Zinger Key Points

- Docusign shares have lagged the overall technology sector in 2024.

- A second-quarter earnings report could show more momentum on profitability and AI growth.

- Our government trade tracker caught Pelosi’s 169% AI winner. Discover how to track all 535 Congress member stock trades today.

Software company Docusign Inc DOCU could share more on its goal of improving profitability and recent company expansions when the company announces second-quarter financial results after market close Thursday.

Earnings Estimates: Analysts expect Docusign to report second-quarter revenue of $727.36 million according to data from Benzinga Pro.

The company reported revenue of $687.69 million in last year's second quarter. Docusign has beaten analyst estimates for revenue in more than 20 straight quarters, according to Benzinga Pro.

Analysts expect the company to report earnings of 80 cents per share for the second quarter. That’s up from 72 cents in last year's second quarter. The company has beaten earnings estimates from analysts in eight straight quarters and 9 of the last 10 quarters overall.

Guidance from Docusign calls for second-quarter revenue to be in a range of $725 million to $729 million.

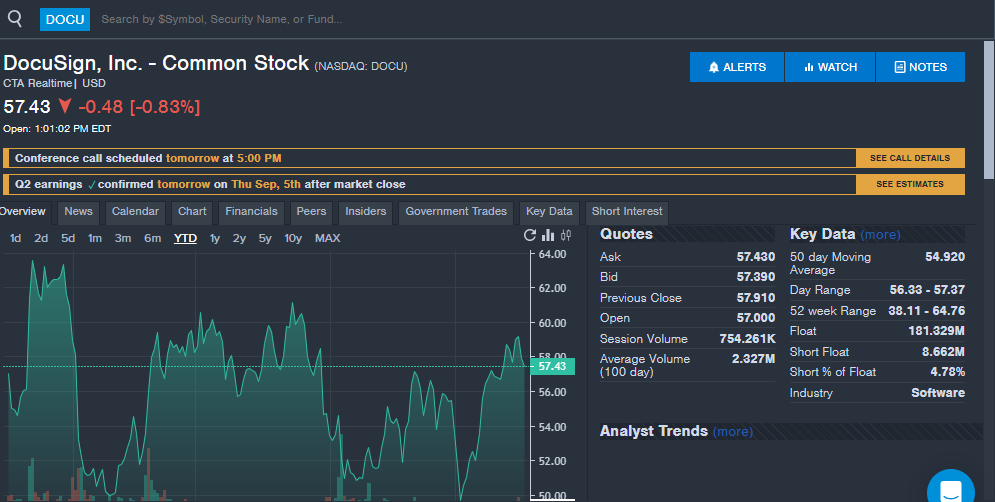

The second-quarter earnings report comes with Docusign shares trading nearly flat year-to-date in 2024. See the Benzinga Pro chart below.

What Analysts Are Saying: Docusign was one of several software companies highlighted in a recent note from RBC Capital with a Sector Perform rating.

RBC Capital said the software sector could benefit from investments in generative AI as spending on seat-based models from the COVID-19 pandemic era is minimizing.

"Software companies themselves saw significant margin expansion during COVID but now as they reinvest for GenAI including higher CapEx, margins are likely flat to up slightly in a best-case scenario, but in some cases going down," RBC Capital said.

The software sector could be ripe for M&A momentum. Analysts say Docusign is one of several stocks that could be a private equity takeout consideration.

"Overall we continue to believe software M&A activity could accelerate and remain in the headlines following a busy start to the year with several potential deals in the press."

Here are other analyst ratings on Docusign and their price targets:

Needham: Reiterated Hold rating, no price target

JMP Securities: Reiterated Market Outperform rating, $84 price target

Key Items to Watch: The company said the first quarter showed a strong start to the fiscal year and the launch of the Docusign Intelligent Agreement Management platform.

Investors and analysts will be looking for an update on this platform and how it is performing.

With many investors having their attention on artificial intelligence, an update on the AI opportunity for Docusign and how it is integrating AI tools and platforms for its customers could be a key item to watch in the earnings report.

The company also said the first quarter showed a focus on stabilizing the business and improving profitability. These two items could be keys for investors and analysts for the software company going forward.

DOCU Price Action: Docusign shares trade at $57.41 on Wednesday versus a 52-week trading range of $38.11 to $64.76.

Read Next:

Image: Courtesy of Docusign

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.