Zinger Key Points

- Major banks are rapidly hiking U.S. recession odds, fueling defensive plays and risk-off sentiment.

- Bitcoin’s rise continues amid macroeconomic jitters, but its resilience may be tested in a true downturn.

- China’s new tariffs just reignited the same market patterns that led to triple- and quadruple-digit wins for Matt Maley. Get Matt’s next trade alert free.

Wall Street's recession sirens are blaring — and as traditional markets brace for impact, Bitcoin's BTC/USD defiant rally has investors asking: is this digital gold 2.0 or just fool's gold with better marketing?

Big Banks Turn Bearish, And Fast

Recession probability forecasts aren't just creeping up — they're sprinting. In the span of days, JPMorgan hiked its odds of a U.S. recession from 40% to 60%, while S&P Global jumped from 25% to 35%. Goldman Sachs and HSBC weren't far behind, now both penciling in a 35%–40% chance.

Related: JPMorgan Raises Recession Risk To 60% As ‘Largest US Tax Hike’ In 60 Years Hits Global Economy

"There can be no doubt that fears of a U.S. recession are intensifying," warned James Toledano, COO of Unity Wallet. "Economic growth is forecast to stall at anywhere between 0.1% and 1%, and many believe these risks are already priced into equities, but I am not so sure that we've even seen the bottom."

For investors looking to tactically position around a recession scenario, the Direxion Daily S&P 500 Bear 3X Shares SPXS or the Direxion Daily Total Bond Market Bear 1X Shares SAGG could offer hedges if equities and bonds take a dive. On the flip side, safe-haven sectors like utilities and staples — accessible via the Utilities Select Sector SPDR ETF XLU or the Consumer Staples Select Sector SPDR Fund XLP – may see relative outperformance.

Bitcoin Climbs As Uncertainty Grows

Meanwhile, Bitcoin has been showing some real swagger — up over 25% in six months and hovering near $86,000. But it's been reluctant to charge past that level.

"Bitcoin's appeal as a decentralized asset grows, especially as traditional markets face volatility," said Toledano. "While Trump's policies have introduced significant macroeconomic uncertainty, they may paradoxically be fueling Bitcoin's recent rise — though the risks remain elevated for all markets, crypto included."

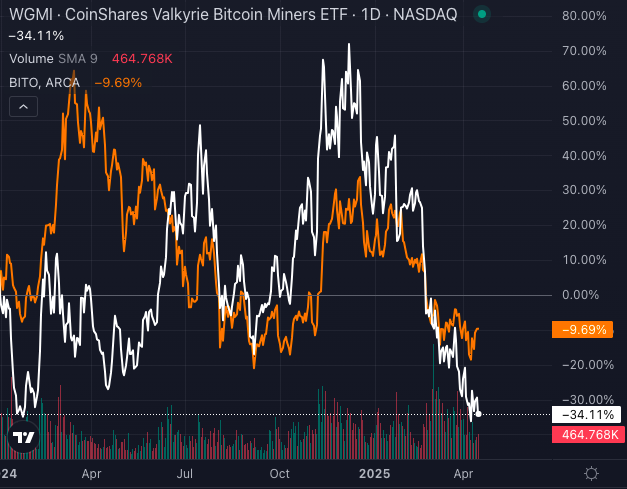

Chart created using Benzinga Pro

Still, if a deep recession hits, will retail investors continue to HODL — or will the thrill give way to fear?

For those betting that crypto's momentum holds, the CoinShares Valkyrie Bitcoin Miners ETF WGMI or the ProShares Bitcoin Strategy ETF BITO provide entry points to ride the wave — without having to hold digital wallets.

As recession odds surge and markets wobble, Bitcoin may be the bold bet — but don't forget, volatility cuts both ways.

Read Next:

Photo: Yalcin Sonat via Shutterstock

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.