Amazon.com, Inc. AMZN rejoined the elite $1 trillion market cap club on Friday after a blowout fourth-quarter earnings report. Amazon first briefly joined the $1 trillion club back in September 2018 before the stock pulled its valuation back below the $1 trillion threshold until this week.

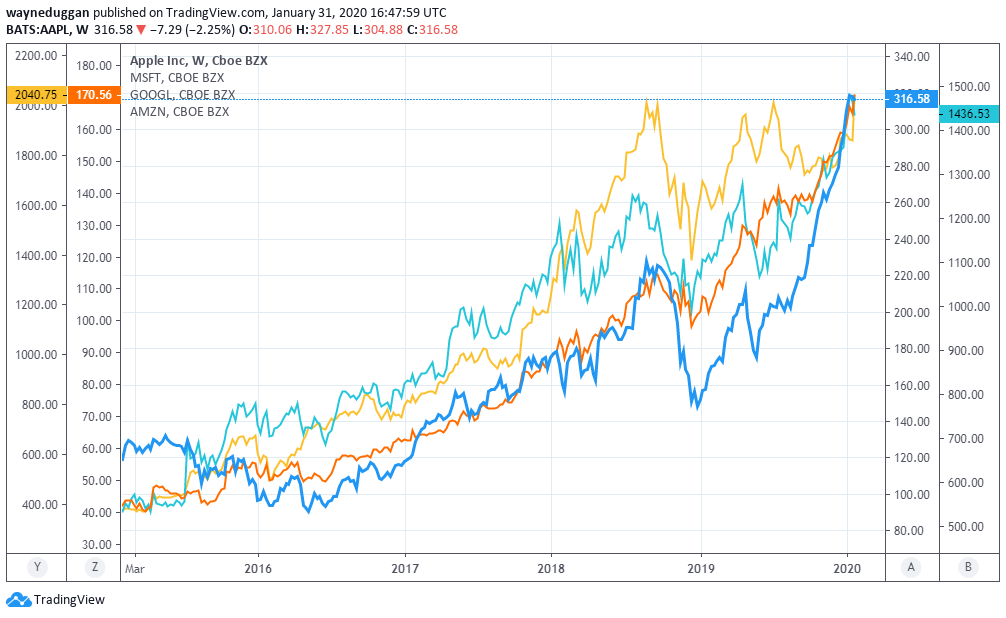

The four U.S.-listed members of the $1 trillion club are now Apple, Inc. AAPL, Amazon, Microsoft Corporation MSFT and Google parent company Alphabet, Inc. GOOG GOOGL.

Path To $1 Trillion

Apple was the first to hit the $1 trillion mark in August 2018, and the company now has a $1.4 trillion valuation. It took Apple roughly 42 years to reach the $1 trillion level following 1976 founding.

Amazon reached $1 trillion within about a month of Apple, but it was a much quicker rise. It took Amazon only 24 years to hit the $1 trillion mark following its founding in 1994.

Microsoft was the next to hit a $1 trillion valuation in April 2019, and the company has now reached a market cap of $1.31 trillion. Microsoft took the longest to reach the mark roughly 44 years after its 1975 founding.

Google was the last company to hit $1 trillion for the first time earlier this month, although its market cap has dropped back below $1 trillion this week on coronavirus-related weakness. Google’s future in the $1 trillion club likely hinges on its earnings report expected out next week. Google was the fastest to hit $1 trillion only 22 years after its 1998 founding.

Chart by TradingView.

While a $1 trillion valuation is certainly a milestone, investors are rightfully concerned about how much additional growth they can expect from such large companies. However, StockTwits message sentiment suggests traders are optimistic all four stocks are headed higher. StockTwits users are most optimistic on Google, with 91.5% of messages mentioning the ticker bullish in nature:

- Amazon: 88.1% bullish.

- Apple: 71.7% bullish.

- Microsoft: 90.4% bullish.

- Google: 91.5% bullish.

Benzinga’s Take

These stocks have all risen to the $1 trillion club on the strength of sustainable long-term revenue growth. In the most recent quarter, Apple was the only company that didn’t report at least double-digit revenue growth.

Do you agree or disagree with these predictions? Email feedback@benzinga.com with your thoughts.

Related Links:

8 Stocks To Buy For This 2020 Presidential Election Year

Photo: Silicon Valley from above, Patrick Nouhailler via Flickr.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.