Zinger Key Points

- AMD's stock was down 8.87% this year.

- Technical analysis suggests a downtrend.

- Feel unsure about the market’s next move? Copy trade alerts from Matt Maley—a Wall Street veteran who consistently finds profits in volatile markets. Claim your 7-day free trial now.

Advanced Micro Devices AMD shares have underperformed Nasdaq 100 despite gaining AI market share this year. Should you buy or sell the stock as its technical analysis indicates a downtrend? Here’s what analysts are saying about the stock.

What Happened: The technical analysis of daily moving averages indicates a bearish trend.

The stock ended at $126.29 apiece on Tuesday. This was above its eight-day simple moving average of $123.48. However, as per Benzinga Pro data, its current stock price was lower than the 20-day moving average of $130.77, 50-day moving average of $140.38 and its 200-day moving average of $154.50.

This implies that the stock is in a downtrend. On the other hand, the relative strength index of 40.31 suggests the stock’s movement is neutral and it is not yet in an overbought or an oversold zone.

Why It Matters: AMD’s 2024 was mixed. New GPUs drove strong data center growth, gaining share against Nvidia’s H100 due to availability and pricing advantages. However, gaming and embedded segments decelerated, impacting overall growth.

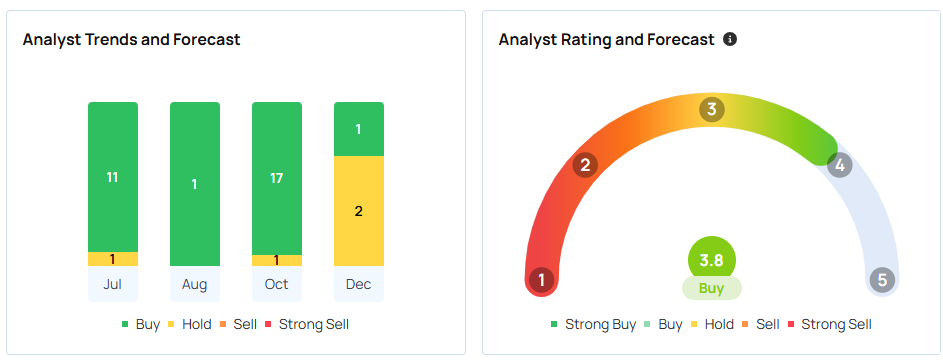

According to Benzinga, AMD has a consensus ‘buy’ with a price target of $195.07 based on the ratings of 30 analysts.

The highest price target out of all the analysts tracked by Benzinga is $265 issued by Melius Research with a ‘buy’ rating on March 8. According to the analysts at Melius, AMD is mirroring Nvidia Corporation‘s NVDA past success. This is despite a recent price target increase, expected by market observers. While AMD’s growth is significant, it’s not seen as threatening Nvidia’s dominance. Nvidia’s broader ecosystem and market expansion benefit AMD by creating a larger market for high-performance AI chips.

AMD is one of Rosenblatt's top picks for the first half of 2025 on momentum in CPU and GPU share gains into 2025 and a broader non-AI recovery exiting 2025. The difference entering 2025 is that the Street acknowledges this dynamic, which has legs for double-digit market share in GPU compute and AI inference at the edge, being a secular opportunity on Xilinx incumbency and chiplet prowess.

The lowest target price was a downgrade from ‘buy’ to ‘neutral’ from BofA Securities. It was adjusted to $155 from $180 per share on Dec. 9. It predicts AMD will hold a small 4% of the $200 billion AI accelerator market in 2025, significantly trailing Nvidia’s dominant 80%+ share. This, coupled with potential PC processor market weakness in the first half of 2025, raises concerns for AMD’s future performance.

The average price target of $164.33 between Morgan Stanley, BofA Securities, and Mizuho implies a 30.81% upside for Nvidia.

Price Action: Shares of AMD were down 0.24% at $125.99 per share in premarket on Thursday. The stock was down 8.87% this year underperforming the Nasdaq 100, which rose by 31.76% this year.

Read Next:

Image via Shutterstock

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.