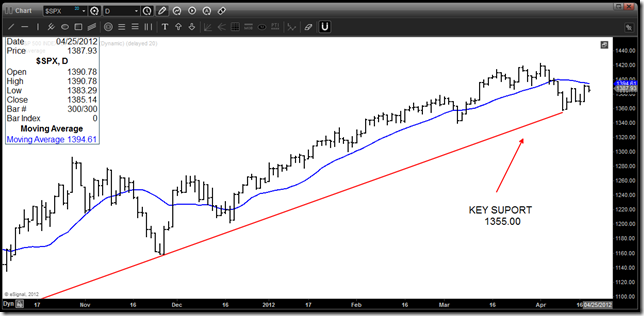

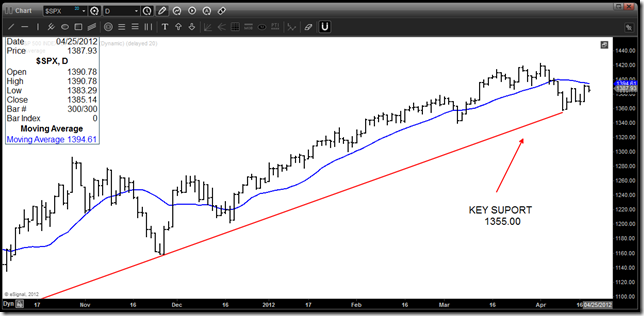

CME - S&P 500 INDEX CASH– (JUNE) Daily

Near Term Trend: Positive to Neutral

Wednesday's Close: 1385.14 (- 5.70)

Ways to Play this:

UPDATE: Four weeks ago, we stated, “If the market approaches the 1410.00 region I would expect that area to be the upper limit of this move, and a retrace toward 1360.00 to follow”.

Subsequently, the market collapsed once it hit just above 1410.00, and then retraced down to 1358.00, before bouncing higher.

We have been pretty much spot- on. In addition, I stated I would short the Index on a daily close below 1388.00- not before.

We did that on April 9th as the market settled at 1382.00. We are currently short with a daily stop close only at 1402.40.

UPDATE: Four weeks ago, we stated, “If the market approaches the 1410.00 region I would expect that area to be the upper limit of this move, and a retrace toward 1360.00 to follow”.

Subsequently, the market collapsed once it hit just above 1410.00, and then retraced down to 1358.00, before bouncing higher.

We have been pretty much spot- on. In addition, I stated I would short the Index on a daily close below 1388.00- not before.

We did that on April 9th as the market settled at 1382.00. We are currently short with a daily stop close only at 1402.40.

NYMEX - CRUDE OIL (June) - Daily

Near Term Trend: Neutral to Negative

Wednesday's Close: $103.36 (+ $.24 cents)

Ways to Play – SPDR Gold TRUST GLD

UPDATE: Over six weeks ago, we were clear in stating, “We still believe since a weekly settlement above $108.40 has not been posted we could see Crude retrace back toward $100.00”.

The price retraced to a low of $101.22, last week.

Although a bounce above $105.00 took place three days ago, this market is still struggling for now.

NYMEX - CRUDE OIL (June) - Daily

Near Term Trend: Neutral to Negative

Wednesday's Close: $103.36 (+ $.24 cents)

Ways to Play – SPDR Gold TRUST GLD

UPDATE: Over six weeks ago, we were clear in stating, “We still believe since a weekly settlement above $108.40 has not been posted we could see Crude retrace back toward $100.00”.

The price retraced to a low of $101.22, last week.

Although a bounce above $105.00 took place three days ago, this market is still struggling for now.

NYMEX - GOLD – Daily

Near Term Trend: Negative

Wednesday's Trade: $1,642.10 (+ $3.30)

Ways to trade - United States Oil Fund USO

UPDATE: Six weeks ago, as the market was trading near $1,710.00, we stated, “Overhead at $1,740.00 could hold, as the market could continue to retrace toward $1,635.00”. Since then, the low has been $1,612.40.

Three weeks ago, we clearly stated, “The challenge will be near term resistance at current levels, up to $1,694.00- resistance at the blue M.A. Line”. We were on point as the high following that statement was $1,697.00, as the market stalled and was hammered once again. & volatility has died. support $1,600.00 is key

NYMEX - GOLD – Daily

Near Term Trend: Negative

Wednesday's Trade: $1,642.10 (+ $3.30)

Ways to trade - United States Oil Fund USO

UPDATE: Six weeks ago, as the market was trading near $1,710.00, we stated, “Overhead at $1,740.00 could hold, as the market could continue to retrace toward $1,635.00”. Since then, the low has been $1,612.40.

Three weeks ago, we clearly stated, “The challenge will be near term resistance at current levels, up to $1,694.00- resistance at the blue M.A. Line”. We were on point as the high following that statement was $1,697.00, as the market stalled and was hammered once again. & volatility has died. support $1,600.00 is key

- SPDR S&P 500 SPY

- ProShares Ultra S&P 500 SSO

- ProShares UltraShort S&P 500 SDS

- ProShares UltraPro S&P 500 UPRO

UPDATE: Four weeks ago, we stated, “If the market approaches the 1410.00 region I would expect that area to be the upper limit of this move, and a retrace toward 1360.00 to follow”.

Subsequently, the market collapsed once it hit just above 1410.00, and then retraced down to 1358.00, before bouncing higher.

We have been pretty much spot- on. In addition, I stated I would short the Index on a daily close below 1388.00- not before.

We did that on April 9th as the market settled at 1382.00. We are currently short with a daily stop close only at 1402.40.

UPDATE: Four weeks ago, we stated, “If the market approaches the 1410.00 region I would expect that area to be the upper limit of this move, and a retrace toward 1360.00 to follow”.

Subsequently, the market collapsed once it hit just above 1410.00, and then retraced down to 1358.00, before bouncing higher.

We have been pretty much spot- on. In addition, I stated I would short the Index on a daily close below 1388.00- not before.

We did that on April 9th as the market settled at 1382.00. We are currently short with a daily stop close only at 1402.40.

NYMEX - CRUDE OIL (June) - Daily

Near Term Trend: Neutral to Negative

Wednesday's Close: $103.36 (+ $.24 cents)

Ways to Play – SPDR Gold TRUST GLD

UPDATE: Over six weeks ago, we were clear in stating, “We still believe since a weekly settlement above $108.40 has not been posted we could see Crude retrace back toward $100.00”.

The price retraced to a low of $101.22, last week.

Although a bounce above $105.00 took place three days ago, this market is still struggling for now.

NYMEX - CRUDE OIL (June) - Daily

Near Term Trend: Neutral to Negative

Wednesday's Close: $103.36 (+ $.24 cents)

Ways to Play – SPDR Gold TRUST GLD

UPDATE: Over six weeks ago, we were clear in stating, “We still believe since a weekly settlement above $108.40 has not been posted we could see Crude retrace back toward $100.00”.

The price retraced to a low of $101.22, last week.

Although a bounce above $105.00 took place three days ago, this market is still struggling for now.

NYMEX - GOLD – Daily

Near Term Trend: Negative

Wednesday's Trade: $1,642.10 (+ $3.30)

Ways to trade - United States Oil Fund USO

UPDATE: Six weeks ago, as the market was trading near $1,710.00, we stated, “Overhead at $1,740.00 could hold, as the market could continue to retrace toward $1,635.00”. Since then, the low has been $1,612.40.

Three weeks ago, we clearly stated, “The challenge will be near term resistance at current levels, up to $1,694.00- resistance at the blue M.A. Line”. We were on point as the high following that statement was $1,697.00, as the market stalled and was hammered once again. & volatility has died. support $1,600.00 is key

NYMEX - GOLD – Daily

Near Term Trend: Negative

Wednesday's Trade: $1,642.10 (+ $3.30)

Ways to trade - United States Oil Fund USO

UPDATE: Six weeks ago, as the market was trading near $1,710.00, we stated, “Overhead at $1,740.00 could hold, as the market could continue to retrace toward $1,635.00”. Since then, the low has been $1,612.40.

Three weeks ago, we clearly stated, “The challenge will be near term resistance at current levels, up to $1,694.00- resistance at the blue M.A. Line”. We were on point as the high following that statement was $1,697.00, as the market stalled and was hammered once again. & volatility has died. support $1,600.00 is key

Editor's Note: Article and charts provided by Chart Lab Pro. Sign up for your FREE 30 day FREE Trial, use the promo code: Chartp2p8i. "The best automated platform for all level investors: www.Chartlabpro.com"

Market News and Data brought to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Posted In:

Benzinga simplifies the market for smarter investing

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.

Join Now: Free!

Already a member?Sign in