After a rough start to 2019, Tesla Inc TSLA investors have a key fundamental catalyst on the horizon this week when the company reports its first-quarter earnings on Wednesday. Before the big numbers come out, Tesla traders should know the key technical levels to be watching in the stock’s chart.

Technical Trends

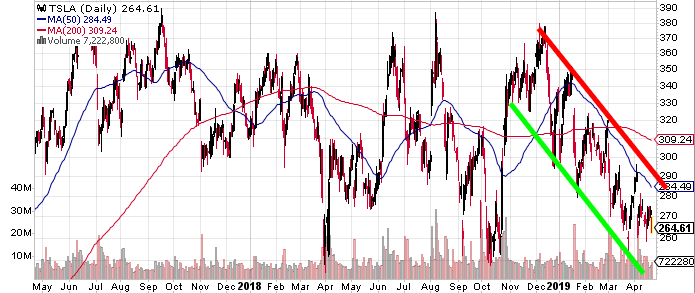

Tesla shares have been caught in a bearish channel since the stock peaked in December at around $380. Since that time, Tesla has made a series of lower highs and lower lows, the hallmark of a bearish technical trend.

Tesla shares peaked in at $296 in early April and are currently trading in the middle of this bearish channel, with Tesla is near its lowest level of 2019. But despite a year-to-date decline of more than 20 percent, the stock has found support several times in the $260 area since mid-March.

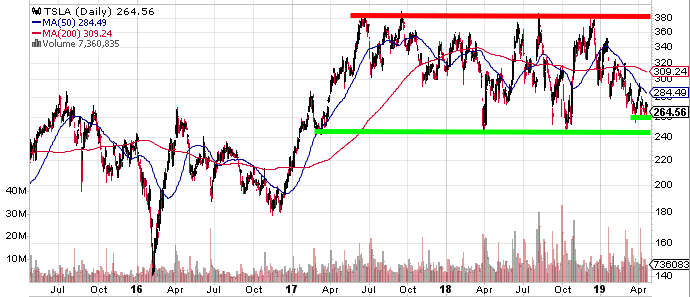

The good news for Tesla investors is that a longer-term perspective on the chart reveals a much more neutral picture. Since early 2017, Tesla has been consolidating in a wide, volatile trading range between around $245 and $380.

Tesla failed to break out to new highs above $380 in June 2017, September 2017, August 2018 and December 2018. Each time a stock fails to break out above a resistance line, the resistance is strengthened.

Support in the $245 to $255 range has also been strengthened by multiple tests in April 2018, October 2018 and most recently in March.

At some point in coming weeks, something is going to have to give in Tesla's chart. The near-term bearish resistance line and the longer-term horizontal support line are pinching Tesla's share price into what technical traders call a descending triangle pattern. The descending triangle is typically considered a bearish pattern, usually eventually resulting in a breakdown below the support.

Key Levels

Regardless of what the chart is saying, the fundamental news this week will likely trump any technical pressures in the near-term. More importantly, traders should see where shares are initially trading after the report comes out.

If the stock reacts positively, the first potential resistance level is the 50-day simple moving average at $285. If Tesla breaches $285 and continues above March highs of $295, it could be back on track for another test of $380 in the medium-term.

If the stock reacts negatively to earnings, the technical damage will be contained as long as Tesla stays above that long-term support level of $245. Below $245, there's a lot of air under the stock until it reaches the $175 to $185 range that served as support way back in late 2016.

Tesla's stock closed Tuesday at $263.90 per share.

Related Links:

Tesla's Weekend Starts With Board Shakeup, Ends With Car Explosion

Short Sellers Earn $770M In Profit From Tesla Deliveries Miss

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.