A controversial credit downgrade of U.S. government long-term debt by Standard & Poor's late Friday has left global financial markets in tatters as stock investors struggle to find firm footing.

Large or small, stocks are expected to take it on the chin early this week as governments wrestle with resurrecting their beaten-down economies. The fact that gold has crossed the $1,700 mark for the first time and that Treasuries are on the rise show where investor sentiment could be headed.

That's not to say that there aren't plenty of bargain stocks out there, including many small caps. Biotech and tech shares in general were among the top gainers on Friday. Most of the upticks in share price continue to be driven by quarterly results.

On Friday, the best-known indicators of small-cap stock performance both declined. The Russell 2000 Index was off 1.67 percent, while the Standard & Poor's Small Cap 600 finished the day 0.97 percent lower. Last week, the Russell lost 10.3 percent of value, while the S&P Small Cap 600 fared slightly better falling 9.4 percent.

Of the best-known market indicators, only the Dow Jones Industrial Average was higher on Friday, up 0.54 percent, but was still down 5.8 percent for the week in its worst performance since October 2008. The Nasdaq Stock Market was off 0.94 percent for the day and is down 11.4 percent since July 22, when stock declines began to kick in. The S&P 500 closed down 0.06 percent on Friday and down 7.2 percent for the week.

The biggest percentage decliner on the Nasdaq Stock Market was Imperial Sugar IPSU, closing down 59.3 percent at $9.44, after reporting a net loss in the second quarter. Chinese telecommunications and e-services provider Cogo Group COGO shed 38.5 percent to $2.88, on an analyst downgrade following release of firm second-quarter results but weak third-quarter guidance.

Raptor Pharmaceutical RPTP: Shares of the early-stage drug developer had fallen 33 percent during Thursday's market sell-off, then rebounded on Friday. Raptor recently reported positive Phase 3 results in a clinical trial of one of the drugs that it's working on.

Marchex MCHX: The marketing company that designs advertising technologies to reach local consumers online reported second-quarter revenue rose 80 percent while net income was nil because of one-time compensation charges. The stock is up 85 percent in the past year.

BG Medicine BGMD: Shares of this life sciences company, which develops diagnostic tests based on biomarkers for cardiovascular, autoimmune and other diseases, finished the week up nearly 9 percent.

Web.com Group WWWW: The Internet services provider soared a second day (it was up almost 20 percent on Thursday) on a big second-quarter revenue jump and a deal that should help it compete better with the likes of GoDaddy.com and possibly double its revenue. Shares are up 160 percent in the past 12 months.

Rosetta Stone RST: The developer of language learning systems posted a second-quarter loss, but its international business investments contributed to a 10 percent rise in revenue.

Market News and Data brought to you by Benzinga APIsLarge or small, stocks are expected to take it on the chin early this week as governments wrestle with resurrecting their beaten-down economies. The fact that gold has crossed the $1,700 mark for the first time and that Treasuries are on the rise show where investor sentiment could be headed.

That's not to say that there aren't plenty of bargain stocks out there, including many small caps. Biotech and tech shares in general were among the top gainers on Friday. Most of the upticks in share price continue to be driven by quarterly results.

On Friday, the best-known indicators of small-cap stock performance both declined. The Russell 2000 Index was off 1.67 percent, while the Standard & Poor's Small Cap 600 finished the day 0.97 percent lower. Last week, the Russell lost 10.3 percent of value, while the S&P Small Cap 600 fared slightly better falling 9.4 percent.

Of the best-known market indicators, only the Dow Jones Industrial Average was higher on Friday, up 0.54 percent, but was still down 5.8 percent for the week in its worst performance since October 2008. The Nasdaq Stock Market was off 0.94 percent for the day and is down 11.4 percent since July 22, when stock declines began to kick in. The S&P 500 closed down 0.06 percent on Friday and down 7.2 percent for the week.

The biggest percentage decliner on the Nasdaq Stock Market was Imperial Sugar IPSU, closing down 59.3 percent at $9.44, after reporting a net loss in the second quarter. Chinese telecommunications and e-services provider Cogo Group COGO shed 38.5 percent to $2.88, on an analyst downgrade following release of firm second-quarter results but weak third-quarter guidance.

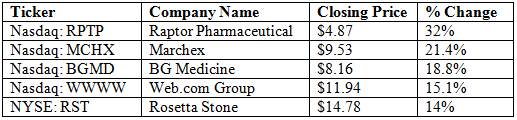

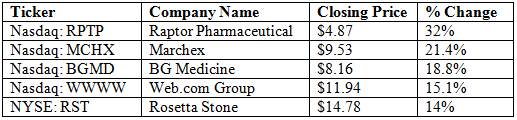

Friday's Top Performing Small Cap Stocks (Data provided by Google Finance)

Raptor Pharmaceutical RPTP: Shares of the early-stage drug developer had fallen 33 percent during Thursday's market sell-off, then rebounded on Friday. Raptor recently reported positive Phase 3 results in a clinical trial of one of the drugs that it's working on.

Marchex MCHX: The marketing company that designs advertising technologies to reach local consumers online reported second-quarter revenue rose 80 percent while net income was nil because of one-time compensation charges. The stock is up 85 percent in the past year.

BG Medicine BGMD: Shares of this life sciences company, which develops diagnostic tests based on biomarkers for cardiovascular, autoimmune and other diseases, finished the week up nearly 9 percent.

Web.com Group WWWW: The Internet services provider soared a second day (it was up almost 20 percent on Thursday) on a big second-quarter revenue jump and a deal that should help it compete better with the likes of GoDaddy.com and possibly double its revenue. Shares are up 160 percent in the past 12 months.

Rosetta Stone RST: The developer of language learning systems posted a second-quarter loss, but its international business investments contributed to a 10 percent rise in revenue.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

Loading...

Posted In: Communications EquipmentConsumer StaplesInformation TechnologyInternet Software & ServicesPackaged Foods & Meats

Benzinga simplifies the market for smarter investing

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.

Join Now: Free!

Already a member?Sign in