Zinger Key Points

- Analysts and experts react to Tesla's third-quarter deliveries.

- While the numbers were important, investor attention could quickly shift to the Robotaxi Day event on Oct. 10.

- Pelosi’s latest AI pick skyrocketed 169% in just one month. Click here to discover the next stock our government trade tracker is spotlighting—before it takes off.

Tesla Inc TSLA analysts and experts highlighted the importance of the company's third-quarter deliveries, while they also pointed to other October catalysts that include full quarterly financial results and the company's highly anticipated Robotaxi Day on Oct. 10.

What Happened: Tesla reported third-quarter deliveries of 462,890 vehicles, up 6.4% year-over-year and up 4.3% quarter-over-quarter.

The figure beat a Street consensus estimate of 461,978, according to data from Tesla.

The company reported third-quarter production of 469,796 vehicles, up 9.1% year-over-year and up 14.4% quarter-over-quarter.

Quarterly deliveries grew year-over-year for the first time in three quarters.

The Model 3 and Model Y made up 339,975 deliveries, up 5.0% year-over-year, with the Other category that includes the Model S, Model X, Tesla Semi and Cybertruck totaled 22,915 units, up 43.4% year-over-year.

Tesla also reported 6.9 GWh of energy storage in the third quarter, down from 9.4 GWh in the second quarter.

Did You Know?

- Congress Is Making Huge Investments. Get Tips On What They Bought And Sold Ahead Of The 2024 Election With Our Easy-to-Use Tool

Daniel Ives on Tesla: Third-quarter delivery numbers were "a step in the right direction," Wedbush analyst Daniel Ives said in a new investor note.

"The 463k number we would characterize as good and a step in the right direction but clearly we and the Street were hoping for 3k-5k upside to this number and we will see some pressure on shares this morning as investors walk away from the delivery numbers expecting more," Ives said.

Ives, who has an Outperform rating and $300 price target, said some Street estimates were in the 465,000 to 470,000 range.

"Overall, this is a clear improvement from 1H and we believe getting in the range of 1.8 million for the year is still the key and important bogey."

Ives believes China was strong in the quarter, which offset weakness for Tesla in the U.S. and Europe.

"We do remain confident in Tesla's ability to hit 1.8 million deliveries for FY24 which we view as a feat given the extensive white-knuckle moments seen throughout the first half of the year.

Third-quarter deliveries were a step in the right direction, but more "heavy lifting" is needed by Elon Musk and the company "to turn around this delivery growth story," Ives said.

Ives looks ahead to the company's Robotaxi Day and third-quarter financial results on Oct. 23 as the next catalysts.

"We continue to believe AI/FSD represents a $1 trillion of value alone for Tesla over the coming years … next week it's time for Musk to have a watershed unveiling event for Robotaxi Day."

Read Also: Tesla Model Y Could End Ford’s Long Reign As America’s Top-Selling Vehicle: Will 2024 Be The Year?

Gene Munster on Tesla: With Tesla stock up 14% over the last two weeks ahead of third-quarter delivery figures, Deepwater Asset Management managing partner Gene Munster believes the declining share price Wednesday is related to a "buy on the rumor, sell on the news" trading philosophy.

"I don't believe the drop in shares is because they missed the whisper numbers," Munster tweeted.

Munster said Wednesday's delivery report was positive "because this marks the return to delivery growth for the first time in nine months."

Tesla's figures come as the automotive market is seeing headwinds and CEO Musk's political speak may have been negative for the stock, Munster said.

Munster said he has concerns for next year's estimates, which could be "highly dependent" on the timing of a new vehicle launch.

Sawyer Merritt on Tesla: Popular Tesla influencer Sawyer Merritt shared that Tesla's third-quarter deliveries may have been a beat or a miss depending on which consensus estimates were used.

Some data included estimates from 12 analysts, while Tesla's investor relations estimate compiled data from 28 analysts.

"Long term, whether Tesla's Q3 delivery numbers were slightly above expectations by 0.19% or fell short by 0.4% is relatively unimportant," Merritt said. "What truly matters is whether FSD is improving and if miles driven per necessary intervention are increasing. All eyes now on the Oct. 10 event."

What's Next: Tesla hosts its Robotaxi Day in California on Oct. 10.

The company will report third-quarter financial results on Oct. 23. Analysts expect the company to report revenue of $25.57 billion, up from $24.93 billion in last year's third quarter, according to data from Benzinga Pro.

Analysts expect the company to report earnings of 59 cents per share in the third quarter, down from 66 cents in last year's third quarter.

Tesla has beaten earnings per share from analysts in four straight quarters, while missing revenue estimates in three of the past four quarters.

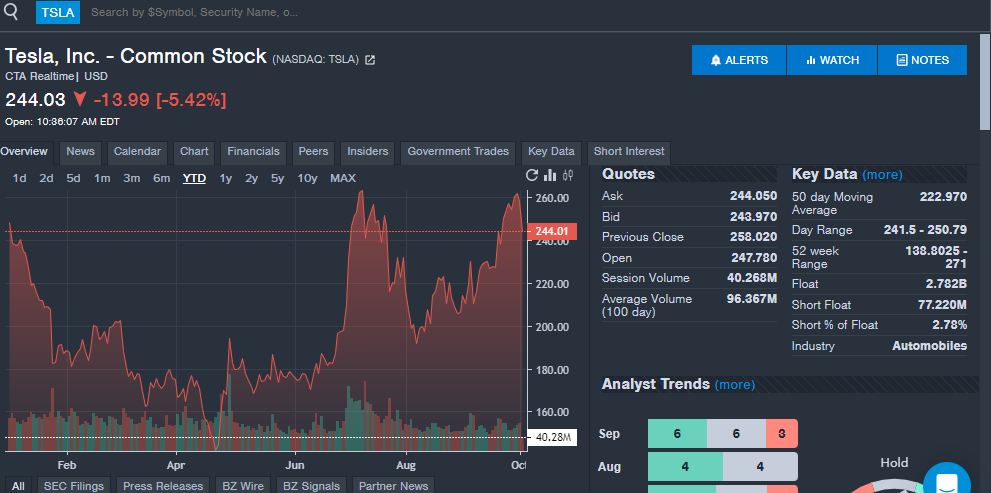

TSLA Price Action: Tesla stock is down 3.08% to $250.07 on Wednesday versus a 52-week trading range of $138.80 to $271. Tesla stock is up 0.5% year-to-date in 2024.

Read Next:

Photo: Shutterstock

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.