Zinger Key Points

- Tesla Inc has surged over 60% since the election.

- The stock is five times more expensive than the industry average.

- Join Chris Capre on Sunday at 1 PM ET to learn the short-term trading strategy built for chaotic, tariff-driven markets—and how to spot fast-moving setups in real time.

Elon Musk‘s Tesla Inc TSLA has surged over 60% since the 2024 election results were announced, making it nearly five times more expensive than the industry average. Additionally, its technical indicators flash overbought warnings.

Despite this, Wedbush’s Dan Ives has increased his price target on the stock to $515 apiece, citing optimism around a potential “game changer” under a Trump administration.

What Happened: Tesla shares are trading at a price nearly 126 times over its 2025 earnings, according to Benzinga Pro data. At the same time, the average forward price-to-earnings of its peers stand at 25.75 times, implying that Tesla is over five times more expensive than its industry’s average.

When compared with other Magnificent Seven stocks and Broadcom, Tesla shares are the most expensive and it has the highest ratio of forward price-to-earnings.

| Stocks | Forward P/E | Industry Average |

| Tesla | 126.582 | 25.75 |

| Apple | 33.333 | 20.23 |

| Alphabet | 21.552 | 125.77 |

| Meta | 24.450 | 125.77 |

| Amazon | 36.630 | 32.14 |

| Nvidia | 31.546 | 37.03 |

| Broadcom | 36.765 | 37.03 |

| Microsoft | 34.014 | 81.74 |

Why It Matters: Shares of Tesla have risen over 60% since Nov. 6, outpacing gains in the Nasdaq 100 index, which advanced by 7% in the same period.

On a year-to-date basis, TSLA is up approximately 84%. Thus, its post-election trajectory has significantly altered the narrative, converting a relatively subdued performance into a highly successful year for Tesla investors.

| Performance | Nasdaq 100 | Tesla Stock |

| Since Nov. 6 | 7% | 60% |

| Year To Date | 33% | 84% |

| Five Year | 153% | 1597% |

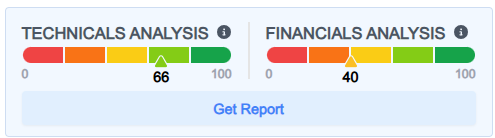

From a technical perspective, the analysis of daily moving averages and its relative strength indicate that the stock price is high and overbought.

TSLA closed at $436.23 on Friday. This was below above the eight and 20-day simple moving averages, of $408.55 and $370.43, respectively. As per Benzinga Pro data, its current stock price is also much higher than the 50 and 200-day moving average prices at $303.86 and $225.59, respectively.

The relative strength index of 79.17 also suggests the stock is overbought. These combined factors usually mean the stock may be overvalued, and there could be a potential for a price correction or a pullback.

Benzinga’s technical analysis scorecard scores the company at 66 points out of 100.

What Are Analysts Saying: Ives raised his Tesla price target to $515, citing a potential “game changer” under a Trump presidency. He believes that the Trump administration will favor Tesla’s AI and autonomous driving initiatives while hindering smaller EV competitors. Ives sees a $2 trillion market cap for Tesla by 2025, excluding potential value from its Optimus robot. This comes amid reports of the Trump team seeking to relax regulations on autonomous vehicles, a move Tesla has advocated for.

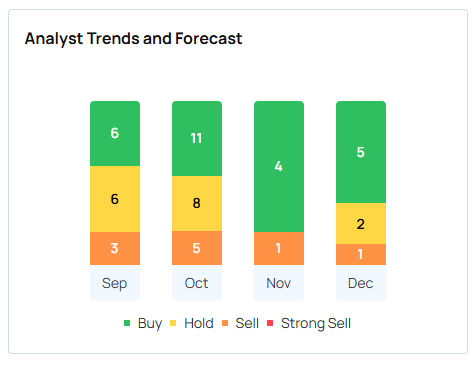

Ives has always been bullish on the Elon Musk-led company. “Tesla is the most undervalued AI name in the market in our view,” said Ives in an X post dated Nov. 11. Tesla has a consensus "buy" rating based on the ratings of 33 analysts tracked by Benzinga.

Price Action: Shares of Tesla were up 5.4% at $459.81 at the time of publication Monday, while Invesco QQQ Trust, Series 1 QQQ was up 1.1% at $536.78.

Read Next:

Photo: Shutterstock

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.