John Bellows over at the Treasury department wrote a Blog that called for a return of the Build America Bond (“BAB”s) program. He used some "facts" to make his point. I don't think he has the facts at all. I'll let you decide. I'll also ask the Treasury department for a clarification.

This is the sentence that I'm calling them on:

The 28% cited is the critical issue. If the IRS collects income from BABs bond holders that equals the 28% that is rebated back to the states then the statement made be Treasury is correct. If the IRS collects less than the 28%, the Treasury statement is incorrect.

I have maintained from the get-go that BABs bonds went to tax free hands. Insurance Cos., pension funds, foreign investors and tax protected individual accounts were all big players

I can't prove the actual IRS tax collections, but neither can Treasury. I wrote about this back on 3/15/11 (my link). At that time I had inquired directly with the IRS. They confirmed to me (in writing) that they do not keep records of BABs related tax income. The IRS response:

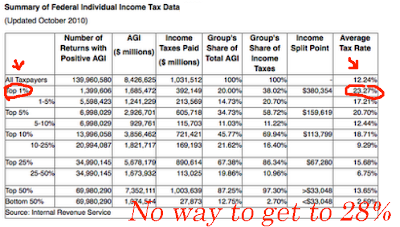

What might be the actual IRS receipts related to BABS? Once again the IRS gives us some answers. Assume the most optimistic case for the Treasury Department. Assume that not one penny of the BABS bonds went to tax protected hands. Assume that the IRS collected the effective marginal rate on every penny of income related to BABs interest payments. In this extremely unlikely scenario the net tax receipts would be equal to the marginal tax paid by the income group that owned the bonds. The answer is that the marginal Federal rate for all income groups is substantially below the 28% claimed by Treasury. The IRS information:

In the rediculously unlikely case that 100% of all BABs bonds went to the top 1% of earners it still would only generate 24% versus the 28% that is claimed in the Blog.

Bottom line:

Treasury does not have the data to back up its claim. Their own organization (IRS) has proved that. In addition there is no reasonable claim that the estimate for the BABs tax collections are even close to 28% (IRS data). A much more reasonable claim would be that the level is below 20%. BABs make no economic sense at a rebate level of 20% or below. That is why the 28% is critical.

So why is Treasury pushing so hard on this? Why are they willing to fib and play fast and lose with important numbers? That's easy to answer:

The big names in this lobbying effort? Surprised?

Treasury's big push for BABs has nothing to do with good economics or solid budgeting and forecasting. It's about the money. In this case it's about money for re-election campaigns and banker's pockets.

Market News and Data brought to you by Benzinga APIsThis is the sentence that I'm calling them on:

The President's Budget proposes to make the BABs program permanent at a 28 percent subsidy rate, making the program revenue-neutral compared to tax-exempt bonds, meaning it will not have any effect on the Federal Budget deficit.

The 28% cited is the critical issue. If the IRS collects income from BABs bond holders that equals the 28% that is rebated back to the states then the statement made be Treasury is correct. If the IRS collects less than the 28%, the Treasury statement is incorrect.

I have maintained from the get-go that BABs bonds went to tax free hands. Insurance Cos., pension funds, foreign investors and tax protected individual accounts were all big players

I can't prove the actual IRS tax collections, but neither can Treasury. I wrote about this back on 3/15/11 (my link). At that time I had inquired directly with the IRS. They confirmed to me (in writing) that they do not keep records of BABs related tax income. The IRS response:

In response to your request for the percentage of tax collections from bonds associated with Build America Bonds, we will not be able to answer your request. Unlike tax-exempt bonds build America bonds are taxable, but the IRS Tax-Exempt area collects no data on the tax obligations associated with them.

What might be the actual IRS receipts related to BABS? Once again the IRS gives us some answers. Assume the most optimistic case for the Treasury Department. Assume that not one penny of the BABS bonds went to tax protected hands. Assume that the IRS collected the effective marginal rate on every penny of income related to BABs interest payments. In this extremely unlikely scenario the net tax receipts would be equal to the marginal tax paid by the income group that owned the bonds. The answer is that the marginal Federal rate for all income groups is substantially below the 28% claimed by Treasury. The IRS information:

In the rediculously unlikely case that 100% of all BABs bonds went to the top 1% of earners it still would only generate 24% versus the 28% that is claimed in the Blog.

Bottom line:

Treasury does not have the data to back up its claim. Their own organization (IRS) has proved that. In addition there is no reasonable claim that the estimate for the BABs tax collections are even close to 28% (IRS data). A much more reasonable claim would be that the level is below 20%. BABs make no economic sense at a rebate level of 20% or below. That is why the 28% is critical.

So why is Treasury pushing so hard on this? Why are they willing to fib and play fast and lose with important numbers? That's easy to answer:

The big names in this lobbying effort? Surprised?

SIFMA

(Securities Industry and financial Markets Association)

ABA

(American Bankers Association)

Goldman Sachs

Citi

BoA

Treasury's big push for BABs has nothing to do with good economics or solid budgeting and forecasting. It's about the money. In this case it's about money for re-election campaigns and banker's pockets.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Loading...

Benzinga simplifies the market for smarter investing

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.

Join Now: Free!

Already a member?Sign in