Zinger Key Points

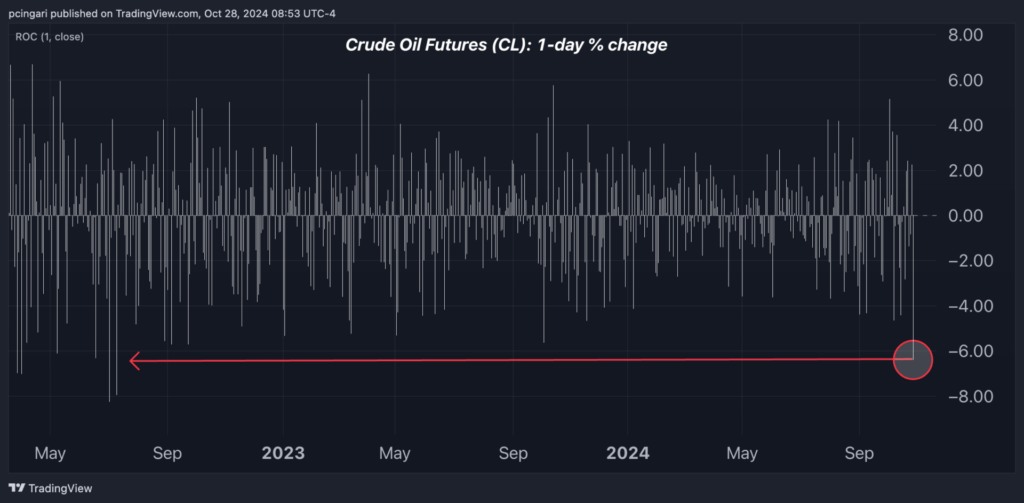

- Crude oil futures dropped 6%, nearing $67/barrel, marking the steepest one-day decline since July 2022.

- Israel’s airstrikes avoid Iranian oil facilities, calming market fears of supply disruptions.

- China’s new tariffs just reignited the same market patterns that led to triple- and quadruple-digit wins for Matt Maley. Get the next trade alert free.

Crude oil prices plummeted over 6% on Monday, approaching levels not seen since early October, as investors processed news of targeted Israeli airstrikes in Iran.

U.S. energy stocks followed suit during premarket trading in New York, with sector ETFs posting sharp losses at the start of the week.

Contracts on West Texas Intermediate (WTI) light crude, as tracked by the United States Oil Fund USO, fell over 6% to around $67 per barrel on Monday morning, marking what could be the worst one-day drop since July 2022.

The sell-off followed Israeli airstrikes over the weekend that targeted military facilities in Iran but spared the country's oil infrastructure.

According to the Israel Defense Forces, the strikes were "targeted and precise," focusing on Iranian missile production and air defense installations.

This measured response likely averted a deeper crisis in the oil market, as analysts warned that a broader assault on Iran's energy sector could have risked up to 1.7 million barrels per day (bpd) of Iranian crude exports and led to further regional destabilization.

U.S. President Joe Biden had cautioned Israel against actions that would directly impact Iran's oil output, warning that such moves could prompt Tehran to retaliate by targeting oil shipping routes in the Middle East.

Analysts Expect Oil Prices To Remain Under Pressure

Goldman Sachs analysts had previously estimated that a sustained 1 million bpd disruption to Iranian oil supply could have pushed Brent prices up by $10–$20 per barrel.

With no immediate threat to Iran's oil exports, the bank's forecast for Brent reaching the mid-$80s by late 2025 now appears overly optimistic compared to the consensus view.

The restrained nature of Israel's actions has led some analysts to predict that oil prices will remain subdued, especially in light of broader market dynamics.

Warren Patterson, head of commodity strategy at ING Group, highlighted that Israel's focused response leaves "the door open for de-escalation," which seems to be reflected in Monday’s price action.

"If we do see some de-escalation, it would allow fundamentals to dictate price direction once again," Patterson explained, adding that a projected market surplus in 2025 “would mean that oil prices are likely to remain under pressure.”

Ole Hansen, head of commodity strategy at Saxo Bank, indicated that crude prices have now retraced most of the gains made in early October, which were fueled by Chinese economic stimulus and concerns over potential disruptions to Iran's supply. Hansen pointed out that "sluggish demand" and the impending reintroduction of OPEC+ barrels could further weigh on oil prices.

China's Declining Demand, OPEC+ Production Decisions Add To Bearish Sentiment

On the demand side, Chinese consumption—accounting for roughly 15% of global oil demand—has been trending downward since May 2024

According to Pascal Devaux, an economist at BNP Paribas, this decline is tied not only to China's economic slowdown but also to structural changes within its energy sector. "Around 45% of new car registrations in China are for electric vehicles, either battery-powered or hybrid," Devaux said, underscoring the impact of the country's low-carbon transition on oil demand.

Capital Economics forecasts that if OPEC+ follows through on its plan to unwind voluntary production cuts initiated in October, an increase in oil supply combined with weak demand growth could drive prices lower throughout the remainder of 2024 and into 2025.

US Energy Stocks See Sharp Losses

Sector ETFs posted notable declines in early trading:

- The Energy Select Sector SPDR Fund XLE, which tracks large-cap U.S. energy companies, was down 2.3% at the start of Monday's session. APA Corporation APA, Diamondback Energy, Inc. FANG, and Marathon Oil Corporation MRO all registered losses between 3% and 4%.

- SPDR S&P Oil & Gas Exploration & Production ETF XOP, a broader measure of exploration and production stocks, slid 2.8%. Kosmos Energy Ltd KOS and Vital Energy Inc. VTLE are both down 4%.

- VanEck Oil Services ETF OIH dropped 1.7%. Companies like ProPetro Holding Corp. PUMP, Liberty Energy Inc. LBRT, and Noble Corporation plc NE were hit particularly hard, each falling by about 4%.

Read Next:

Image: Shutterstock

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.