Zinger Key Points

- China's latest stimulus package boosts optimism with Trip.com, JD.com and Alibaba offering significant upside potential, per analysts.

- Analysts predict 42% upside for Trip.com, almost 37% for JD.com and nearly 30% for Alibaba in the next 12 months.

- China’s new tariffs just reignited the same market patterns that led to triple- and quadruple-digit wins for Matt Maley. Get the next trade alert free.

China's latest economic stimulus is making waves across global markets. Following a bold series of moves by the People's Bank of China (PBoC), which included:

- Slashing the reserve requirement ratio (RRR) for banks

- Reducing key repo rates

Accordingly, an influx of liquidity is expected to hit the country's financial system. The goal? Inject approximately $140 billion into the economy and encourage more lending to boost growth.

While there's been some volatility following this news, certain U.S.-listed Chinese stocks remain hot picks for analysts. Here's a closer look at three large-cap stocks with strong upside potential, alk are currently rated a Buy by analysts.

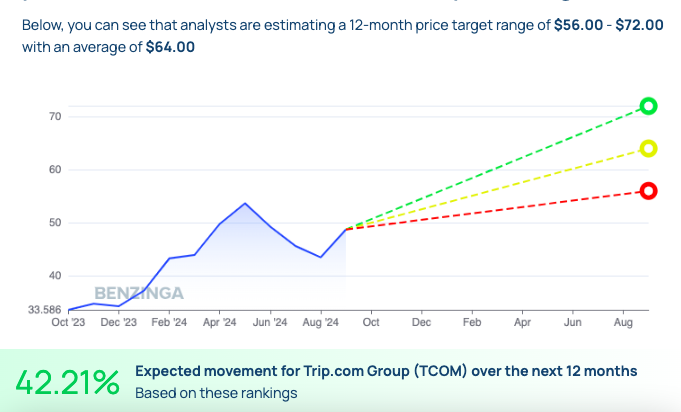

Trip.com: Ready To Soar 42% As China’s Travel Boom Takes Off

Source: Benzinga Stock Report – TCOM

First on the list is Trip.com Group TCOM, China's largest online travel agency. The stock has soared over 43% in the past year, with a remarkable 44% year-to-date gain.

Analysts are particularly optimistic about Trip.com's potential as China's travel sector rebounds, with passport penetration still low in the country. With international travel ramping up, Trip.com is expected to see higher-margin growth.

Analysts predict the stock could rise between $56 and $72 over the next 12 months, with an average target of $64 — representing an impressive 42.21% upside.

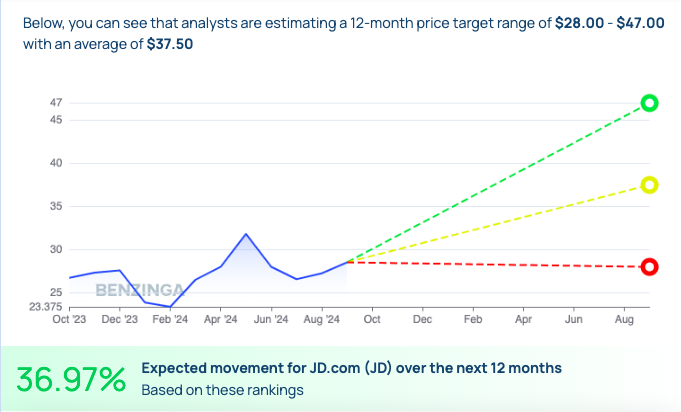

JD.com: Delivering A 37% Upside With E-Commerce Dominance

Source: Benzinga Stock Report – JD

Next up is JD.com JD, one of China's leading e-commerce platforms.

JD.com's strength lies in its extensive logistics and fulfillment infrastructure, which has driven its 22% gain so far this year.

Analysts are bullish on JD's future, estimating a price range of $28 to $47, with an average target of $37.50. This suggests the stock could see a potential 36.97% upside over the next year, positioning it as another strong pick in the sector.

Read Also: Alibaba Partners With Nvidia To Advance AI, Autonomous Driving, Chart Indicates Positive Momentum

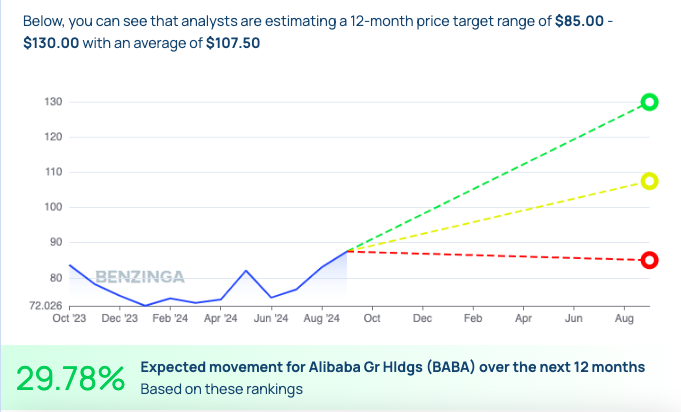

Alibaba: The Commerce Giant Poised For A 30% Leap

Source: Benzinga Stock Report – BABA

Rounding out the list is Alibaba Group BABA BABAF, a titan in the global e-commerce space.

While Alibaba has faced challenges in recent years, its diverse business operations — from online marketplaces to cloud computing — continue to attract analyst interest. The stock is up 21% year-to-date and analysts are forecasting a 12-month price target range of $85 to $130, averaging at $107.50. This implies an upside of 29.78%, making Alibaba a solid long-term bet.

As China's economic engine shifts into high gear with the latest stimulus package, these three large-cap stocks — Trip.com, JD.com and Alibaba — are positioned to capitalize on the country's recovery and growth.

Read Next:

Photo: Shutterstock

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.