The Large Cap Blend style ranks first out of the twelve fund styles as detailed in my style rankings for ETFs and mutual funds. It gets my Neutral rating, which is based on aggregation of ratings of 39 ETFs and 1,046 mutual funds in the Large Cap Blend style as of October 12, 2012. Prior reports on the best & worst ETFs and mutual funds in every sector and style are here.

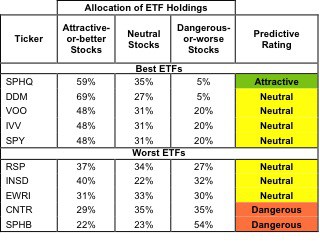

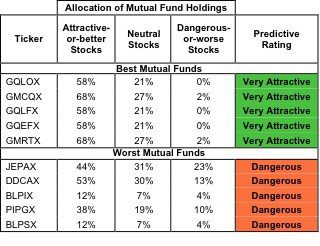

Figures 1 and 2 show the five best and worst rated ETFs and mutual funds in the style. Not all Large Cap Blend style ETFs and mutual funds are created the same. The number of holdings varies widely (from 20 to 990), which creates drastically different investment implications and ratings. The best ETFs and mutual funds allocate more value to Attractive-or-better-rated stocks than the worst, which allocate too much value to Neutral-or-worse-rated stocks.

To identify the best and avoid the worst ETFs and mutual funds within the Large Cap Blend style, investors need a predictive rating based on (1) stocks ratings of the holdings and (2) the all-in expenses of each ETF and mutual fund. Investors need not rely on backward-looking ratings. My fund rating methodology is detailed here.

Investors seeking exposure to the Large Cap Blend style should buy one of the Attractive-or-better rated ETFs or mutual funds from Figures 1 and 2.

Get my ratings on all ETFs and mutual funds in this style on my free mutual fund and ETF screener.

Figure 1: ETFs with the Best & Worst Ratings – Top 5

Best ETFs exclude ETFs with NAV’s less than $100 million.

Sources: New Constructs, LLC and company filings

Russell Growth at a Reasonable Price ETF GRPC and ProShares UltraPro Dow30 UDOW are excluded from Figure 1 because their total net assets (TNA) are below $100 million and do not meet our liquidity standards.

Figure 2: Mutual Funds with the Best & Worst Ratings – Top 5

* Best mutual funds exclude funds with NAV’s less than 100 million.

Sources: New Constructs, LLC and company filings

PowerShares S&P 500 High Quality Portfolio SPHQ is my top-rated Large Cap Blend ETF and GMO Trust: GMO Quality Fund GQLOX is my top-rated Large Cap Blend mutual fund. Both earn an Attractive-or-better rating.

PowerShares S&P High Beta Portfolio SPHB is my worst-rated Large Cap Blend ETF and ProFund: Bull ProFund BLPSX is my worst-rated Large Cap Blend mutual fund. Both earn my Dangerous rating.

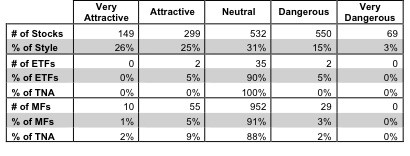

Figure 3 shows that 448 out of the 1,599 stocks (over 51% of the total net assets) held by Large Cap Blend ETFs and mutual funds get an Attractive-or-better rating. However, only 2 out of 39 Large Cap Blend ETFs (less than 1% of total net assets) and 65 out of 1,046 Large Cap Blend mutual funds (less than 11% of total net assets) get an Attractive-or-better rating.

The takeaways are: you cannot simply judge an ETF or a mutual fund by a style label or its top five holdings. ETFs and mutual funds with the same style label can have drastically different holdings that will translate into significantly different returns for your investment portfolio.

Figure 3: Large Cap Blend Style Landscape For ETFs, Mutual Funds & Stocks

As detailed in “Cheap Funds Dupe Investors”, the fund industry offers many cheap funds but very few funds with high-quality stocks, or with what I call good portfolio management.

Investors need to tread carefully when considering Large Cap Blend ETFs and mutual funds, as only 2 ETFs and 65 mutual funds in the Large Cap Blend style allocate enough value to Attractive-or-better-rated stocks to earn an Attractive rating. For example, here are two very different stocks that are both held by our worst mutual fund, ProFund: Bull ProFund BLPSX.

McDonald’s MCD is one of my favorite stocks held by Large Cap Blend ETFs and mutual funds and earns my Very Attractive rating. MCD is a model of effective capital management with a return on invested capital (ROIC) of 16.7% in 2011. This is in the 87th percentile of all Russell 3000 companies as McDonald’s has improved its ROIC every year for the past decade. In spite of the recession, McDonald’s has become even more profitable and efficient with their capital in the last four years. McDonald’s is not only a great company; it is also an attractive stock due to the market’s pessimistic view of future cash flows. The company’s current stock price (~$92.36) implies that after-tax profits (NOPAT) will permanently decrease by 10%. This seems unlikely given that the company has increased its profits by an average of 11% over the past decade. Low expectations and strong historical performance make McDonald’s an excellent long candidate.

Simon Property Group SPG is one of my least favorite stocks held by Large Cap Blend ETFs and mutual funds and earns my Very Dangerous rating. SPG has misleading earnings – its economic earnings are negative and declining while its reports accounting earnings are positive and increasing. During the 14 years in my model, the company has never generated positive economic earnings. Not only is SPG not profitable, it is also overvalued. To justify its current stock price (~$153.05), the company must increase profits by 12.3% compounded annually for 20 years. That is a lot of future value creation for a company that has never created value. Investors should avoid this stock.

BLPSX holds shares in over 400 companies. Investors would be better off allocating their money to a stock like MCD and avoiding SPG altogether rather than naively diversifying across many stocks.

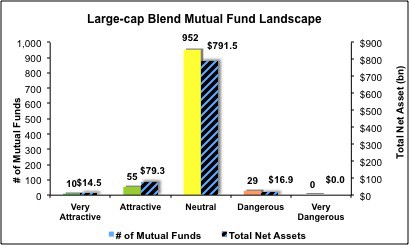

Figures 4 and 5 show the rating landscape of all Large Cap Blend ETFs and mutual funds.

Our style rankings for ETFs and mutual funds report ranks all styles and highlights those that offer the best investments.

Figure 4: Separating the Best ETFs From the Worst Funds

Figure 5: Separating the Best Mutual Funds From the Worst Funds

Review my full list of ratings and rankings along with reports on all 39 ETFs and 1,046 mutual funds in the Large Cap Blend style.

Disclosure: I receive no compensation to write about any specific stock, sector, style or theme.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.