Zinger Key Points

- Google's search share holds strong as AI rivals grow, analyst sees no major threats yet.

- BofA analyst stays bullish on Google as AI monetization boosts search and ad revenue.

- The new Benzinga Rankings show you exactly how stocks stack up—scoring them across five key factors that matter most to investors. Every day, one stock rises to the top. Which one is leading today?

BofA Securities analyst Justin Post maintained a Buy rating on Alphabet Inc GOOG GOOGL Google with a price target of $225.

Statcounter January data indicates that Google’s global search share was up 5bps month-on-month (down 169bps year-on-year) to 89.8%, while Bing’s share was down 4bps M/M (up 51bps Y/Y) to 3.9%. Others (which include Yandex, Baidu Inc BIDU, and Naver, but not ChatGPT) were up 1bps M/M (up 101bps Y/Y) to 5.0%.

Also Read: Monday.com Beats Q4 Earnings Estimates, Boasts 32% Revenue Growth: CEO Calls AI A Game-Changer

The top share gainer in the Other category was Yandex (up 96bps Y/Y).

In the US, Google’s share declined 5bps M/M (down 12bps Y/Y), with mobile down 5bps M/M (down 64bps Y/Y) and desktop up 53bps M/M (down 95bps Y/Y), while Bing’s share was up 7bps M/M (down 49bps Y/Y). Yahoo has gained 50bps Y/Y US share.

Given new AI entrants such as ChatGPT and Perplexity (which are not included in search share data), daily web visits (including desktop and mobile web) could be a better measure of AI competition than Search.

In January, global average daily web visits to Google were down 1% Y/Y (up 1% M/M) to 2.7 billion, ChatGPT was up 148% Y/Y (up 4% M/M) to 128 million, Bing was up 18% Y/Y (up 1% M/M) to 59 million.

In the US, Google visits were flat Y/Y (up 2% M/M) at 542 million, ChatGPT was up 96% Y/Y (up 4% M/M) to 18mn, Bing was down 9% Y/Y (down 3% M/M) to 12 million.

Data shows healthy growth among new AI platforms that Post tracks, but the combined daily web traffic is less than 0.3% of Google visits.

In January, Perplexity’s global traffic was up 279% year over year (up 6% M/M) to 3.2 million, and Claude’s was up 439% year over year (up 4% M/M) to 2.5 million.

Overall, Post did not observe a boost to Google’s traffic from AI Overviews but did not see a significant headwind from emerging AI search competition.

So far, ChatGPT and other AI-based engines do not appear to be materially impacting Google search traffic or share but could be capturing a healthy share of incremental AI-driven activity.

Post noted that traffic data are just estimates. On a fourth-quarter 2024 call, Google management emphasized healthy growth in Search volumes, aided by AI Overviews and Circle to search.

Given that the fourth quarter was another quarter of strong Search revenue growth, Post remained constructive on AI monetization benefits for Google Search. Also, the analyst’s recent channel checks suggest ads in the top position in AIOs are delivering higher CTRs and aiding search pricing.

Post projected fiscal 2025 sales of $328.59 billion and fiscal 2026 sales of $367.42 billion.

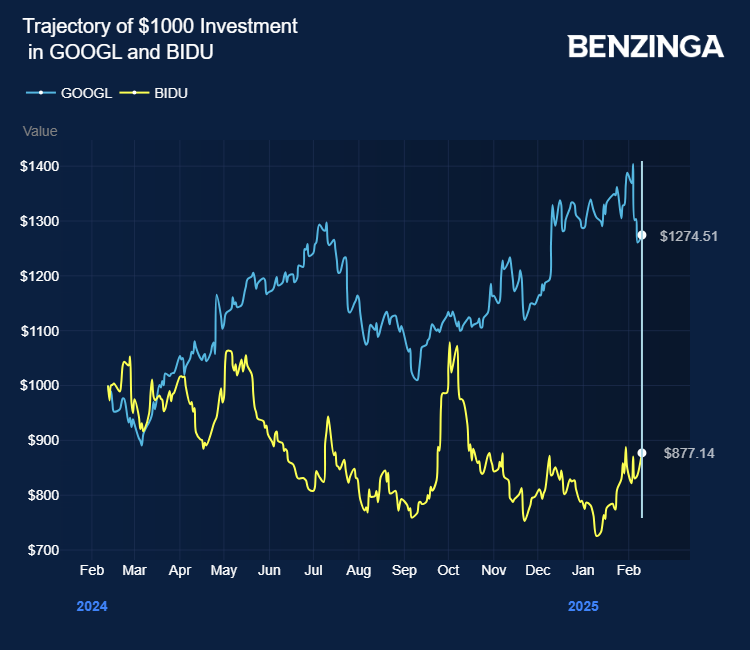

Price Action: GOOGL stock is up 0.94% at $187.08 at the last check on Monday.

Also Read:

Photo via Shutterstock

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.