Aurora Cannabis Inc ACB is off to a hot start to 2019, but the stock is still trading well below its 2018 highs. The stock has been trading in a very narrow range for roughly a month now, and technical traders are anticipating a breakout in one direction or another in the near future.

Technical Trends

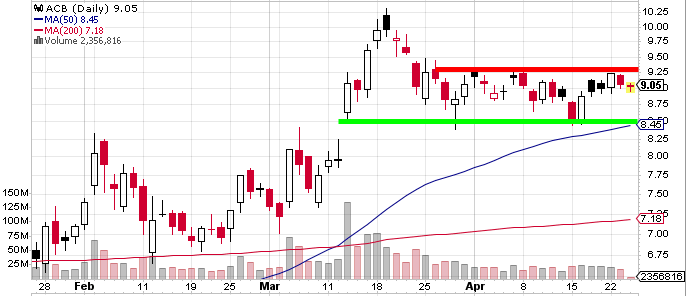

Aurora shares have been trapped in a narrow horizontal trading range between around $8.50 and $9.25 since mid-March. For a stock with a history of extreme volatility, Aurora has been stuck in an extended low-volatility consolidation period.

Aurora last tested the top of the consolidation channel April 22 when it closed at $9.23 before turning lower once again. It bounced off the bottom of the channel when it closed at $8.50 on April 15 and then bounced after opening at the same level the following day.

Despite the extended breather, Aurora shares are sitting on overall year-to-date gains of 81.7 percent, giving bulls reason for optimism the stock is simply digesting the large move before making new highs.

A look at a longer-term chart shows Aurora shares have been in a bullish trading channel since December of last year, when the stock bottomed at around $4.50. Aurora is currently trading near the bottom of that longer-term bullish channel, suggesting a bounce could be coming in the near future.

Since that time, Aurora has made a series of higher highs and higher lows, the trademark of a bullish trend. Its most recent high was $10.32 back in March.

Levels To Watch

Sometime in the next week or two, one of the two trading patterns must break. The support line of the bullish longer-term channel is converging with the resistance line of the shorter-term neutral trading channel forming an ascending triangle pattern. The ascending triangle pattern typically results in a bullish breakout to new highs when the rising support line eventually forces the stock above the resistance line.

In the near term, Aurora traders should watch the key near-term support level at $8.50, the bottom of the consolidation channel. A breakout below $8.50 would take out both the neutral technical support line and the bullish longer-term support line. Below $8.50, the next potential support level would be February lows of around $6.70.

If Aurora trades higher in the coming days, a breakout above $9.25 could put the stock back on track to test 2019 highs of $10.32 in the near term. In the longer-term, the stock’s all-time high of $12.52 could be the last source of major resistance keeping the stock from a blue sky scenario.

At time of publication Wednesday afternoon, the stock traded at $9.09 per share.

Related Links:

Technical Levels To Watch Ahead Of Tesla's Q1 Earnings

Bank Of America Initiates Coverage On Cannabis Stocks, Names Surprising Top Pick

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.

Cannabis is evolving – don’t get left behind!

Curious about what’s next for the industry and how to leverage California’s unique market?

Join top executives, policymakers, and investors at the Benzinga Cannabis Market Spotlight in Anaheim, CA, at the House of Blues on November 12. Dive deep into the latest strategies, investment trends, and brand insights that are shaping the future of cannabis!

Get your tickets now to secure your spot and avoid last-minute price hikes.