Zinger Key Points

- Fed targets inflation of around 2% over the longer run, with its favorite inflation gauge being the annual rate of the price index for PCE.

- Krugman said inflation is basically in line with the target if the lagging shelter measures are accounted for.

- Feel unsure about the market’s next move? Copy trade alerts from Matt Maley—a Wall Street veteran who consistently finds profits in volatile markets. Claim your 7-day free trial now.

The Federal Reserve’s rate-setting committee -the Federal Open Market Committee, kickstarts a two-day meeting on Tuesday and the futures market currently bakes in a 67% probability of a 50-basis-point rate cut. Ahead of the all-important meeting, Nobel laureate Paul Krugman said on Monday the fed funds rates are “too high.”

Data Turns Benign: The Fed targets inflation of around 2% over the longer run, with its favorite inflation gauge being the annual rate of the price index for personal consumption expenditure. The latest available data show that the annual rate of headline and core consumer price inflation was 2.5% and 3.2%, respectively, in August.

Using the personal consumption expenditure as an inflation measure shows the annual headline and core rate at 2.5% and 2.6%, respectively, in July.

Krugman said inflation is basically in line with the target if the lagging shelter measures are accounted for. Pointing to the job openings data, he said, “The labor market is cooler than it was before the pandemic.” Job openings fell to 8.83 million in July, the lowest since 2021, according to a Bureau of Labor Statistics report.

See Also: Best Inflation Stocks

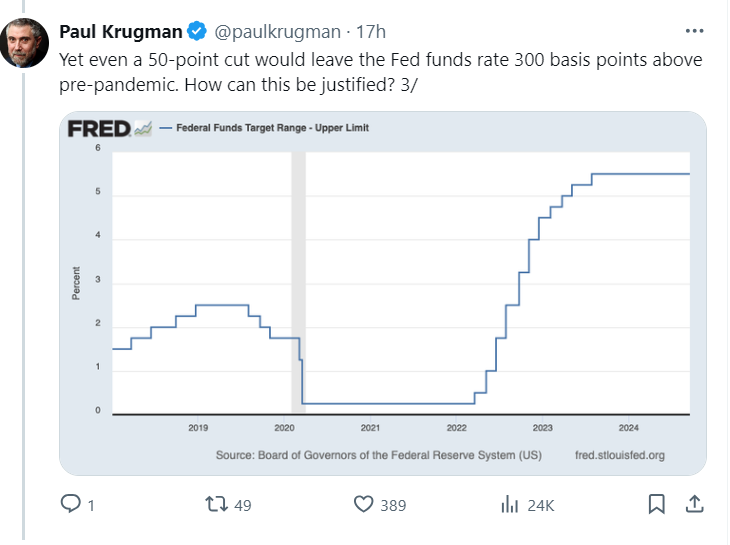

Rates Elevated: Juxtaposing that with the Fed funds rate, Krugman noted that even a 50-point cut would leave the Fed funds rate 300 basis points above pre-pandemic.

“How can this be justified?” he asked. While self-answering the question, the economist said the economy doesn’t seem to be in a recession yet. The Fed is apparently waiting to adjust the taps until it turns ice-cold, he said, adding that “maybe it’s PTSD from the unexpected inflation of 2021-22, but it’s still a big mistake.”

“Also bear in mind that the risks are asymmetric: we’re probably back in the world where excessively loose monetary policy will only gradually affect inflation, while a labor market downturn could happen very fast,” Krugman said.

Realistically, there is hope for a 50 basis-point cut, the economist said. He, however, said the argument for incrementalism is very weak.

Meanwhile, economists on the other end of the spectrum such as Peter Schiff think a rate cut now would be a huge mistake, as it would potentially weaken the dollar and fan inflationary pressure, with the vicious cycle continuing.

The iShares TIPS Bond ETF TIP, an ETF tracking the investment results of an index composed of inflation-protected U.S. Treasury bonds, ended Monday's session up 0.34% at $110.82, according to Benzinga Pro data.

Read Next:

Photo by TANYA LARA on Shutterstock

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.