elections and possibly through March 2025.”

Fitch projects that the government debt-to-GDP ratio will climb to 124.4% by the end of 2026, significantly above the median for AA-rated nations.

“Despite the rising debt level, the financing flexibility of federal government benefits tremendously from the role of the U.S. dollar in the share of global reserves and the most important currency in trade, borrowing and in global payments,” Fitch wrote.

Regarding monetary policy, Fitch expects the Federal Reserve to initiate a rate cut cycle, with a 25 basis point reduction likely in September 2024, followed by an additional 125 basis points in cuts throughout 2025.

Market Reactions

Both Treasury yields and the U.S. dollar remained broadly unchanged following the Fitch Ratings’ report.

The U.S. Dollar Index (DXY), tracked by the Invesco DB USD Index Bullish Fund ETF UUP, was 0.3% higher at 3:30 p.m. ET.

Treasury yields were up by about 3 basis points across the curve, slightly rising during the session amid a stronger-than-predicted economic growth in the second quarter. Treasury-linked exchange traded funds (ETFs) fell Thursday.

The iShares 20+ Year Treasury Bond ETF TLT slipped 0.9%, while the US 10 Year Treasury Note ETF UTEN eased 0.5%.

Stocks pared their gains during afternoon trading in New York. The SPDR S&P 500 ETF Trust SPY edged up 0.2%, while the tech-heavy Invesco QQQ Trust, Series 1 QQQ, which had surged 1.4% by midday, was up just 0.1%.

Now Read:

Image: Shutterstock

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.