I suppose that the Non Farm Payroll report could have been worse than it was. But not much worse. Some of the talking heads are calling the latest news a “soft patch”. Maybe so. We shall see. My read is that the report was (more) clear evidence that the economy is grinding down. The second half of this year is likely to show only marginal growth. The June NFP was the tip off. As is often the case, pictures tell the story better than words.

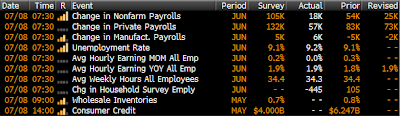

A recap of the NFP data. Note that there is no category that was not under street expectations. Things are much worse in employment land than anyone thought.

Labor force participation is now at levels not seen in a decade. A look at this chart confirms that as of Friday it hit a new record low.

So why no jobs? Easy, we are not making as much “stuff”. Follows are some regional indicators of economic performance. Yes, there are a few “plusses” on the list but mostly it is flat to down. This chart and the key underneath tells the story of the decline.

The best single gauge of manufacturing comes from the ISM. This is now at 55. A fall below 50 would signal a contraction. Are we going to get to that magic number? This chart suggests we might:

There are some conflicting signals in the credit market. If you believed that the Leading Indicators Index gives a clue to the future you might get a “warm” feeling looking at the following chart. The yield curve is now as steep as its been in a very long time. Some economists will tell you that a steep curve is a sign of an expanding economy. I take a different view. To me this steepness is just a reflection 0f the fact that short-term rates are stuck at zero because of continued Fed efforts to stimulate the economy. I don't see this chart as something to cheer about. To me it is evidence that the bond market is becoming unglued.

This final chart poses an important question. It is very clear that the correlation between stocks and bonds has broken down in the past few months. Bonds have been (correctly) signaling a slowdown. Stocks, on the other hand, have been oblivious to what the bond market is worrying about. That can't last in my opinion. Something will have to give. Either stocks or bonds are mispricing what is going on in the summer of 2011. That, or another QE is right around the corner.

I'm in the camp that says, "the Fed's hands are tied". There will not be another big effort on the monetary front for the rest of the year. The Fed has shot its wad and they have nothing left to shoot but blanks. For me, the weak side of the equation is stocks.

We have three weeks left until 8/2 and the world blows up. The latest NFP report might be the ticket to get a handshake deal between the warring factions. I see a package coming that will include another big cut in FICA taxes. The existing 2% reduction for workers will be extended for another year. It is possible that it will be cut by another point or two. We will also see a reduction in the rate that employers pay. They could get a 2% break in a desperate effort to create some jobs.

It will be the ultimate joke if the biggest deficit reduction effort in history results in an increase in the 2012 red ink by about $300 billion due to the new cuts in payroll taxes. The joke will be on us. Minor/temporary cuts in payroll taxes are not going to change the structural problems the country faces. More debt (and bad faith) are not what the global markets (and bond raters) are looking for.

Hulath concludes:

I disagree. If the big Deficit Reduction Plan of 2011 brings us a $2 trillion deficit (an increase of 300-400b versus current budget) for 2012, then all bets are off. I think bond buyers will go on strike if that is what we get.

Market News and Data brought to you by Benzinga APIsA recap of the NFP data. Note that there is no category that was not under street expectations. Things are much worse in employment land than anyone thought.

Labor force participation is now at levels not seen in a decade. A look at this chart confirms that as of Friday it hit a new record low.

So why no jobs? Easy, we are not making as much “stuff”. Follows are some regional indicators of economic performance. Yes, there are a few “plusses” on the list but mostly it is flat to down. This chart and the key underneath tells the story of the decline.

The best single gauge of manufacturing comes from the ISM. This is now at 55. A fall below 50 would signal a contraction. Are we going to get to that magic number? This chart suggests we might:

There are some conflicting signals in the credit market. If you believed that the Leading Indicators Index gives a clue to the future you might get a “warm” feeling looking at the following chart. The yield curve is now as steep as its been in a very long time. Some economists will tell you that a steep curve is a sign of an expanding economy. I take a different view. To me this steepness is just a reflection 0f the fact that short-term rates are stuck at zero because of continued Fed efforts to stimulate the economy. I don't see this chart as something to cheer about. To me it is evidence that the bond market is becoming unglued.

This final chart poses an important question. It is very clear that the correlation between stocks and bonds has broken down in the past few months. Bonds have been (correctly) signaling a slowdown. Stocks, on the other hand, have been oblivious to what the bond market is worrying about. That can't last in my opinion. Something will have to give. Either stocks or bonds are mispricing what is going on in the summer of 2011. That, or another QE is right around the corner.

I'm in the camp that says, "the Fed's hands are tied". There will not be another big effort on the monetary front for the rest of the year. The Fed has shot its wad and they have nothing left to shoot but blanks. For me, the weak side of the equation is stocks.

We have three weeks left until 8/2 and the world blows up. The latest NFP report might be the ticket to get a handshake deal between the warring factions. I see a package coming that will include another big cut in FICA taxes. The existing 2% reduction for workers will be extended for another year. It is possible that it will be cut by another point or two. We will also see a reduction in the rate that employers pay. They could get a 2% break in a desperate effort to create some jobs.

It will be the ultimate joke if the biggest deficit reduction effort in history results in an increase in the 2012 red ink by about $300 billion due to the new cuts in payroll taxes. The joke will be on us. Minor/temporary cuts in payroll taxes are not going to change the structural problems the country faces. More debt (and bad faith) are not what the global markets (and bond raters) are looking for.

Hulath concludes:

After QE2, The Fed's UST demand will be replaced by UST demand of market participants who, again, and to their general surprise, find themselves back in a deflationary, consumer deleveraging environment.

I disagree. If the big Deficit Reduction Plan of 2011 brings us a $2 trillion deficit (an increase of 300-400b versus current budget) for 2012, then all bets are off. I think bond buyers will go on strike if that is what we get.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Benzinga simplifies the market for smarter investing

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.

Join Now: Free!

Already a member?Sign in