The question of the day is, can the win streak reach five? That might be a struggle, judging from how things look early on.

All of that optimism about the China talks seems to be ebbing a little, and there’s no timetable for a next round. Meanwhile, In corporate news, shares of Macy’s Inc. M got crushed ahead of the opening bell after the retailer reported weak holiday results and cut its outlook. On the other hand, Target Corporation TGT reported solid holiday sales. As we say often, the retail sector is really one of individual stories, so it’s probably best to look at it company by company. However, as of this morning, the entire sector appeared to come under pressure.

Wednesday’s moderately higher close for the S&P 500 Index (SPX) marked the fourth-straight day of gains, the first time that’s happened since a five-session stretch ending last Sept. 14. Though stocks closed off their highs, they still managed to finish the day just above what might be a key level at 2584. From a technical standpoint, the SPX’s ability to close above that mark could signal underlying strength, some analysts believe.

Take Pause Before Calling a Pause

Stocks rose Wednesday afternoon after minutes from December’s Federal Open Market Committee (FOMC) meeting showed Fed officials indicating they might have more patience before raising rates further. The Fed news this week is far from over, as Fed Chair Jerome Powell speaks today. He’s been out there a lot lately, and frequently moves the market in a big way one direction or another when he talks. His remarks today are scheduled for 12:45 p.m. ET.

And that’s not all. Fed Vice Chair Richard Clarida delivers a speech called Economic Outlook and Monetary Policy tonight. Those certainly sound like topics investors might want to hear about from the Fed. Clarida, who only recently took the job, has been sounding mainly dovish so far.

Some media reports suggested the minutes were a sign of the Fed being ready to “pause” on hikes, but that’s arguably the wrong word to use. As we noted here yesterday, the Fed is likely going to remain vigilant about inflation. Last week’s jobs report looked like a bases-clearing home run, and another one like it, perhaps accompanied by rising energy prices, might have the Fed dusting off its previous more hawkish assumptions for 2019.

Anyone who’s lived through a few market cycles likely knows the wheel can spin quickly. The Fed’s biggest fear probably remains inflation, mainly because when inflation rises, it tends to do so exponentially. The Fed typically wants to get out ahead of rising prices. So don’t be surprised if we’re back here in a month or two wondering whether a rate hike might be ahead. Especially if oil goes above $60 a barrel and we have another good jobs report on our hands. As a reminder, crude rose for the eighth-straight session Wednesday and is back above $52 a barrel. That’s a more than 20% rise from the lows seen around Christmas.

Weaker Dollar? Possible Implications

Another thing the Fed minutes seemed to do, besides maybe helping give the stock market a lift, was to put more support behind the weak dollar story. The dollar index fell to near 95 late on Wednesday, the lowest level in three months. Typically, rate hikes tend to prop up the currency of the country making them, so it would stand to reason that the dollar would weaken if people expect the Fed to stay dovish.

On the other hand, a weaker dollar tends to also help lift commodity prices, and not just for energy. Think about food, for instance. Corn, wheat, cattle, and other prices all could start getting support if the dollar stays weak, and that also could play into the inflation picture if it lasts a while. Speaking of which, December consumer price index (CPI data) are due Friday. Analysts expect a drop of 0.1% in the headline number, probably in part due to cheap gas prices. Core CPI, which strips out energy and food, is seen rising 0.2%, according to Briefing.com.

Getting back to the dollar, a weaker greenback might help give multinational U.S. firms a lift, though it’s still a bit early to see an earnings impact for Q4. More likely any benefits would start to seep into Q1 earnings, because the dollar stayed pretty strong through most of late 2018. We’ll have to wait and see if this is just a pause in the dollar rally, or perhaps something more prolonged.

Sentiment Shift on Earnings?

It’s a new year, and maybe that means there’s some new sentiment shaping up. Consider the case of homebuilder Lennar Corporation LEN, which reported on Wednesday that its Q4 earnings beat Wall Street analysts’ expectations but revenue missed. Also, the company declined to issue guidance, citing uncertainty about the market. Last year, when companies had any bad news at all, they tended to get punished. So when LEN shares fell right after the earnings, it seemed to carry along the 2018 sentiment.

Then later in the day, LEN shares came back in a big way, rising more than 9% at one point. Instead of punishing the stock, it looks like at least some investors focused more on some of the positives in the company’s earnings report and its call with analysts. During the call, LEN said it was seeing improvement in buyer traffic so far in its fiscal Q1 as interest rates declined, Reuters reported. This appeared to be one factor in the stock’s rally, and perhaps it indicates improved investor sentiment as earnings season approaches.

A similar situation developed right after the market closed Wednesday, when Bed, Bath & Beyond BBBY stock lifted off in post-market trading following earnings, though it eased back after the Macy’s news. The results were pretty much in line with Wall Street analysts’ expectations. What seemed to get people excited was the company’s fiscal 2019 net earnings guidance, which it said would be similar to fiscal 2018 results. So does this mean “steady as she goes” is now considered enough for a stock to rally? Last year, it seemed like steady guidance or even slightly better guidance sent most companies to the woodshed. This might be something to ponder in the days ahead.

In other corporate news early Thursday, Ford F announced job cuts in Europe as the company faces struggles in that market. The company says its move is designed to improve profitability and reduce costs. For investors, the announcement could serve as a signal that the auto industry continues to face challenges, and it also could be another sign of European economic softness.

Meanwhile, American Airlines AAL shares slid in the pre-market after the company cut guidance. The AAL news comes on the back of recent bad news from Delta Airlines DAL and a major downgrade yesterday on United UAL. Clearly the airlines are having a tough time.

Volatility Backs Off

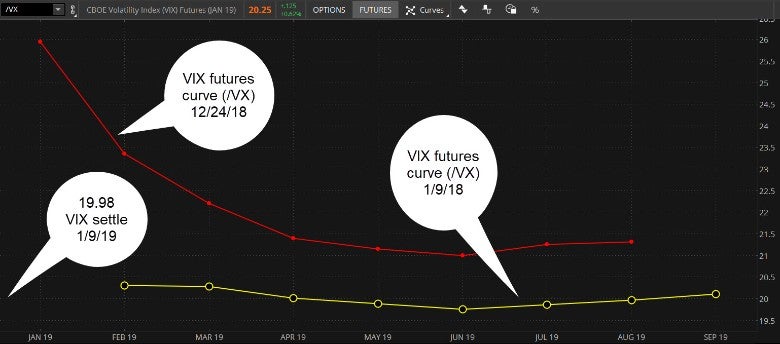

In another sign that sentiment might be changing, the market’s most closely watched “fear index,” the VIX, edged below 20 on Wednesday for the first time in a month before clawing back above that mark early Thursday. It had traded well above 30 in the week around Christmas as waves of turbulence sent the market up and down like a paper boat in an Atlantic hurricane.

Wednesday’s VIX action put the cash price below the next three months of futures prices (see chart below). Until recently, the cash price had been above futures, an unusual trend that in the case of VIX had appeared to indicate high expectations for more near-term volatility. As of Wednesday afternoon, however, the near-term futures contract prices enjoyed a premium to cash, perhaps suggesting that some investors expect relatively calmer times for the moment. We’ll have to wait and see.

Figure 1: Shifting Curves. Hard to believe, but it was a little over two weeks ago, on Christmas Eve, when a market meltdown pushed near-term volatility to its highest levels since February. Yesterday, the first few months of the VIX term structure (aka VIX futures curve) moved back to contango, meaning nearer-term VIX futures (/VX) are priced higher than the cash index. The red line shows the futures curve on December 24; the yellow line shows it as of yesterday's close when the index settled at 19.98. Data source: Cboe Global Markets. Chart source: The thinkorswim® platform from TD Ameritrade. For illustrative purposes only. Past performance does not guarantee future results.

Nice Bun But Not a Lot of Beef on Trade: This week brought plenty of positive headlines about trade talks, but not a lot of specifics. While it’s always nice to hear that China is buying some U.S. products, as it did recently by scooping up another load of soybeans, the issues are far more complex than simple product trade. It’s unclear if the two countries can make progress on more complicated issues like intellectual property and technology transfers. Then there’s the issue of what sort of compliance might be built into any deal. China has made deals in the past, but compliance is sometimes troublesome, as U.S. Commerce Secretary Wilbur Ross pointed out in a televised interview a few days ago.

The trade talks ended Wednesday in Beijing. Markets appeared to get a shot in the arm as the talks occurred, but the optimism started to fade by Thursday. A lot could hang on whether the two parties schedule another round or retreat to their separate corners for a while. Also, investors might be looking for signs that both China and the U.S. took the same conclusions out of these talks. In the past, there were times when one party offered a different conclusion than the other. So far, that hasn’t happened this time, but then again, there also hasn’t been much detail offered.

Financials Still Not Perking Up Much: A recent rise in “risk-on” sentiment, with more investors betting against near-term volatility and so-called “defensive” sectors like utilities and staples taking another hit on Wednesday, hasn’t permeated the financial sector in any great way yet. Financials rose slightly Wednesday, but haven’t shown much zip lately. This could reflect the Treasury yield curve remaining pretty close to flat, though it did tick up slightly at mid-week, perhaps helping the sector a bit. The 10-year yield, which ended Wednesday at 2.71%, still has just a 16 basis-point premium to the two-year. This situation often makes business tough for some banks, which tend to make money by lending for the long term and paying for short-term deposits. If long-term rates stay low compared with short-term ones, banks’ margins can come under pressure.

Some analysts say a flatter yield curve tends to hurt smaller banks more than larger ones, so we’ll see late next week what some of the major institutions say when they start putting out Q4 earnings news. It seems like there’s a lot of good stuff going on in the financial industry, including what some analysts say are solid credit conditions and strong capital levels. That just hasn’t been enough, it seems, to help the sector launch a rally.

Small Fry Fly: Back at the end of August, the small-cap Russell 2000 Index (RUT) hit an all-time high of 1742. Then the bottom fell out. By Christmas Eve, the index had dropped 27% to just below 1267, putting it well into bear market territory at 13-month lows. Valuations of small-caps fell to a six-year trough. It’s probably too soon to say there’s been a turn-around, but since striking that low, the RUT is up more than 13%. On Wednesday, its gains once again outpaced the SPX. What’s interesting here for the broader market is that sometimes small-caps can be a leading indicator. Note how the RUT’s troubles preceded the broader market decline, which didn’t really get underway until October. Now the RUT is outpacing its big brethren over the last two weeks since the pre-holiday plunge.

Earlier this week, The Wall Street Journal reported that analysts expect double-digit earnings growth for small-cap stocks this year. By contrast, most analysts expect mid-single digit earnings growth for S&P 500 companies. One caveat to the small stock bull thesis: Some investors piled into small-caps last summer amid trade war worries, perhaps thinking that small-caps might offer protection because they don’t sell so many products into foreign markets. However, if the tariff battle continues, analysts warn that small stocks could still get hit.

Information from TDA is not intended to be investment advice or construed as a recommendation or endorsement of any particular investment or investment strategy, and is for illustrative purposes only. Be sure to understand all risks involved with each strategy, including commission costs, before attempting to place any trade.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.