One approach to generating consistently high returns on investment — which is inherently fraught with risk — is to capitalize on the stages of the economic cycle with sector rotation.

Sector Rotation Defined

Sector rotation is an investment strategy that recommends shifting investment dollars committed to one sector to another in a bid for above-market returns.

This approach takes advantage of cyclical trends in the economy.

The Logic Behind Sector Rotation

It's common knowledge that the market and the economy move in cycles, and the economic cycle consists of five distinct phases:

- Expansion — a period of rising economic output.

- Peak — a point before the downward move begins.

- Contraction — a period when economic output begins to fall.

- Recession — a period characterized by a significant decline in economic activity.

- Trough — a point before the recovery or upward move starts.

Just like the economy, the stock market also goes through a four-stage cycle:

- Accumulation — a consolidation phase when price action is neutral as buyers step in to take control over the sellers.

- Markup — a phase when the market makes higher highs and higher lows as bulls gain over bears.

- Distribution — a phase when bulls begin to lose their grip, bears take over and the price action turns neutral yet again.

- Decline/markdown — the market enters a phase of decline when bears dominate over the bulls.

Different sectors of the stock market perform differently during the phases of the economic and market cycle.

Defensive sectors such as consumer staples, utility and health care stocks tend to outperform during a recessionary phase, while consumer discretionary and tech stocks tend to fare well during early expansions.

It's only logical for an astute investor to liquidate holdings in a sector that has fallen out of favor and divert the investment into sectors that are back in favor.

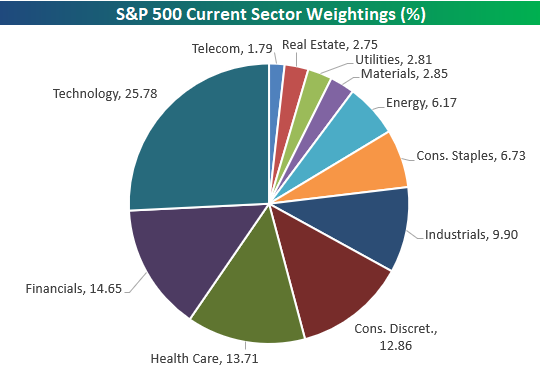

The classes in the S&P 500 are weighted as follows in the index:

Infographic courtesy of Bespoke.

The Process

The first step in benefiting from a sector rotation strategy is identifying the stage of the economic cycle. Since the stock market is forward-looking, it is necessary to call the stage of economic cycle ahead of time and begin to move into sectors that are likely to outperform.

Investing in ETFs presents an easy way to quickly move into a sector without having to buy individual stocks. Since the U.S. economy is thought by many to be in the last leg of a long expansionary cycle, shifting into defensive sectors such as utilities ahead of an impending recession could be a sound strategy.

Utilities SPDR XLU and Vanguard Utilities ETF VPU are among the sector ETFs that give investor exposure to the utility sector.

The move out of technology stocks and into financial stocks seen recently may also have to do with sector rotation.

Apart from the economic cycle, interest rate cycles also catalyze sector rotation. With the Fed having kicked off monetary policy normalization in December 2015, financial stocks are back in favor, as these companies' income is interest-rate sensitive. The rate was maintained at extremely accommodative levels of 0-0.25 percent between December 2008 and December 2015,

Sector Rotation Advantages

Sector rotation strategy can assist in profit-taking irrespective of how the economy is performing and serves as a defensive strategy against economic ups and downs.

Limitations

Timing the economic cycle is not a simple task, as an economy is at the mercy of countless variables. Even if an investor correctly calls an economic cycle, picking the right sectors is a tough assignment.

Rotating too much may not be viable for a retail investor, as it involves high costs in the form of brokerage fees and commissions.

Notwithstanding the pitfalls, sector rotation is an effective strategy, and if handled carefully, can fetch superlative returns. The popularization of ETF investing has only made the job easier.

Related Links:

How The 'Real Economy' Has Fared During The Longest Bull Market In History

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.