Overall, Factset estimates earnings of the S&P 500 companies to increase 2.8 percent, with seven of the 11 sectors expected to report year-over-year growth in earnings. This is a slowdown from the 10.3 percent growth seen in the second quarter.

Expectations concerning earnings of financial firms are muted.

"We've seen relatively low volatility, and a couple quarters ago that hurt a lot of banks. I'm interested to see how the trading businesses have held up in low volatility," said Victor Jones, director of trading at TD Ameritrade.

"The key drivers of the earnings reports are going to be net interest margins and whether yields picked up. And low volatility, whether businesses were able to maintain profitability in a low volatility environment."

Against this backdrop, here is what the sell-side expects from banks when they report their quarterly earnings scorecards.

Deutsche Bank analyst Matt O'Connor expects strong net interest margin or net interest income trends, given the Fed's rate hikes.

However, the analyst sees sluggish loan growth, and the combination of a flatter yield curve and less positive deposit trends impacting the outlook for NII. That said, the analyst believes capital market revenues may come in slightly better than the recently lowered expectations.

1. Citigroup

- Earnings Date: Oct. 12, before the market open.

- Street Estimates: EPS of $1.32 vs. $1.24; revenues of $17.90 billion, up 0.8 percent.

Deutsche Bank said the bar for Citigroup is high, as its shares are most expensive versus peers on current earnings. The firm said the focus is likely to be on the U.S. card, as credit is expected to worsen.

Barclays expects operating earnings per share of $1.25, which was after the trimming it did in September to reflect weaker trading and a higher-than-expected efficiency ratio.

See also: Short Sellers Piling Into Big Bank Stocks Ahead Of Q3 Earnings2. JPMorgan

- Earnings Date: Oct. 12, before the market open.

- Street Estimates: EPS of $1.66 vs. $1.58; revenues of $25.23 billion, down 1.10 percent.

Deutsche Bank noted that shares of JPMorgan have outperformed the past few years, but it attributed its recent downgrade to potential pressure from increased competition in the bank, sluggish card earnings, and the combo of slowing loan growth and a flatter yield curve.

Barclays is below consensus on JPMorgan, expecting earnings per share of $1.62. The firm expects the results to be hit by weak trading revenues, driven by seasonality and volatility. The firm also expects the recent hurricanes to have hurt results, while it says expectations have not fully discounted the market challenges in the third quarter.

3. Bank of America

- Earnings Date: Oct. 13, before the market open.

- Street Estimates: EPS of 46 cents vs. 41 cents; revenues of $21.95 billion, up 0.4 percent.

Given the high expectations for Bank of America, Deutsche Bank said the sluggish NII outlook would be more pronounced. Barclays analyst Jason Goldberg expects expenses to remain controlled, asset quality to be benign and share repurchases to accelerate.

The firm expects a fairly decent outlook for the fourth quarter in terms of metrics such as NII, loan growth, better consumer fee trends and expense trajectory.

4. Wells Fargo

- Earnings Date: Oct. 13, before the market open.

- Street Estimates: EPS of $1.03, same as last year; revenues of $22.39 billion, up 0.30 percent.

Deutsche Bank sees headline issues impacting Wells Fargo & Co WFC. Therefore, the firm feels an improvement in the efficiency ratio is important for shifting focus back to fundamentals. Specifically, the firm expects another 80-basis-point drop in the efficiency ratio in the third quarter, although it sees the possibility of an improvement in the fourth quarter.

At the same time, Barclays expects a sluggish loan growth environment and low long-term rates to impact results. However, the firm expects the company to see some tailwind from the June rate hike and the continued market strength.

The firm expects an improved core efficiency ratio, while it looks forward to incremental progress reports on its efficiency/expensive initiatives and for commentary around loan growth and NII initiatives.

5. PNC Financial

- Earnings Date: Oct. 13, before the market open.

- Street Estimates: EPS of $2.13 vs. $1.84; revenues of $4.11 billion, up 7.40 percent.

Deutsche Bank suspects whether the above-peer loan growth that was in part responsible for the strong stock performance of PNC Financial Services Group Inc PNC could continue after the third quarter.

Barclays expects the loan growth achieved on the back of franchise expansion to continue in the third quarter. The firm also expects a few hundred basis points of positive leverage in 2017, as revenue growth outpaces expense growth.

6. Goldman Sachs

- Earnings Date: Oct. 17, before the market open.

- Street Estimates: EPS of $4.17 vs. $4.88; revenues of $7.54 billion, down 7.70 percent.

Deutsche Bank thinks Goldman Sachs Group Inc GS's fixed income, currency and commodities disappointment may not be as worse as feared. The firm expects other businesses to perform well and strong equity I&L to boost headline earnings per share.

Meanwhile, Barclays expects Goldman to elaborate on the $5 billion-plus market-independent revenue opportunity it unveiled at Barclay's conference. The firm sees a modest increase in its buyback program.

7. Morgan Stanley

- Earnings Date: Oct. 17, before the market open.

- Street Estimates: EPS of 81 cents vs. 80 cents; Revenues of $9.01 billion, up 1.20 percent.

Deutsche Bank believes Morgan Stanley MS's third-quarter trading is likely to have outperformed peers, given an overweight in equity trading. Meanwhile, Barclays is of the view weak trading and investment banking businesses will weigh on results. The firm expects the share repurchase program to accelerate, as the company embarks on its 2017 CCAR plan.

8. M&T Bank

- Earnings Date: Oct. 18, before the market open.

- Street Estimates: EPS of $2.40 vs. $2.10; revenues of $1.43 billion, up 5.70 percent.

Deutsche Bank said, for M&T Bank Corporation MTB, the focus is on expense outlook, given the higher legal costs. Barclays expects the quarterly results to be stymied by sluggish loan growth environment and seasonal weakness in the company's dealer finance portfolio.

That said, the firm expects more modest NIM expansion, relatively benign asset quality and a slowdown in share repurchase activity.

9. U.S. Bancorp

- Earnings Date: Oct. 18, before the market open.

- Street Estimates: EPS of 88 cents vs. 84 cents; revenues of $5.60 billion, up 4.80 percent.

Deutsche Bank said the focus would be on expense growth when U.S. Bancorp USB reports its financial results. The firm expects a slowdown in growth to 4 percent from the 6–7-percent growth recently.

At the same time, Barclays noted that the company expects lower-than-expected loan growth, while it expects positive operating leverage in the third quarter, the first time in two years.

10. BB&T

- Earnings Date: Oct. 19, before the market open.

- Street Estimates: EPS of 78 cents vs. 73 cents; revenues of $2.84 billion, up 0.80 percent.

Deutsche Bank noted that BB&T Corporation BBT's loan growth guidance was lowered mid-quarter. The firm expects the company's insurance business to take a hit from the hurricanes.

However, the bar for expectations are low overall, the firm said. If the company is too optimistic, the firm said the markets may not believe it and brace for a lowering later in the fourth quarter.

Meanwhile, Barclays was already bracing for soft loan growth and fee income. The firm expects a marginal impact from the hurricanes.

11. KeyCorp

- Earnings Date: Oct. 19, before the market open.

- Street Estimates: EPS of 35 cents vs. 30 cents; revenues of $1.56 billion, up 16.50 percent.

With the First Niagara Financial Group cost savings already realized, Deutsche Bank said the focus concerning KeyCorp KEY shifts to revenue synergies. The firm added that investment banking fees is also an area of focus.

Barclays nudged down its earnings per share estimate by a cent to 36 cents, reflecting a decline in investment banking revenues.

12. Citizens Financial Group

- Earnings Date: Oct. 20, before the market open.

- Street Estimates: EPS of 64 cents vs. 56 cents; revenues of $1.43 billion, up 3.50 percent.

Deutsche Bank wondered whether a solid quarter will catalyze an upward move in Citizens Financial Group Inc CFG's shares.

Barclays has an above-consensus earnings per share estimate for the bank, given its loan growth outperforming peers. That said, the firm said its NIM has lagged.

"In addition to sound underlying results, we expect progress on its TOP IV efficiency initiative program," the firm said.

13. SunTrust Banks

- Earnings Date: Oct. 20, before the market open.

- Street Estimates: EPS of $1.05 vs. 91 cents; revenues of $2.31 billion, up 3.50 percent.

Deutsche Bank noted that SunTrust Banks, Inc. STI's efficiency ratio was stable in the third quarter after dropping sharply in the second quarter. The firm said an outlook for further improvement would be an added advantage.

Meanwhile, Barclay's $1.01 per share earnings estimate is based on expectations for a modest NIM and balance sheet expansion, incrementally higher fees and expenses, and a higher loan loss provision. That said, the firm said reduced activity, fee waivers and reserve build, all resulting due to the recent hurricanes, could impact near term, although creating opportunity over time.

14. Fifth Third Bancorp

- Earnings Date: Oct. 24, before the market open.

- Street Estimates: EPS of 47 cents vs. 65 cents; revenues of $1.55 billion, down 11.80 percent.

Deutsche Bank surmised whether the lower-than-expected expense trend in Fifth Third Bancorp FITB's second quarter is sustainable.

Barclays models modest net interest income growth, sluggish loan growth and a slight uptick in NIM, while it also expects modest increases in fee income and expense.

15. Regions Financial

- Earnings Date: Oct. 24, before the market open.

- Street Estimates: EPS of 25 cents vs. 24 cents; revenues of $1.44 billion, up 0.50 percent.

On Regions Financial Corp RF, Deutsche Bank raised a couple of questions as to where the NIM expansion is enough to drive higher NII and when loans will inflect.

Barclays said it expects the company's results to include an oil-field services-related lease impairment as well as a higher loan loss provision. The firm also expects results to be impacted by hurricanes and tempered loan growth.

16. Huntington Bancshares

- Earnings Date: Oct. 25, before the market open.

- Street Estimates: EPS of 25 cents vs. 11 cents; revenues of $1.1 billion, up 18.90 percent.

Deutsche Bank said Huntington Bancshares Incorporated HBAN's detailed expense color has been helpful, reducing the risk of another expense disappointment. The firm said the focus now shifts to revenue growth initiatives.

Barclays expects the company to hit its annualized cost savings target in the third quarter. The firm also said revenue synergies remain on track. In order to achieve the end of 2017 loan growth guidance, the firm noted that the company to reaccelerate growth in the second half of 2017 after a sluggish first half.

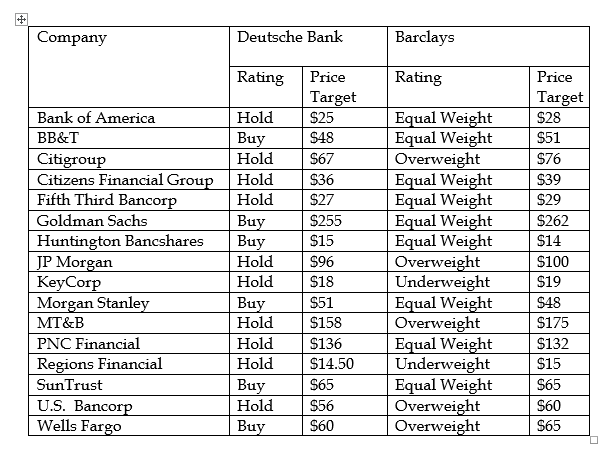

Ratings/Price Targets

Related News: A Bounty With Bank ETFs? Maybe

Related News: A Bounty With Bank ETFs? Maybe

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.