The earnings season is picking up momentum next week, with several widely followed and high-profile companies lined up to release their quarterly results. Here is a brief on companies due to report and what to expect from each.

1. General Motors

- Date of reporting: Oct. 24.

- Consensus:

- EPS: $1.15 versus $1.72 last year.

- Revenues: $32.88 billion, down 23.20 percent.

UBS analyst Colin Langan is below consensus on General Motors Company GM, although he expressed optimism about the company's ability to grow margins due to new launches and restructuring savings.

The analyst sees potential for further cash return to shareholders, given the company's strong cash-flow outlook. The analyst also believes the company has a strong position in autonomous vehicles with Cruise Automation.

UBS said the valuation of GM implied limited long-term value on the core auto business.

Focus: North American margins, pricing, changes to full-year guidance of $6-$6.50, updates on the progress of cruise automation.

2. Caterpillar

Date: Oct. 24.

Consensus:

- EPS: $1.27 versus 85 cents last year.

- Revenues: $10.63 billion, up 16 percent.

UBS analyst Steven Fisher sees upside for Caterpillar Inc. CAT from continued growth in non-residential construction, an improvement in mining capex and potential for the company to generate and deploy $10 billion of excess cash after capex and dividends in 2018-2020.

Fisher said Caterpillar shares are pricing in an earnings recovery and an eventual advance to a cyclical peak. The analyst said earnings upside sooner than expected will result in a higher share price.

UBS's earnings per share estimate is in line with the consensus.

Focus: Initial 2018 guidance, construction margin and cash generation and balance.

3. AT&T

Date: Oct. 24.

Consensus:

- EPS: 75 cents versus 74 cents last year.

- Revenues: $40.12 billion, down 1.90 percent.

Analyst John Hodulik noted that AT&T Inc. T's shares have been under pressure since it announced video losses in third quarter. The analyst, however, expects wireless margins to be strong, given lower iPhone upgrades and less promotional activity than typical in the third quarter.

UBS noted that AT&T shares have declined about 16 percent in the year-to-date period on investor concerns about cord cutting and wireless competition as well as risks associated with the Time Warner Inc TWX deal and post-merger integration.

Focus: Wireless phone adds, ARPU, margins, entertainment revenues and margins.

4. Amazon

Date: Oct. 26.

Consensus:

- EPS: 3 cents versus 52 cents last year.

- Revenues: $42.05 billion, up 28.60 percent.

UBS analyst Eric Sheridan believes Amazon.com, Inc. AMZN can deliver 25 percent year-over-year revenue growth in the third quarter, driven by continued strength in North American retail, with AWS growing 40 percent.

However, weighed down by investments in multiple growth opportunities, UBS expects operating margins to be down.

UBS said the market is increasingly pricing in long-tailed revenue opportunities across a wide range of verticals.

Focus: Disclosure of Whole Foods financial contribution, details of competitive dynamics in cloud and the resultant impact on AWS growth.

See also: Big Bank Q3 Earnings Roundup

5. Alphabet

Date: Oct. 26.

Consensus:

- EPS: $8.33 versus $9.06 last year.

- Revenues: $27.20 billion, up 21.20 percent.

Sheridan said his channel checks revealed that Alphabet Inc GOOGL GOOG is on track to report another strong quarter for mobile search and YouTube. This is despite the regulatory environment remaining an overhang.

"We view Alphabet as a favourable risk/reward with sustained revenue momentum (incl. multiple emerging non-advertising revenue streams), increased transparency and exposure to key secular growth ahead," the analyst said.

UBS said investors will be satisfied if the company can maintain consistency in core operating margins, mid- to high-teens revenue growth, and/or a consistent shareholder return policy over the long term.

Focus: Clarity on the potential business impact of recent changes to Google Shopping in Europe, investment properties, uses of cash in 2017, update on core Search business momentum and cloud and hardware strategy.

6. Ford

Date: Oct. 26.

Consensus:

- EPS: 33 cents versus 26 cents last year.

- Revenues: $32.84 billion, down 1.50 percent.

UBS's Langan expects Ford Motor Company F's sales to plateau and not decline, with earnings expected to grow, thanks to renewed focus on costs. The analyst expects pre-tax income to increase in 2018 due to positive nix and the non-recurrence of recall costs in North America as well as gains in South America and Asia-Pacific, excluding China.

Focus: North American margins, pricing and changes to full-year guidance of $1.65-$1.85.

7. Comcast

Date: Oct. 26.

Consensus:

- EPS: 50 cents versus 46 cents last year.

- Revenues: $21.04 billion, down 1.30 percent.

Hodulik noted that Comcast Corporation CMCSA's preannouncement of third quarter video losses of 100,000-150,000 due to storms and competition has renewed investor fears that cord-cutting is picking up.

That said, the analyst believes the company's business is insulated by its broadband and commercial business.

Focus: Video and HSD net adds, cable revenue growth and margins, NBCU growth and margins, commentary on margins and capital intensity.

8. Bristol-Myers Squibb

Date: Oct. 26.

Consensus:

- EPS: 77 cents, flat with last year.

- Revenues: $5.19 billion up 5.50 percent.

Analyst Marc Goodman expects in line earnings per share for Bristol-Myers Squibb Co BMY. The analyst sees potential for upside from a positive CheckMate-227 interim readout before the year-end.

Longer term, the analyst expects the company to maintain its leadership in the rapidly growing IO space, with its significant portfolio of internal assets. The firm also pointed to Eliquis, Orencia and non-IO pipeline as growth drivers.

"We expect significant oncology sales growth to drive operating margins up from mid-20s to low-30s by 2021," the firm said.

Focus: Opdivo and Eliquis sales (UBS estimates third-quarter Opdivo sales of $1.16 billion and Eliquis sales of $1.25 billion).

9. Merck

Date: Oct. 27.

Consensus:

- EPS: $1.03 versus $1.07 last year.

- Revenues: $10.52 billion, down 0.10 percent.

Goodman is above-consensus on Merck & Co., Inc. MRK. The analyst said expectations for the IO/chemo regimen in 1L lung incrementally increased following the MYSTIC result.

UBS thinks Keytruda sales need to continue to ramp, with the firm expecting sales of $1.08 billion for the third quarter. Additionally, data from KeyNote-189 need to support the current view to keep this stock moving higher, the firm said.

Focus: Commentaries on the launch progress in the U.S. for 1L lung and the potential readout of KeyNote-189.

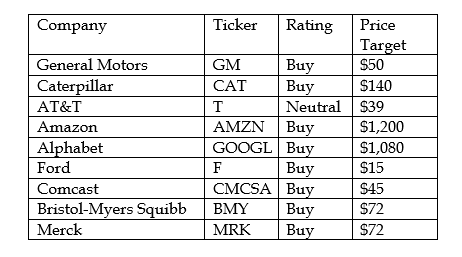

Ratings/Price Targets

Related Link: Intel And AMD: Are Q3 Expectations Realistic?

Related Link: Intel And AMD: Are Q3 Expectations Realistic?

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.