Axsome Therapeutics Inc AXSM has been a standout gainer in January, advancing a little more than 200 percent so far this month. In the same period, the S&P 500 Index added 6.3 percent and the iShares NASDAQ Biotechnology Index IBB 13.5 percent.

The Pipeline

This micro-cap, actively traded biotech specializes in developing therapies for diseases of the central nervous system.

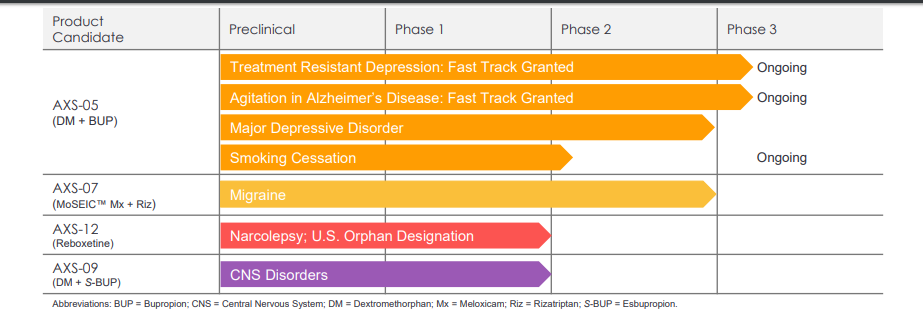

Axsome's pipeline consists of four CNS assets. Its lead asset AXS-05 is in different stages of development for four indications: treatment-resistant depression, agitation in Alzheimer's, major depressive disorder, or MDD, and smoking cessation.

For the former two indications, the candidate has been granted Fast Track designation, and late-stage trials are underway.

Axsome's other assets include AXS-07 (migraine), AXS-12 (narcolepsy) and AXS-09 (CNS disorders).

Source: Axsome

Under pain and primary care, Axsome has two assets, AXS-02 and AXS-06, that are being evaluated for osteoarthritis and rheumatoid arthritis.

See Also: Searching For A Treatment: NASH Investigational Drugs With Catalysts This Year

Financials

Axsome has yet to turn a profit. In 2017, the company reported a loss of $1.27 per share, narrower than the $1.42 per share loss in the previous year.

As of Sept. 30, 2018, the company $15.22 million in cash, while for the quarter ended Sep. 30, it incurred operating expenditures of $8.24 million, according to its 10-Q filing. The cash burn rate suggests that Axsome's cash balance will see the company through two quarters.

The company announced Jan. 7 that it raised approximately $23.3 million through the sale of 2.88 million shares under its existing at-the-market facility with Leerink Partners LLC.

Stock On A Tear

After losing about 50 percent in 2018, Axsome shares have started the new year on firmer footing.

The bulk of the gains made by the stock in January came Jan. 7, when the company reported positive results for a Phase 2 study of AXS-05 in patients with MDD.

The stock jumped 161 percent Jan. 7.

The company said the pipeline asset, a NMDA receptor antagonist, achieved statistically significant reduction in the Montgomery-Asberg Depression Rating Scale total score averaged over a six-week treatment period vs. the widely used antidepressant bupropion.

Following the development, the company said it intends to meet with the FDA to discuss a potential regulatory path for the MDD indications.

2019 Catalysts

The strong rally in Axsome shares could trigger concerns over a heady valuation. Yet 2019 is full of catalysts that could send the stock soaring — or deflate it, depending on how the results pan out.

The upcoming catalysts are based on the year-end clinical update provided by the company:

- Final Phase 3 results of AXS-05 in treatment resistant depression: Q1

- Start of Phase 3 trial of AXS-07 in acute migraine In Q1; top-line data in 2019

- Top-line results from the Phase 2 study of AXS-05 in smoking cessation: Q1 19

- Top-line results of the Phase 2 trial of AXS-12 in narcolepsy: H1 2019

- Interim efficacy analysis of Phase 2/3 trial of AXS-05 in agitation in Alzheimer's patients in 2019; top-line data from the trial due between H2 2019 and H1 2020

The sell-side is bullish on Axsome, with most analysts rating the shares a Buy, and the average price target is $24, according to the Yahoo database. The data suggests the potential for incremental 180-percent gains.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.